Pyramid Technoplast Limited plans to go public and raise up to Rs 153.05 crore. The subscription for the IPO will be open from August 18 to August 22, 2023. The price band is fixed at Rs 151- Rs 166 per share.

The IPO comprises of fresh issue of shares worth Rs 91.30 crore and Offer For Sale worth Rs 61.75 crore. The face value of each share is Rs 10 and the miminum lot size for retail investors is 90 shares per lot.

Company Summary

Pyramid Technoplast is an industrial packaging company engaged in the business of manufacturing polymer based molded products (Polymer Drums) mainly used by chemical, agrochemical, speciality chemical and pharmaceutical companies for their packaging requirements. The company is one of the leading manufacturers of rigid Intermediate Bulk Containers (IBC) in India, manufacturing 1,000 litre capacity IBC The company also manufactures MS Drums made of mild steel (MS) used in the packaging and transport of chemicals, agrochemicals and speciality chemicals.

The company has six strategically situated manufacturing units out of which four units are in Bharuch, GIDC, Gujarat and two are situated at Silvassa, UT of Dadra and Nagar Haveli. The seventh manufacturing unit is under construction at the Bharuch, GIDC, Gujarat, adjacent to the existing units.

The total installed capacity of the company’s Polymer Drum manufacturing units is 20,612 MTPA and the total installed capacity of its IBC manufacturing unit is 12,820 MTPA and the total installed capacity of its MS Drums unit is 6,200 MTPA. The company’s product offering in polymer based packaging by way of drums ranges from 20 litres to 250 litres and IBC is 1,000 litres.

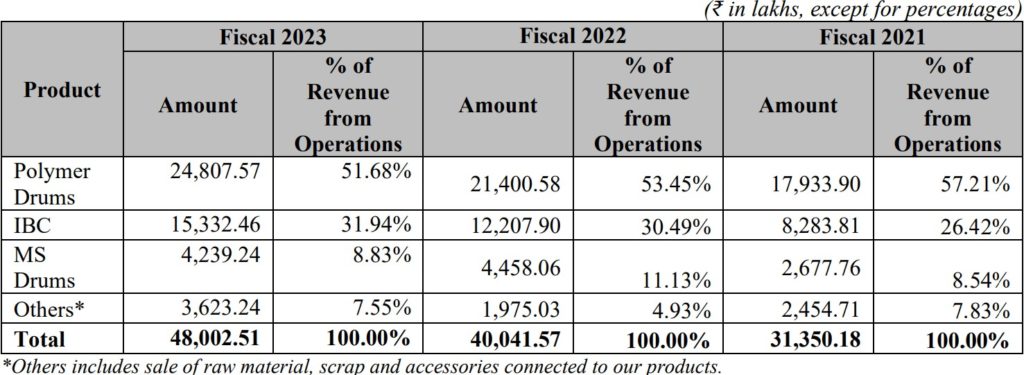

For FY23, Polymer Drums contributed 51.68% of the total revenue from operations, IBC contributed 31.94% of the revenue from operations and MS Drums’ share was 8.83%. The company has served more than 376 customers on a regular basis during the past three financial years.

The revenues from operations across product verticals for fiscals 2023, 2022 and 2021, is shown in the table below:

Company Financials

Period Ended | FY23 | FY22 | FY21 |

Total Assets (Rs in crore) | 225.78 | 183.76 | 153.46 |

Total Revenue (Rs in crore) | 482.03 | 402.64 | 316.18 |

EBITDA (Rs in crore) | 51.83 | 44.43 | 32.5 |

EBITDA Margin (%) | 10.75% | 11.03% | 10.28% |

Profit After Tax (PAT) (Rs in crore) | 31.76 | 26.15 | 16.99 |

PAT Margin (%) | 6.62% | 6.53% | 5.42% |

ROE (%) | 29.61% | 34.77% | 34.79% |

ROCE (%) | 21.37% | 21.38% | 21.11% |

Company Strengths

- Diverse customer base from various industries.

- Comprehensive product portfolio, providing alternative packaging solutions according to different customers’ requirements.

- Strategic location of the company’s manufacturing units.

- Quality standard certifications and quality tests adhering to safety levels outlined by United Nations Recommendations as well as the Bureau of Indian Standards.

- Experienced promoters and senior management team.

Purpose of the IPO

The company plans to use the net proceeds from fresh issue of shares towards repayment and/or pre-payment, in full or part, of certain outstanding borrowings availed by the company aggregating to Rs 40 crore; funding of working capital requirements of the company totalling Rs 40.21 crore; and general corporate purposes.

The proceeds from the Offer for Sale shall be received by the selling shareholders and the company will not receive any proceeds from the Offer for Sale.

Company Promoters

Bijaykumar Agarwal, Jaiprakash Agarwal, Yash Synthetics Private Limited, Credence Financial Consulatncy LLP, Pushpa Devi Agarwal, and Madhu Agarwal are promoters of the company.

IPO Details

IPO Subscription Date | August 18 to August 22, 2023 |

Face Value | Rs 10 per share |

Price Band | Rs 151 to Rs 166 per share |

Lot Size | 90 shares |

Total Issue Size | 92,20,000 shares aggregating up to Rs 153.05 crore |

Fresh Issue | 55,00,000 shares aggregating up to Rs 91.30 crore |

Offer for Sale | 37,20,000 shares aggregating up to Rs 61.75 crore |

Issue Type | Book Built Issue IPO |

Listing At | BSE, NSE |

IPO Lot Size

Application | Lots | Shares | Amount |

Retail (Minimum) | 1 | 90 | Rs 14,940 |

Retail (Maximum) | 13 | 1170 | Rs 1,94,220 |

Small HNI (Minimum) | 14 | 1,260 | Rs 2,09,160 |

Small HNI (Maximum) | 66 | 5,940 | Rs 9,86,040 |

Large HNI (Minimum) | 67 | 6,030 | Rs 10,00,980 |

Allotment Details

Event | Date |

Basis of Allotment of Shares | August 25, 2023 |

Initiation of Refunds | August 28, 2023 |

Credit of Shares to Demat Account | August 29 2023 |

Listing Date | August 30, 2023 |

To check allotment, click here