Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.19% higher at 18,756.50, signalling that Dalal Street was headed for positive start on Friday.

Japanese stocks were trading higher, tracking Wall Street overnight. The Nikkei 225 index surged 1.61% and the Topix index rose 1.25%. Meanwhile, the Chinese markets were trading a tad lower. The CSI 300 index slipped 0.05% and the Hang Seng fell 0.12%

Indian rupee depreciated by 2 paise to close at 82.57 against the US dollar on Thursday.

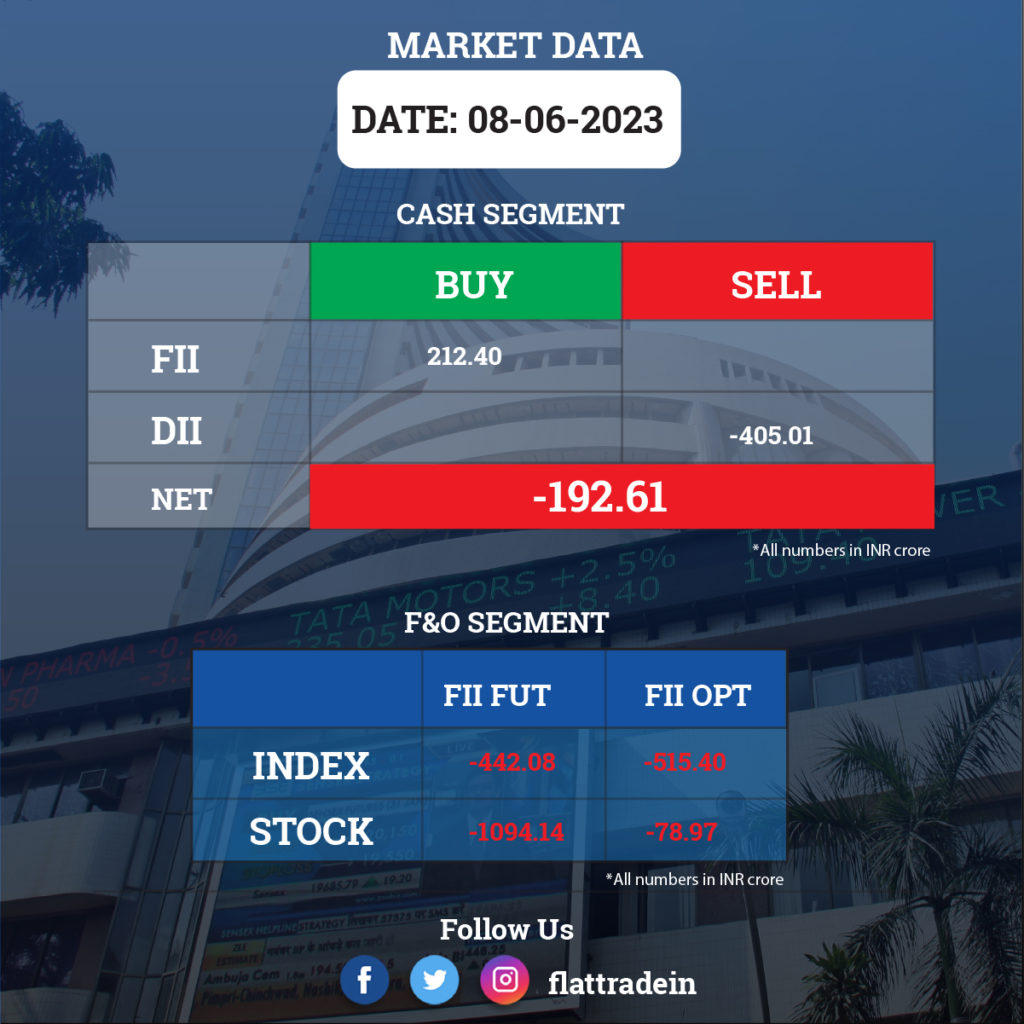

FII/DII Trading Data

Stocks in News Today

Kotak Mahindra Bank: Canada Pension Fund is likely to sell a 1.66% stake or 3.3 crore shares in the private sector lender, CNBC-TV18 reported quoting sources. The shares are offered at Rs 1,792.18 to Rs 1,886.50 apiece. The price range represents a discount of up to 5% compared to Thursday’s close. The deal size may be around $754 million. Canada Pension Plan Investment Board holds a 4.34% stake or 8.63 crore shares in the bank as of March 2023.

HDFC Bank: The lender has shortlisted Arvind Kapil, its current retail assets head, to spearhead the home loans business post its mega-merger with India’s biggest mortgage financier Housing Development Finance Corp., Bloomberg reported citing sources. Kapil, who has worked at HDFC Bank for almost a quarter of a century, recently met executives at the mortgage lender to discuss plans for the loan book post-merger, according to people familiar with the matter. The decision is yet to be finalized and may still change with the merger slated to be completed as soon as July 1, they said.

Tata Power: Tata Power Renewable Energy through its subsidiary TP Vardhaman Surya received a Letter of Award (LoA) to set up 966 MW RTC (round-the-clock) hybrid renewable power for Tata Steel. The project has a hybrid renewable capacity of 379 MW solar and 587 MW wind power. Tata Steel will invest 26% equity in the said project. The project will be commissioned by June 1, 2025.

Hindustan Aeronautics (HAL): The state-owned defence company said the meeting of the Board of Directors will be held on June 27 to consider a proposal for the sub-division of equity shares. Hence, the trading window for trading in the securities of the company will remain closed for all insiders, including designated persons, connected persons and their immediate relatives from June 9 till 48 hours after the declaration of the outcome of the board meeting.

Biocon: The Active Pharmaceutical Ingredient (API) manufacturing facility in Bengaluru received a certificate of GMP (good manufacturing practice) compliance from the Competent Authority of Germany. The said Bengaluru facility underwent an EU GMP inspection in February 2023.

NHPC: The company’s subsidiary NHDC has received a pump hydro storage site in Khandwa, Madhya Pradesh with an estimated storage capacity of 525 MW X 6 hours, from the New and Renewable Energy Department, Government of Madhya Pradesh.

GAIL India: The state-owned natural gas company has released payment to all stakeholders of JBF Petrochemicals as per an NCLT order. The Corporate Insolvency Resolution Process (CIRP) will be completed in 15 months. GAIL has already infused a total resolution plan amount of Rs 2,101 crore, thus acquiring 100% stake in JBF Petrochemicals.

Aether Industries: The speciality chemical manufacturer has inked a license agreement with Saudi Aramco Technologies Company for the commercialisation of the sustainable Converge polyols technology. The agreement formally initiates Aether’s activities towards manufacturing and commercialization at Aether of the Converge polyols technology and product series.

Blue Dart: The company appointed Sudha Pai as chief financial officer with effect from Sept. 1, 2023. Pai is currently the chief financial officer at DHL Global Forwarding, India. Blue Dart also named VN Iyer as group CFO with effect from September 1.

Capacit’e Infraprojects: The company plans to raise Rs 96.3 crore through a preferential issue of equity shares. The funds will be utilized for its long-term working capital requirements.

CEAT: The company has signed an agreement to further invest up to Rs 9 crore to acquire 10.89% of Tyresnmore. Upon completion of the agreement, Tyresnmore will become a subsidiary of the company with CEAT, holding a 56.9% stake on a fully diluted basis.

IRB Infrastructure Developers: The company’s gross toll revenue gained 8.9% year-on-year to Rs 864.75 million from Rs 794.32 million a year ago.

Pitti Engineering: The company has made an additional investment of Rs 5 lakh in its wholly owned subsidiary, Pitti Rail and Engineering Components, by subscribing to 50,000 fully paid-up equity shares of face value of Rs 10 each through a rights issue. With this investment, Pitti Rail is expected to meet its expenses for operations and general corporate purposes.

Abans Holding: The company’s subsidiary, Abans Agri Warehousing & Logistics, has signed a share transfer agreement to sell its entire 100% stake in Shanghai Yilan Trading Co. (SYTCL) to Forever Trading F.Z.C. for a composite consideration of CNY 354,595. Subsequently, SYTCL will cease to be the wholly owned step-down subsidiary of Abans Holdings Limited. The transaction is expected to be completed within three months.