Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.25% higher at 17,982, signalling that Dalal Street was headed for a positive start on Monday.

Most Asian shares were trading higher. The Nikkei 225 index slipped 0.02% and the Topix was up 0.24%. China’s CSI 300 index jumped 0.90% and the Hang Seng gained 0.24%.

Indian rupee fell 11 paise to 82.83 against the US dollar on Friday.

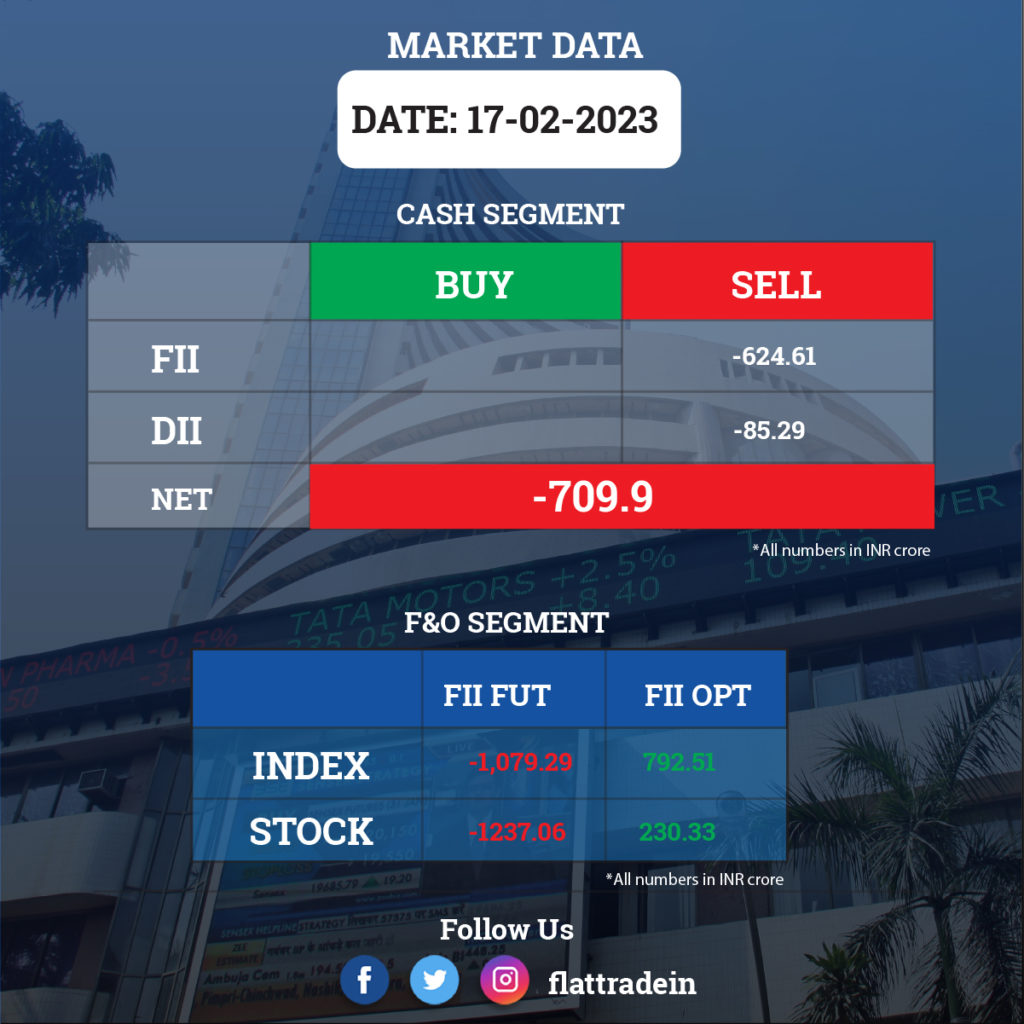

FII/DII Trading Data

Stocks in News Today

Sun Pharmaceutical Industries: The company has entered into agreements to acquire minority stake in two medical devices companies. The firm will pick 26.09% equity in Agatsa Software, an early-stage digital diagnostic devices company, and 27.39% in Remidio Innovative Solutions, a company that provides innovative products enabling early detection of eye diseases.

Adani Group: NSE has tweaked the constituents of its major indices with two companies, Adani Wilmar and Adani Power, which will get added to the Nifty indices starting from March 31, 2023. Adani Wilmar will be part of Nifty Next 50 and Nifty 100 indices, while Adani Power will be included in Nifty 500, Nifty 200, Nifty Midcap 100, Nifty Midcap 150, Nifty LargeMidcap 250, and Nifty Midsmallcap 400 indices.

Meanwhile, ABB India, Canara Bank, Page Industries, Varun Beverages have been included in Nifty Next 50 index, while Bandhan Bank, Biocon, Gland Pharma, Mphasis, Paytm have been excluded.

Hindustan Unilever (HUL): The FMCG major has signed an agreement for sale of its atta and salt business carried out under the brands Annapurna and Captain Cook, for Rs 60.4 crore, to Uma Global Foods Pte Ltd and Uma Consumer Products. Both the companies are subsidiaries of Singapore-headquartered company Reactivate Brands International, and an affiliate of CSAW Aqbator Pte Ltd. (Singapore). The deal involves distribution support by HUL to provide transitionary support for a period of 24 months.

Samvardhana Motherson International (SAMIL): The component manufacturer on Sunday announced that it is buying SAS Autosystemtechnik (SAS), which manufactures auto cockpit modules, from French company Faurecia for Rs 4,790 crore. “This acquisition will transform Motherson Group as a leading assembler of cockpit modules globally, with a special focus on electric vehicle (EV) models,” said Vivek Chaand Sehgal, chairman, SAMIL.

Power Grid Corporation of India: The state-owned electric power transmission utility was declared as the successful bidder under tariff-based competitive bidding to establish inter-state transmission system for various projects on build, own operate and transfer (BOOT) basis. The projects included an establishment of 765kV D/C transmission lines passing through Gujarat, 400kV D/C transmission lines traversing through Orissa & Chhattisgarh (bays extension works), new 765/400kV GIS at Khavda in Gujarat, and new 765/400kV substation at Ahmedabad (bays extension work) at Navsari in Gujarat. The company received letter of intent for the said projects.

CRISIL: The rating agency has recorded 6.3% YoY decline in consolidated profit at Rs 158.02 crore for quarter ended December 2022 due to high base. In Q4CY22, the profit was inflated by exceptional gain of Rs 45.82 crore due to profit on sale of immovable property. Consolidated revenue from operations grew by 16.5 percent YoY to Rs 822.3 crore for the quarter. At the operating level, EBITDA grew by 12.3 percent YoY to Rs 216.2 crore but margin fell 98 bps YoY due to higher employee cost and other expenses.

United Breweries: The Supreme Court admitted appeals against a National Company Law Appellate Tribunal (NCLAT) order upholding the Rs 873-crore penalty imposed by CCI on United Breweries (Rs 750 crore) and other beer makers. The SC has stayed the proceedings to recover the penalty, subject to the beer makers depositing an additional 10% of the penalty. The CCI, on September 24, 2021, imposed penalties of over Rs 873 crore on UBL, Carlsberg India, All India Brewers’ Association (AIBA) and 11 individuals for cartelisation in the sale and supply of beer.

Cipla: The US drug regulator has issued 8 observations in Form 483 for Pithampur manufacturing facility of the pharma company. The USFDA conducted a current good manufacturing practices (cGMP) inspection at Pithampur facility during February 6-17, 2023.

Dilip Buildcon: The company’s joint venture Dilip Buildcon – Skyway Infraprojects has received letter of acceptance for Rewa Bansagar Multi Village Scheme, from Madhya Pradesh Jal Nigam Maryadit, Bhopal. The order includes engineering, procurement, construction, testing commissioning, trial run and operation and maintenance of various components of Rewa Bansagar MVS in single package on turnkey job basis. DBL will also do operation & maintenance of the entire water supply scheme for 10 years.

PNC Infratech: The company’s subsidiary Sonauli Gorakhpur Highways Private Limited has achieved financial closure for four-laning of Sonauli – Gorakhpur section of NH-29E on hybrid annuity mode in Uttar Pradesh. The project bid cost is Rs 1,458 crore and construction period for the said road project is 730 days from appointed date.

Pennar Industries: The engineering company has bagged orders worth Rs 851 crore under several verticals including steel, tubes, and railways. These orders are expected to be executed within the next two quarters.

KEC International: The infrastructure EPC major has received orders worth Rs 3,023 crore under its civil, cables and transmission & distribution segments. With these orders, its YTD order intake stands at a record level of over Rs 18,500 crore, a growth of over 30 percent YoY.

Future Enterprises Ltd (FEL): The debt-ridden has defaulted on the payment of interest of Rs 12.75 crore on two non-convertible debentures (NCDs). The due date for payment was February 16, 2023, FEL said in an exchange filing. The NCDs have a coupon rate of 9.60%.

HG Infra Engineering: The company has received the provisional completion certificate for a road project in Rajasthan, which comprises upgrading to two lane with paved shoulder from Kundal to Jhadol. It has been provisionally declared fit for entry into operation on August 24, 2021.

Bharat Forge: The company’ subsidiary, Kalyani Strategic Systems, has signed a Memorandum of Understanding with Rolls-Royce Marine, North America to develop naval propulsion systems including controllable pitch propellers and shafting systems.

RITES: The company has secured a new EPC work of Rs 76.08 crore for provision of EI based automatic signaling with continuous track circuiting and other associated works. This is along with suitable indoor alterations in electronic interlocking /RRI/PI stations enroute in Dhaulpur- Gwalior section of Jhansi division of North Central Railway.