Market Opening - An Overview

Nifty futures on the Singapore Exchange traded were trading 0.33% higher at 18,010, indicating that Dalal Street was headed for a positive start on Thursday.

Asian shares were trading higher as expectations of softer inflation numbers boosted investors’ risk appetite. The Nikkei 225 index was up 0.03%, the Topix rose 0.31%. China’s CSI 300 index advanced 0.07% and the Hang Seng was up 0.53%.

Indian rupee rose 21 paise to 81.57 against the US dollar on Wednesday.

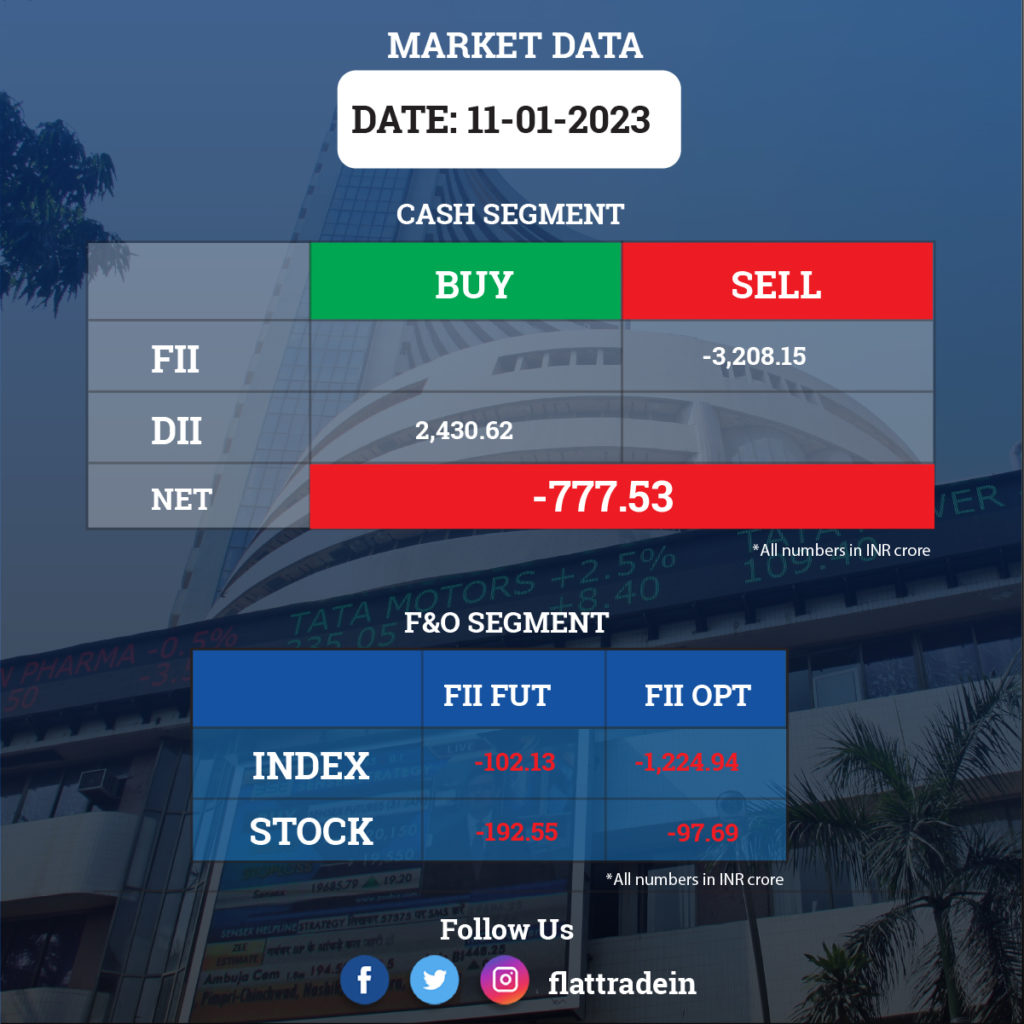

FII/DII Trading Data

Upcoming Results

Infosys, HCL Technologies, Anand Rathi Wealth, Cyient, Den Networks, G G Engineering, GM Breweries, GTPL Hathway, and Plastiblends India will report quarterly earnings on January 12.

Stocks in News Today

Reliance Jio: The telecom arm of Reliance Industries expanded its footprint in Tamil Nadu with the unveiling of True 5G services in five cities. The company rolled out 5G services in Coimbatore, Madurai, Tiruchirappalli, Salem, Hosur and Vellore in addition to the facility already being available in Chennai. Reliance Jio has invested Rs 40,446 crore in the state.

Adani Enterprises: Adani Group said that it plans to invest Rs 60,000 crore in Madhya Pradesh across mineral exploration, energy, agriculture, renewable energy and coal sectors. The group, however, did not give a timeline for these investments.

State Bank of India: The lender said that the Central government has extended the term of office of Challa Sreenivasulu Setty as Managing Director of the bank for a period of two years with effect from January 20, 2023.

Hindustan Unilever Ltd (HUL): The FMCG company has completed the acquisition of 51% stake in Zywie for Rs 264.28 crore. With this acquisition, Zywie Ventures has become a subsidiary of the company.

Route Mobile: The company has signed an exclusive SMS firewall solution and connectivity service agreement with a leading mobile network operator in Sri Lanka. The company will provide an end-to-end A2P monetization suite for all international A2P SMS’ terminating on its network. Route Mobile will serve as the exclusive partner of the mobile network operator for 2 years.

5paisa Capital: The financial service provider has reported a 2.5% sequential increase in consolidated net profit of Rs 11.02 crore for the quarter ended December FY23. Consolidated revenue from operations stood at Rs 83.76 crore for the quarter, up 5.3% QoQ. For the nine months period from April-December 2022, consolidated profit increased by 212% YoY to Rs 29.15 crore, helped by improvement in quality of acquisition, focus on technology and providing superior trading platforms to customers. Revenue during the same period grew by 18.5 percent to Rs 247.3 crore.

Elgi Equipments: Pattons Inc, USA, a subsidiary of the company, has identified a suitable buyer for its property and has completed the sale on January 10. The company had already received approval from board of directors for the sale of a property of Pattons Inc, which constituted more than 20% of its total assets.

IIFL Wealth Management: The company will consider the declaration of a fourth interim dividend, if any, for FY23 as well as a sub-division of equity shares. The board members will also consider the issue of fully paid-up bonus equity share(s) to the shareholders of the company.

Antony Waste Handling: The company has secured a bagged a multi-year mechanical power sweeping contract from Pimpri Chinchwad Municipal Corporation (PCMC). The contract is for the supply of four power sweeping machines and requires 161 km of road to be attended to daily. The company reported record sales of refuse derived fuel (RDF) at 15,337 tonnes. The total tonnage handled stood at approximately 1.05 million tonnes, up 4% YoY. The company said it witnessed seasonal weakness at its collection and transportation (C&T) operations that was offset by strong growth at its processing contracts.

Central Bank of India: The public sector lender has entered into a strategic co-lending partnership with Mamta Projects to offer MSME loans to borrowers at competitive rates. The co-lending arrangement will result in greater expansion of portfolio by Central Bank of India and Mamta Projects.