Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.33% higher at 18,672, signalling that Dalal Street was headed for positive start on Monday.

Asian shares were mixed as investors awaited interest rate decision from the US, Europe, China and Japan this week. The Nikkei 225 index rose 0.68% ans the Topix gained 0.7%. The Hang Seng fell 0.61% and the CSI 300 index lost 0.3%.

Indian rupee appreciated by 12 paise to 82.46 against the US dollar on Friday.

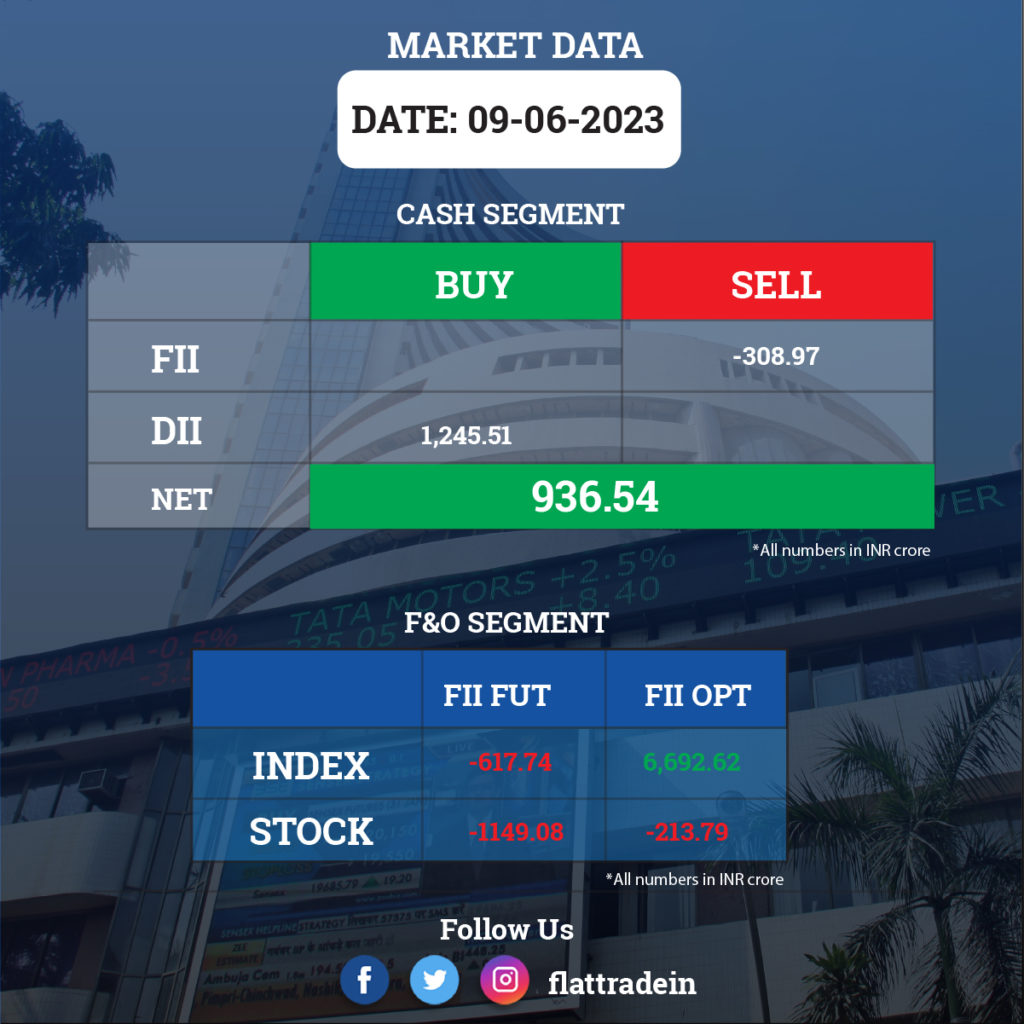

FII/DII Trading Data

Stocks in News Today

InterGlobe Aviation (IndiGo): The low-cost carrier has expanded its codeshare partnership with Turkish Airlines for the US. It will launch codeshare flights to four cities in the US via Istanbul from June 15. The flights will connect New York, Boston, Chicago, and Washington.

TVS Motor Company: TVS Credit Services Limited, the financing arm of TVS Motor Company, said it has raised Rs 480 crores from Premji Invest. Through a combination of primary and secondary investments, Premji Invest will acquire a 9.7% equity stake in TVS Credit for Rs 737 crores, the company said in an exchange filing.

TVS Motor (Singapore) Pte, a subsidiary of two-wheeler maker TVS Motor, said that it has agreed to acquire an additional 25% stake in Swiss E-Mobility Group (Holding) AG, also known as SEMG, based in Switzerland. After the acquisition of the 25% shares from existing minority shareholders is done, SEMG will become a wholly-owned subsidiary of TVS Motor (Singapore) Pte Ltd, TVS Motor said in the filing.

Cochin Shipyard: The Indian Navy has declared the shipbuilding company as L1 (lowest) bidder for the mid-life upgrade of a ship. The estimated contract value of the project is around Rs 300 crore, and it is to be executed in about 24 months.

Go Fashion: Venture capital firm Sequoia Capital will sell up to 10.18% stake in Go Fashion, the parent entity of Indian clothing brand Go Colors, via a block deal, CNBC TV-18 reported citing sources. The floor price for the stake sale will be Rs 1,135 per share, the persons privy to the development told the news channel. This would mark a discount of 5 percent as compared to the last closing price. The total size of the block deal will be Rs 624 crore, the report added.

Info Edge: The company said that it will sell its entire shareholding, held through unit Startup Investments (Holding) Ltd., in its associate company Happily Unmarried Marketing to VLCC Health Care for approximately Rs 61 crore through a mix of cash and share swap.

Steel Authority of India Ltd. (SAIL): Life Insurance Corporation of India acquired additional 2% stake in the steel company via open market transactions. With this investment, LIC has increased its shareholding in SAIL to 8.687 percent, up from 6.686 percent earlier.

Allcargo Logistics: The company has completed the acquisition of 30% stake in Gati-Kintetsu Express from KWE-Kintetsu World Express and KWE Kintetsu Express. Allcargo Logistics now holds 30% stake and Gati holds the existing 70% stake in Gati-Kintetsu.

Karnataka Bank: Srikrishnan Hari Hara Sarma has formally assumed the responsibilities of managing director and the chief executive officer of the company.

Karur Vysya Bank: The Tamil Nadu-based lender has revised base rate to 11.20% from 10.75% and benchmark prime lending rate to 16.20% from 15.75% with effect from June 16.

Easy Trip Planners: EaseMyTrip.com, the travel portal operated by the copany, has become the official travel partner of the World Padel League 2023. The partnership will provide travel solutions to players, officials and fans attending the game.

Power Finance Corporation: The company’s unit PFC Consulting incorporated two special purpose vehicles for development of independent transmission projects.

GHCL: Both the exchanges — BSE and NSE — have granted approval for the listing and admission to dealings of equity shares of company’s unit GHCL Textiles with effect from June 12.

Jupiter Wagons: NCLT, Kolkata, has approved the resolution plan submitted by Jupiter Wagons for acquiring the controlling stake of Stone India under the corporate insolvency resolution process (CIRP) of the Insolvency and Bankruptcy Code, 2016. After implementation of the resolution plan, Stone India will become a subsidiary of Jupiter Wagons.

Brightcom Group: The company estimates a topline of about Rs 9,196.03 crore to Rs 9,667.63 crore in FY24, a growth of 27.51% over FY23. It expects profit after tax at Rs 1,659.14 crore – Rs 1,744.23 crore, a growth of 24.12% in the current fiscal over FY23.