Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.09% lower at 18,864, signalling that Dalal Street was headed for muted start on Wednesday.

Asian markets were mixed as investors remained cautious ahead of Jerome Powell’s congressional testimony. The Nikkei 225 index was up 0.4% and the Topix index gained 0.42%. The CSI 300 index fell 0.34% and the Hang Seng tanked 1.58%.

Indian rupee fell 17 paise to 82.12 against the US dollar on Tuesday.

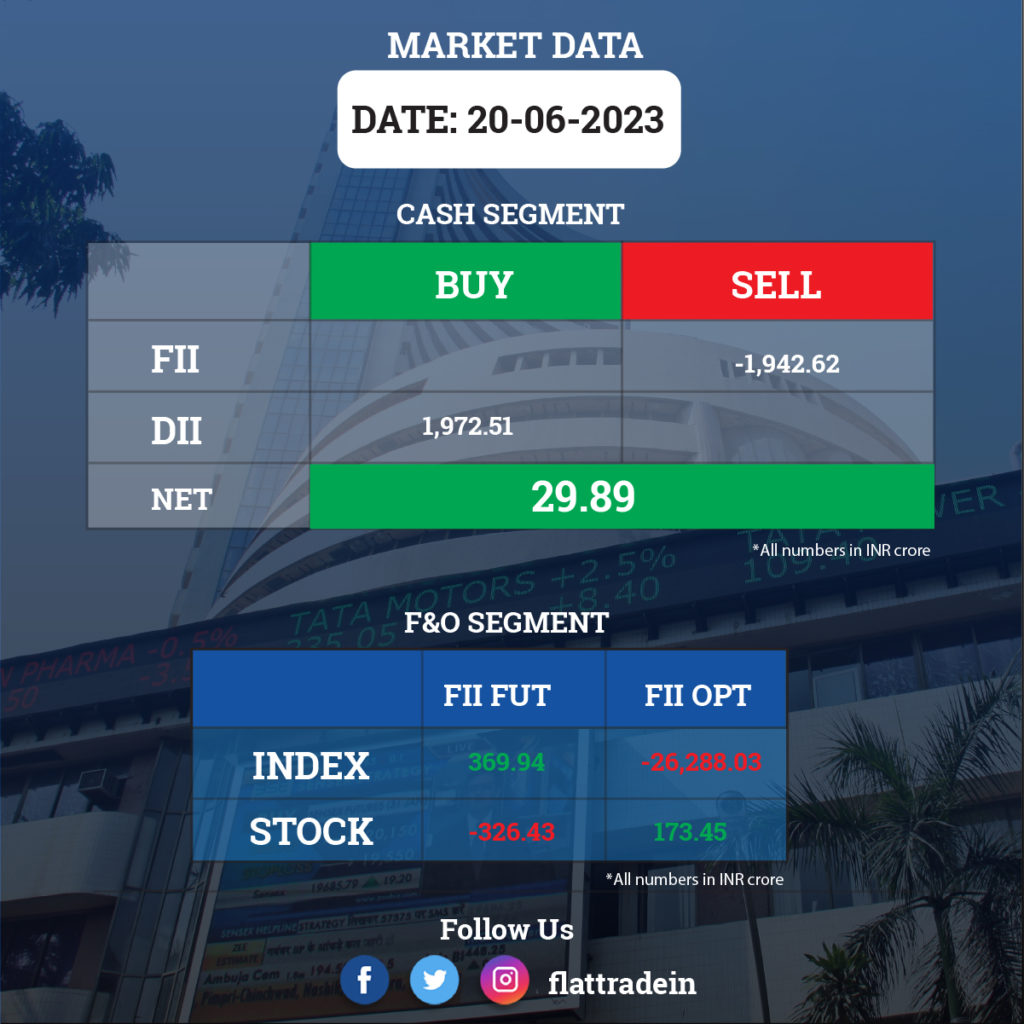

FII/DII Trading Data

Stocks in News Today

HDFC, HDFC Life Insurance: The Competition Commission of India has approved HDFC Ltd.’s acquisition of additional shareholding in HDFC Life. The acquisition of additional shareholding will be done via one or more market purchases on stock exchanges. After the merger of HDFC Ltd. and HDFC Bank, the merged HDFC Bank entity will hold over 50% shares in HDFC Life.

Coal India: The employee offer-for-sale (OFS) will open from June 21 to June 23, 2023. The government will sell up to 92.44 lakh shares or 0.15% stake in Coal India to its employees at a price of Rs 226.10 a share.

Pidilite Industries: The company has launched its manufacturing facilities under its two joint ventures, Pidilite Litokol and Tenax Pidilite in Amod, Gujarat. Litokol SPA Italy and Tenax SPA Italy have transferred technology to Pidilite as part of the joint venture. Pidilite will be leveraging its distribution network to sell epoxy, urethane grout, certain epoxy adhesives for tile application and stone care range products.

HDFC Asset Management Company: SBI Mutual Fund, Societe Generale, Zulia Investments, and Smallcap World Fund have bought 99.1 lakh equity shares or 4.64% stake in HDFC AMC via open market transactions at an average price of Rs 1,873 per share. Meanwhile, Abrdn Investment Management has exited the company by selling the entire 2.18 crore shares or 10.2% stake at the same price, which amounted to Rs 4,079.07 crore.

GR Infraprojects: The company has bagged hybrid annuity mode order for four laning of NH 530B in Uttar Pradesh from National Highway Authority of India with project cost of Rs 1,085.47. It has also executed with National Highways Logistics Management for designing, building, financing and operating and transfer for logistics park in Indore for project cost of Rs 758.1 crore.

IDFC First Bank: The lender’s board has approved the appointment of Madhivanan Balakrishnan , as the Whole-time Director (Additional Director), designated as ‘Executive Director and Chief Operating Officer’ and Key Managerial Personnel of the bank for three years, subject to shareholders’ approval.

Landmark Cars: The company said that they have incorporated a wholly-owned subsidiary named ‘Aeromark Cars’ via a related party transaction. Aeromark Cars, which is yet to commence operations, plans to carry on the business of sales, after sales, and allied business.

CMS Info Systems: The company has completed execution of ATM Managed Services of over 5,200 ATMs for Punjab National Bank (PNB) across 526 cities and towns in 26 states. With this development, CMS has become the largest ATM Managed Services provider to PNB.

Krishna Institute of Medical Sciences: SBI Mutual Fund has bought 40.68 lakh shares or 5.08% stake in KIMS via open market transactions at an average price of Rs 1,710 per share, amounting to Rs 695.7 crore, while General Atlantic Singapore was the seller in this deal.

Thyrocare Technologies: Foreign portfolio investor Arisaig Asia Consumer Fund has offloaded 26.72 lakh equity shares or 5.05% stake in the diagnostic and preventive care laboratories chain at an average price of Rs 488.18 per share, which amounted to Rs 130.47 crore. However, ICICI Prudential Mutual Fund bought 22.53 lakh equity shares or 4.25% stake in Thyrocare at an average price of Rs 488 per share, amounting to Rs 109.95 crore.

Timken India: Promoter Timken Singapore has offloaded 76 lakh equity shares or 10.1% stake in the ball and roller bearing manufacturing company via open market transactions at an average price of Rs 3,107.75 per share, which amounted to Rs 2,361.89 crore. However, Kuwait Investment Authority has bought 5.07 lakh shares or 0.67% stake in the company at an average price of Rs 3,100.30 per share.

Archean Chemical Industries: Societe Generale has bought 6.42 lakh equity shares in the chemical manufacturing company via open market transactions at an average price of Rs 510 per share. However, Norges Bank on account of the Government Pension Fund Global sold 9.5 lakh shares or 0.77% stake in the company at an average price of Rs 510.87 per share.

Jamna Auto Industries: Smallcap World Fund Inc has sold 59.05 lakh shares or 1.48% stake in the company via open market transactions at an average price of Rs 96.15 per share, which amounted to Rs 56.78 crore. As of March 2023, Smallcap World Fund had held 1.28 crore shares or 3.22% stake in the company.

Shilpa Medicare: The company will consider proposal of fund raising by way of rights issue of equity shares on June 23.

Aptech: The company’s Managing Director and CEO Anil Pant has taken an indefinite leave on account of sudden deterioration of his health. The board has constituted an Interim Committee to ensure smooth functioning and continuity of operations of the company.

Gujarat Gujarat Alkalies and Chemicals: Ex-Finance Secretary Hasmukh Adhia takes over as Chairman from Raj Kumar.

Vivanta Industries: The company has secured an order worth Rs 9.2 crore for installation, commissioning, integration, training and support for content library solution from Technowire Data Science.