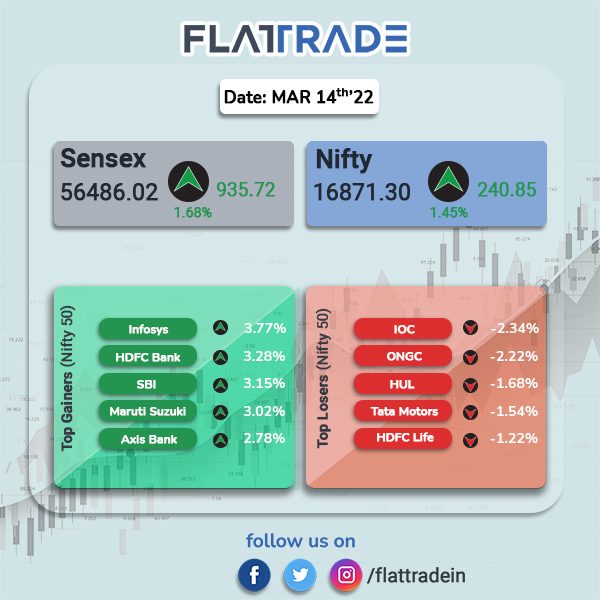

Benchmark equity indices jumped more than 1%, helped by gains in bank, financial services, IT and auto stocks. The Sensex surged 1.68% and the Nifty rose 1.45%.

Top gainers in Nifty sector indices were Media [2.45%], Bank [2.22%], Financial Services [2.16%], IT [1.92%] and Auto [0.95%]. Top losers were Realty [-1.69%], Metal [-0.47%] and Energy [-0.46%].

Indian rupee edged up 3 pasie to 76.56 against the US dollar.

Stock in News Today

Paytm: The company’s Payments Bank may have violated rules by allowing data to flow to servers abroad and did not properly verify its customers, Bloomberg reported. Paytm Payments Bank was required to maintain a service-level agreement with its technology vendor that would ringfence the entity from its owners.

Larsen & Toubro (L&T): The company’s water and effluent business bagged significant contracts from Gujarat Water Infrastructure, which has placed EPC order for a pipeline project to enhance water supply to Amreli, Junagadh, Botad and Rajkot. It also secured a project from a client in Dubai for supply, installation, testing and commissioning of water distribution network and large meter connections. L&T defined significant contracts as those in the value range of Rs 1,000 crore to Rs 2,500 crore.

PNC Infratech Ltd: The infrastructure company shares rose after the company was declared the lowest bidder for National Highways project worth Rs 738 crore in Uttar Pradesh. The project will be constructed in 24 months and operated for 15 years post construction.

Sobha Ltd: The realty firm has appointed Jagadish Nangineni as an additional director in the capacity of Wholetime Director designated as Managing Director and Key Managerial Personnel. The appointment, effective from April 1, will be valid for term of five years. Jagadish Nangineni succeeds Jagdish Chandra Sharma whose resignation has been accepted by the company’s board.

Alembic Pharmaceuticals: The drug manufacturer received tentative approval from the US health regulator FDA for its ANDA for Macitentan tablets, 10 mg. The drug is therapeutically equivalent to Opsumit tablets, 10 mg of Actelion Pharmaceuticals US. The drug is indicated for treatment of pulmonary arterial hypertension, to delay disease progression.

Power Mech: The company won orders worth Rs 2,120 crore under Jal Jeevan Mission programme. The orders pertain to the provision of functional household tap connection under Jal Jeevan mission in 2,120 villages in Pratapgarh, Fatehpur and Meerut in Uttar Pradesh.

Hindustan Aeronautics Limited (HAL): The company has signed an MoU with Bengaluru-based company SASMOS to work together on advanced electronics, electrical and fibre optic interconnections in the aerospace domain. HAL’s subsidiary Naini Aerospace Limited (NAeL) was also a signatory to the MoU, SASMOS’ statement noted.

BHEL: The government-owned has dispatched its 42nd nuclear steam generator to NPCIL for installation at a 700 MWe unit in Rajasthan Atomic Power Project. The steam generator was flagged off from BHEL’s Trichy plant in the presence of senior officials of BHEL and NPCIL.

Coal India Ltd: The company’s subsidiary The Mahanadi Coalfields Limited (MCL), has crossed 157 million tonne (MT) in coal production in the financial year of 2021-22, to become the leading coal producing company in the country, a release said. MCL produced 7.62 lakh tonne of dry fuel which is the highest in a day during the current financial year reaching 157.7 MT with a growth of around 16 per cent over the last financial year.

Kabra Extrusiontechnik: The company’s battery division Battrixx announced the acquisition of 100% stake in Pune-based Varos Technology. Varos pioneers in developing and leveraging IOT tools for EV infrastructure and battery management systems.

Krsnaa Diagnostics: The company informed the exchange that Shivananda Rao has tendered his resignation from the post of chief operating officer (COO) of the company. Rao has resigned due to personal reasons and the resignation is effective from closing of business hours on Monday, March 14, 2022.

Hindalco Industries: The company’ shares were offloaded by ICICI Prudential Mutual Fund (MF), which sold 11.81 lakh equity shares or 0.05% stake of the company. Post the transaction, ICICI Prudential Mutual Fund (MF) decreased its shareholding to 3.01% stake from 3.07% stake held in Hindalco Industries. The deal was executed in secondary market.