Market Opening - An Overview

Nifty futures on the Singapore Exchange traded 0.10% higher at 18,056.50, signalling that Dalal Street was headed for a positive start on Monday.

Asian shares were mixed as Japanese shares were trading lower as the yen rose to weigh on exporters. The Nikkei 225 index was down 1.01% and the Topix fell 0.56%. Meanwhile, shares in China were trading higher as economic activity rebounded. The Hang Seng rose 0.37% and the CSI 300 index was up 1.76%.

Indian rupee rose 22 paise to 81.32 against the US dollar on Friday.

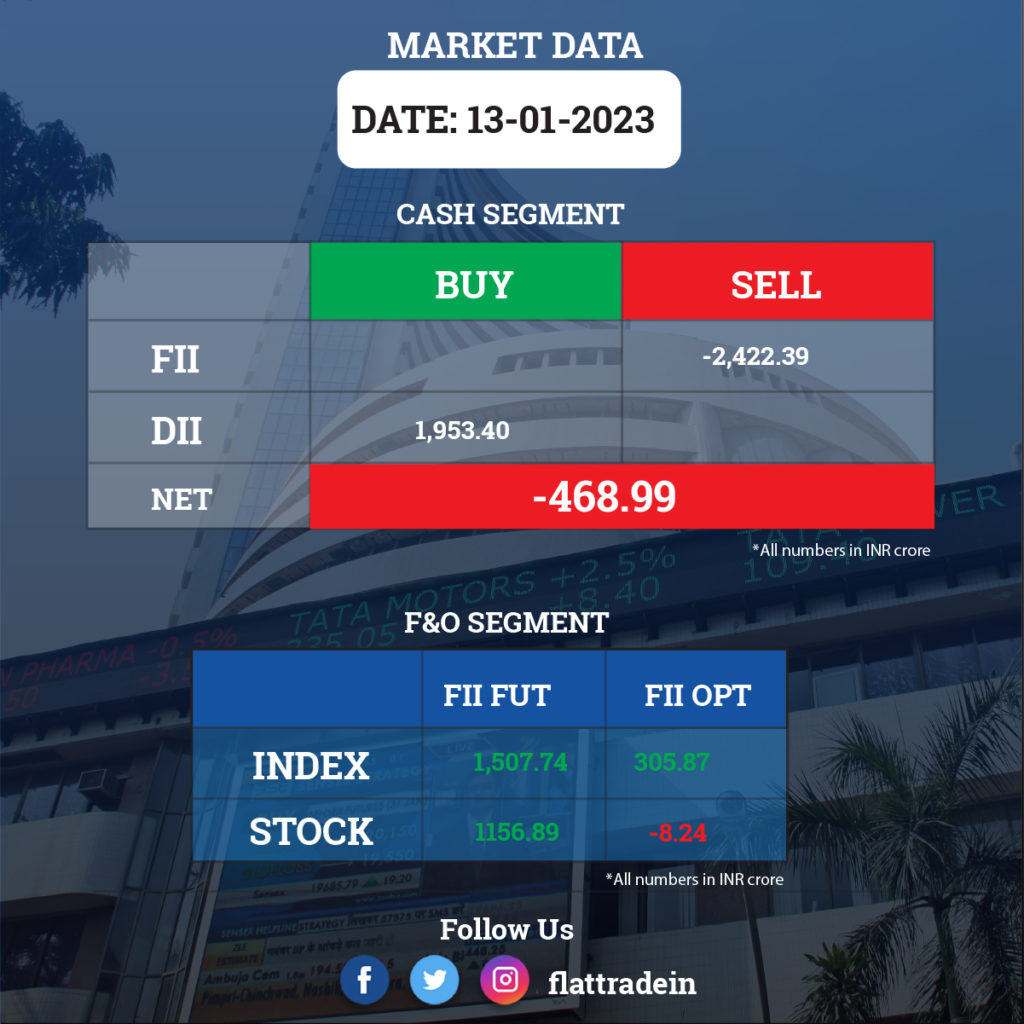

FII/DII Trading Data

Upcoming Results

Federal Bank, Angel One, Bank of Maharashtra, JSW Ispat Special Products, Tinplate Company of India, Kesoram Industries, Shree Ganesh Remedies, and Trident Texofab will be in focus ahead of quarterly earnings on January 16.

Stocks in News Today

Wipro: The IT services company said that its revenue from operation rose to Rs 23,229 crore in Q3FY23 from Rs 20,313.6 crore in the year-ago period. The net profit rose to Rs 3,053 crore in the reported quarter from Rs 2,969 crore in the year-ago period. It has declared an interim dividend of Rs 1 per equity share. The revenue expectations from IT Services business for the full year is expected to be in the range of 11.5% to 12%, in constant currency terms. The attrition has been recorded at 21.2% during the quarter.

HDFC Bank: The leading private sector lender registered a 18.5% year-on-year growth in standalone profit at Rs 12,259.5 crore for quarter ended December FY23, supported by strong net interest income, operating profit and lower provisions. Net interest income grew by 24.6% to Rs 22,988 crore, beating analysts’ expectations, for the quarter. Gross non-performing assets as well as net NPAs remained unchanged at 1.23% and 0.33% on sequential basis, respectively.

Avenue Supermarts (DMart): The company posted 6.7% year-on-year growth in consolidated profit at Rs 589.7 crore in Q3FY23 impacted by weak operating margin performance. Revenue from operations grew by 25.5% YoY to Rs 11,569 crore during the quarter. The company’s EBITDA increased by 11.4% to Rs 965.3 crore, but margin fell 110 bps YoY to 8.3% for the quarter due to higher input cost.

Tata Consultancy Services (TCS): Shares of the company will trade ex-dividend with respect to both special and interim dividend announced. The company announced a special dividend of Rs 67 and an interim dividend of Rs 8 per share, respectively. The record date to determine the shareholders’ eligibility for the said dividend is January 17.

L&T Finance Holdings: The NBFC reported consolidated profit at Rs 454 crore for the quarter ended December 2022, up 39% YoY. Net interest income grew by 24% YoY to Rs 1,693 crore for the quarter with net interest margin expanding by 70 bps YoY to 8.8%. The company concluded divestment of the mutual fund business and received sale consideration of Rs 3,485 crore along with surplus cash balance Rs 764 crore aggregating to Rs 4,249 crore. L&T Finance Holdings’ board has approved merger of 3 subsidiaries — L&T Finance, L&T Infra Credit, & L&T Mutual Fund Trustee — with the company.

Dr Reddy’s Laboratories: The pharma company has acquired trademark rights of breast cancer drug, PRIMCYV, from Pfizer Products India. With these rights, the company will use drug in the Indian market. Since May 2022, company has been marketing the drug in collaboration with Pfizer Products India under the brand name PRIMCYV in India.

Delhivery: The logistics company completed the acquisition of Algorhythm Tech. With this, Algorhythm has become a wholly0owned subsidiary of the company with effect from January 13, 2023.

Just Dial: The company reported a 288.4% year-on-year increase in consolidated profit at Rs 75.32 crore for the quarter December FY23, driven by strong operating performance and sales. Revenue from operations grew by 39% to Rs 221.4 crore for the quarter YoY. For nine months ended December FY23, profit grew by 62.2% YoY to Rs 79.1 crore and revenue increased by 27.5% to Rs 612.2 crore compared to year-ago period.

RattanIndia Enterprises: The company completed acquisition of 100% shareholding in the electric motorcycles company Revolt Motors. Revolt Motors is the highest selling electric bike in the country with its manufacturing facility in Manesar, Haryana. It has expanded its footprint pan-India with 30 dealerships spread across the country.

Sula Vineyards: The company recorded 13% year-on-year growth in its own brands gross billings at Rs 187.2 crore for quarter ended December FY23, led by strong growth in volumes as well as realisations. Wine tourism has grown 13% YoY to Rs 23 crore, with a 48% improvement in nine-month period for FY23 against same period of last year.

Mahindra & Mahindra (M&M): The National Company Law Tribunal has approved the merger of Mahindra Electric Mobility with the company. The appointed date of the scheme is April 1, 2021.

Wonderla Holidays: The company said that it is in discussions with the Madhya Pradesh government to explore the possibility of setting up an amusement park in the state.

Mahindra Lifespace Developers: The company has purchased 4.35 acres land in Singasandra, Bengaluru, to build a residential project with premium apartments.

HG Infra Engineering: The company has received an order worth Rs 412 crore from Delhi Metro Rail Corp Ltd for the construction of an elevated viaduct and four stations of Delhi’s mass rapid transit system. The project is expected to be completed in 2 years.

Whirlpool: Vishal Bhola has resigned as Managing Director of the company and he will be relieved from the services of the company as Managing Director with effect from April 4, 2023. The Board has appointed Narasimhan Eswar as Additional Director and Managing Director with effect from same date for a period of five years.