Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.26% lower at 18,337.50, signalling that Dalal Street was headed for negative start on Thursday.

Most Asian stocks were trading lower as investors were worried over the risk of the US defaulting on its debt. The Nikkei 225 index rose 0.48% and the Topix slipped 0.06%. The Hang Seng plunged 1.61% and the CSI 300 index fell 0.17%.

Indian rupee appreciated by 14 paise to close at 82.67 against the US dollar on Wednesday.

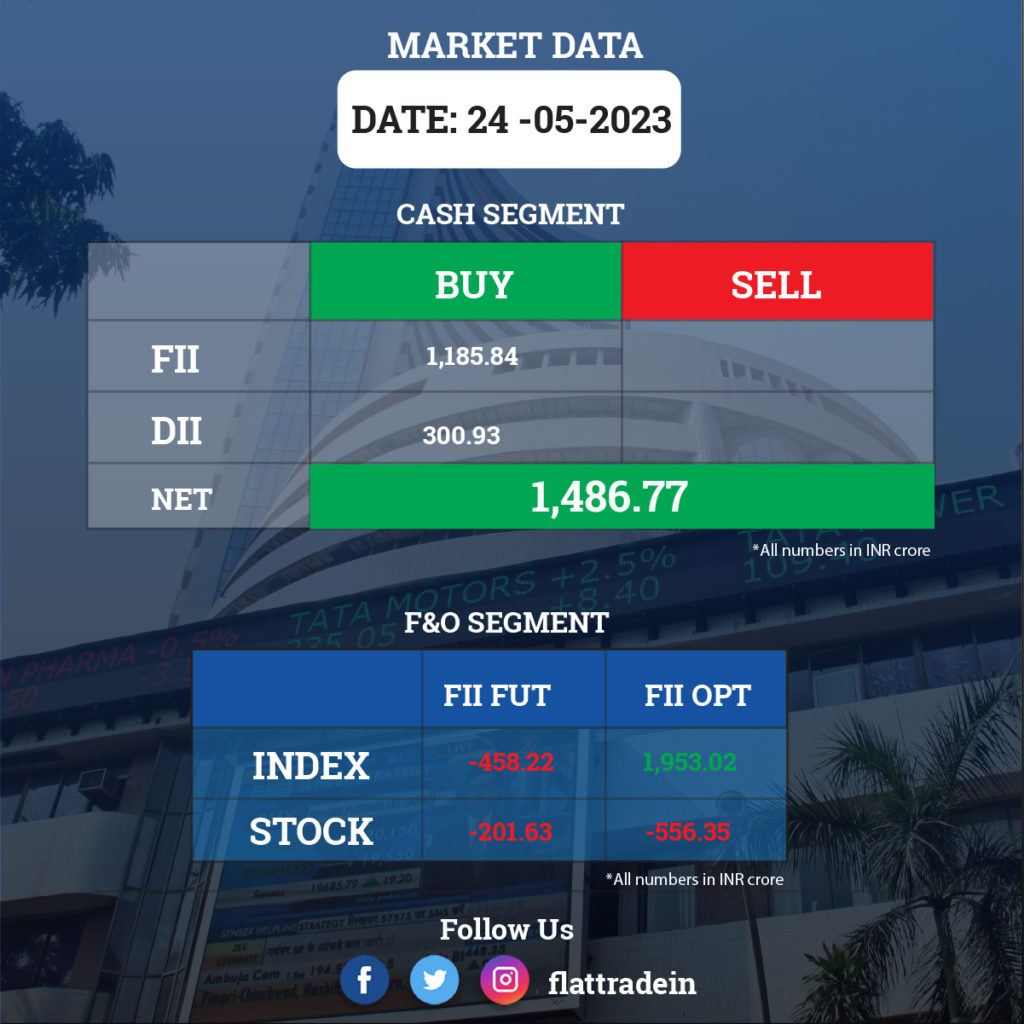

FII/DII Trading Data

Upcoming Results

Vodafone Idea, Gujarat State Fertilizers & Chemicals, Zee Entertainment Enterprises, Page Industries, Infibeam Avenues, General Insurance Corporation of India, ITD Cementation India, AIA Engineering, Triveni Engineering & Industries, Medplus Health Services, Strides Pharma Science, Heritage Foods, Emami, GMM Pfaudler, Bharat Dynamics, Prince Pipes and Fittings, Eclerx Services, Kolte-Patil Developers. Subros, Gokaldas Exports, HealthCare Global Enterprises, Indostar Capital Finance, Voltamp Transformers, Dhanuka Agritech, Mrs Bectors Food Specialities, Harsha Engineers International, Carysil, Indian Energy Exchange, Ashapura Minechem, Axiscades Technologies, Balmer Lawrie & Co., Black Box, John Cockerill India, Disa India, Esab India, Expleo Solutions, Ganesha Ecosphere, Globus Spirits, HBL Power Systems, Hindustan Oil Exploration Co., IFCI, Igarashi Motors India, Ingersoll-Rand (India), Indian Railway Finance Corporation, Jai Corp, Manali Petrochemical, Mishra Dhatu Nigam, Pokarna, Radico Khaitan, Reliance Infrastructure, Rolex Rings, Saksoft, Sandhar Technologies, SEPC, Shilpa Medicare, Suven Pharmaceuticals, TTK Prestige, and Uniparts India.

Stocks in News Today

Life Insurance Corporation of India (LIC): The LIC has recorded a standalone profit of Rs 13,427.8 crore for the quarter ended March FY23, a rise of 466% over the corresponding period last fiscal. The sequential growth in profit was 112%. Standalone net premium income fell by 8.3% year-on-year to Rs 1.31 lakh crore for the March FY23 quarter, but on a sequential basis, the said premium income increased by 17.9%. Its standalone revenue was down 7% YoY at Rs 2 lakh crore in Q4FY23. The board recommended a dividend of Rs 3 per share.

FSN E-Commerce Ventures (Nykaa): The company has recorded consolidated profit at Rs 2.41 crore for quarter ended March FY23, down 71.8% compared to the same period last fiscal, impacted by a high base in Q4FY22 due to tax write-back. Revenue from operations for the quarter grew by 33.7% to Rs 1,301.73 crore compared to the same quarter previous fiscal. Ebitda was up 84% YoY to Rs 70.70 crore in Q4FY23.

Infosys: The leading IT services firm has announced its collaboration with Adobe to transform the digital workforce through Infosys’ online learning platform, Infosys Springboard, under its Tech for Good charter. Both organisations will aim to create over 10,000 new Adobe-certified experts globally by 2025.

Oil India: The state-owned oil company has recorded standalone profit at Rs 1,788.3 crore for the March FY23 quarter, rising 2.4% over the previous quarter supported by higher other income. Its standalone revenue from operations (net of excise duty) grew by 0.4% sequentially to Rs 5,398 crore in Q4FY23. The board recommended a final dividend of Rs 5.50 per share.

National Aluminium Co.: The company’s consolidated revenue was down 15.62% YoY at Rs 3,670.86 crore in Q4FY23. Ebitda was down 52.88% YoY at Rs 766.52 crore in Q4FY23. Consolidated net profit was down 51.73% YoY at Rs 495 crore in Q4FY23.

Wipro: The IT consulting firm announced a partnership between its Engineering Edge business line and Spartan Radar, an automated mobility sensor software provider, to build advanced vehicle solutions. Wipro’s corporate investment subsidiary Wipro Ventures has invested in Spartan Radar’s Series B funding round.

Adani Ports and Special Economic Zone (APSEZ): The company said thta it will make long-term investment of $10 billion in Vietnam, including $3 billion in ports and wind and solar power projects.

Bayer CropScience: The company said its consolidated revenue was up 1.99% YoY at Rs 982.5 crore in Q4FY23. Ebitda was up 2.54% YoY at Rs 205.80 crore in Q4FY23. Consolidated net profit was up 3.8% YoY at Rs 158.5 crore in Q4FY23. The company has received exceptional gain of Rs 31 crore from sale of its environmental science business. The company has declared a final dividend of Rs 30 per share, amounting to an outgo of Rs 134.80 crore.

Lakshmi Machine Works: The company’s revenue was up 30.5% YoY at Rs 1,303.04 crore in Q4FY23. Ebitda was up 30.44% YoY at Rs 118.26 crore in Q4FY23. Consolidated net profit was up 13.74% YoY at Rs 94.1 crore in Q4FY23. The company will pay a dividend of Rs 98.50 per share.

Nava: The company’s consolidated revenue was down 13.28% YoY at Rs 881.44 crore in Q4FY23. Ebitda was down 13.79% YoY at Rs 347.22 crore in Q4FY23. Consolidated net profit was down 9.52% YoY at Rs 246.66 crore in Q4FY23.

Rupa & Co.: The company’s Q4FY23 consolidated revenue was down 8.52% YoY at Rs 401.91 crore in Q4FY23. Ebitda was down 62.93% YoY at Rs 27.15 crore in Q4FY23. Consolidated net profit was down 61.71% YoY at Rs 18.69 crore in Q4FY23. The board recommended a dividend of Rs 3 per share.

Aptech: The company’s Q4FY23 consolidated revenue was up 175.66% YoY at Rs 178.46 crore in Q4FY23. Ebitda surged 260.89% YoY at Rs 34.97 crore in Q4FY23. Consolidated net profit was up 30.53% YoY at Rs 33.35 crore in Q4FY23. The board approved issue of bonus shares in the ratio of 2:5. The company has declared an interim dividend of Rs 6 per share for the fiscal 2023.

Gujarat Pipavav Port: The company’s Q4FY23 consolidated revenue was up 6.86% YoY at Rs 234.73 crore in Q4FY23. Ebitda was up 1.30% YoY at Rs 129.95 crore in Q4FY23. Consolidated net profit was up 30.75% YoY at Rs 97.32 crore in Q4FY23. The company has incurred a net exceptional item of Rs 49.77 crore during the March quarter due to losses from cyclone Tauktae. The company declared a dividend of Rs 3.40 per share.

JB Chemicals & Pharmaceuticals: The company’s consolidated revenue was up 22.05% YoY at Rs 762.32 crore in Q4FY23. Ebitda was up 31% YoY at Rs 163.64 crore in Q4FY23. Consolidated net profit was up 3.13% YoY at Rs 87.63 crore in Q4FY23. The board has approved split of equity shares of face value Rs 2 each into shares of face value of Rs 1 each. It also declared a final dividend of Rs 9.25 per share for the fiscal 2023.

BL Kashyap and Sons: The civil engineering and construction company has secured new order worth Rs 132 crore from Indian School of Business. The total order book stood at Rs 2,650 crore till date.

Prudent Corporate Advisory Services: The consolidated revenue up 36.62% YoY at Rs 176.97 crore in Q4FY23. Ebitda was up 73.18% YoY at Rs 58.5 crore in Q4FY23. Consolidated net profit was up 81.55% YoY at Rs 41.23 crore in Q4FY23. The board has announced a final dividend of Rs 1.5 per share.

Trident: The company’s Q4FY23 consolidated revenues was down 15.86% YoY at Rs 1,573.25 crore in Q4FY23. Ebitda was down 20.48% YoY at Rs 268.52 crore in Q4FY23. Consoldiated net profit was down 27.91% YoY at Rs 130.66 crore in Q4FY23. The company has declared a first interim dividend of Rs 0.36 per share for the fiscal 2024, with June 1 as record date.

Venus Pipes & Tubes: The company’s revenue was up 59.99% YoY at Rs 176.28 crore in Q4FY23. Ebitda up 57.17% YoY at Rs 21.58 crore in Q4FY23. Consolidated net profit was up 66.42% YoY at Rs 13.43 crore in Q4FY23. The board has recommended a final dividend of Rs 0.5 per share for the fiscal 2023.

Tamil Nadu Newsprint & Papers: The company’s revenue was up 3.9% YoY at Rs 1,427.29 crore in Q4FY23. Ebitda was up 146.07% YoY at Rs 275.03 crore in Q4FY23. Net profit was up 358.24% YoY at Rs 102.83 crore in Q4FY23. The board has announced a dividend of Rs 5 per share for fiscal 2023.

ZF Commercial Vehicle Control Systems India: The company’s Q4FY23 consolidated revenue was up 24.98% YoY at Rs 977.28 crore in Q4FY23. Ebitda was up 61.73% YoY at Rs 143.99 crore in Q4FY23. Consolidated net profit was up 78.82% YoY at Rs 101.21 crore in Q4FY23. The company will pay a dividend of Rs 13 per share for fiscal 2023.

Garden Reach Shipbuilders & Engineers: The company has entered into a contract with Indian Navy for the supply of 10 in number 30 mm Naval Surface Gun (NSG) with electro-optical fire control system (EOFCS) and ammunition at a cost of Rs 248.51 crore. Profit for March FY23 quarter increased by 17.1% year-on-year to Rs 55.3 crore despite weak operating numbers, led by higher other income and topline. Revenue rose by 10.7% to Rs 601.2 crore compared to the year-ago period.