Gujarat-based Rolex Rings is set to open its initial public offering on July 28 and the auto components maker has fixed the price band for the initial share sale at ₹880-900 apiece.

Rolex plans to raise Rs 731 crore by issuing fresh shares of ₹56 crore and an offer for sale (OFS) of about 75 lakh equity shares by Rivendell PE, which holds 41% stake in the comapny.

The company’s promoters include Rupesh Dayashankar Madeka, Manesh Dayashankar Madeka, Pinakin Dayashankar Madeka, Bhautik Dayashankar Madeka and Jiten Dayashankar Madeka having a shareholding of 48.8% at the time of filing red herring prospectus.

According to its draft prospectus, the funds raised via the IPO will be utilised for the purpose of funding its long-term working capital requirements and for general corporate purposes. The company plans to use Rs 45 crore from the net Proceeds towards funding the day-to-day operations.

Company Overview

Rolex has three manufacturing units in Rajkot, Gujarat, with annual achievable capacity of 144,750 MTPA in forging and 69 million parts per annum in machining. It is one of the top five forging companies in India with respect to installed capacity, and it manufactures and supplies hot rolled forged and machined bearing rings, and automotive components for various vehicle segments.

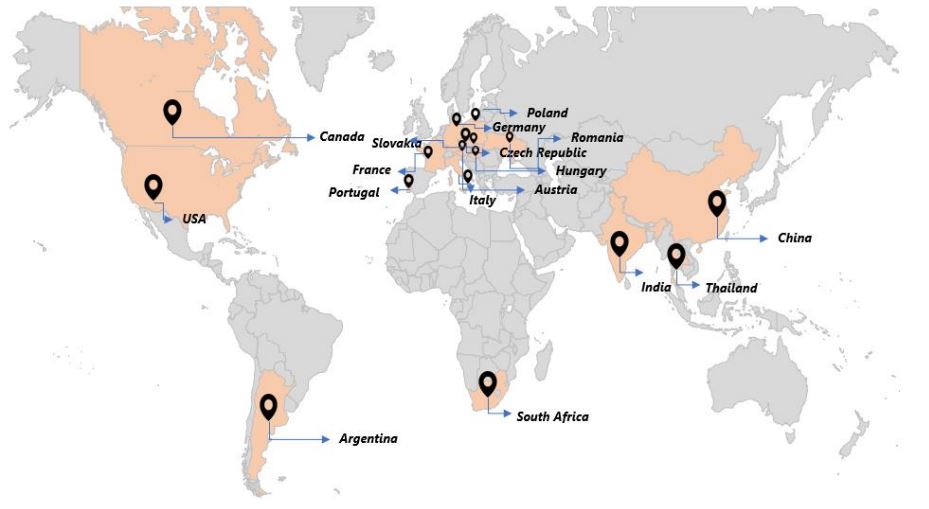

The segments include two-wheelers, passenger vehicles, commercial vehicles, off-highway vehicles, electric vehicles), industrial machinery, wind turbines and railways, amongst other segments across domestic and international markets.

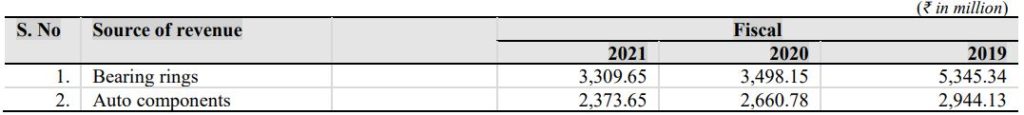

For fiscal 2021, 2020 and 2019, revenue from operations from international markets as a percentage of total revenue from operations stood at 56.12%, 53.82%, and 56.27%, respectively. The company’s revenue from various products can be attributable to the following sources:

Rolex Rings' Global Footprint

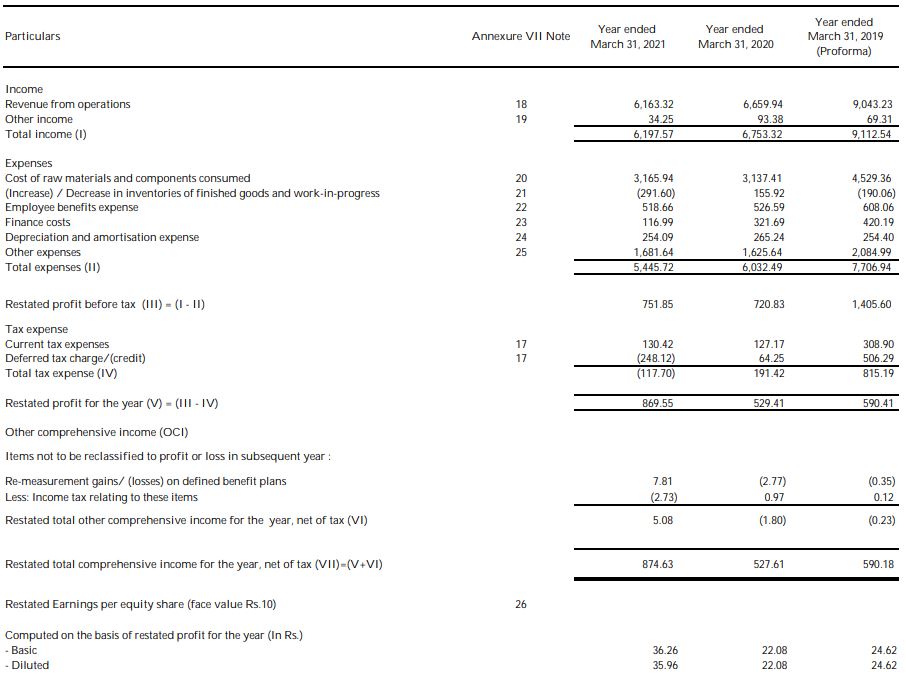

Financial Performance

Rolex Rings reported a 64.24% increase in profit after tax at Rs 86.95 crore, from Rs 52.94 crore in the previous fiscal. Its revenues from operations stood at Rs 616.36 crore in FY21, as against Rs 666 crore in the year-ago period. The profit and loss account for the past three years is given below

Company's Strength

- Comprehensive product portfolio

- Manufacturing capabilities offering scale, flexibility and location advantage

- Long standing customer relationships and diversified revenue base across geographies

- Experienced Promoters and management team with strong domain expertise

IPO Details

| IPO Opening Date | July 28, 2021 |

| IPO Closing Date | July 30, 2021 |

| Issue Type | Book Built Issue IPO |

| Face Value | Rs 10 per equity share |

| IPO Price | Rs 880 to Rs 900 per equity share |

| Market Lot | 16 Shares |

| Min Order Quantity | 16 Shares |

| Listing Exchanges | NSE, BSE |

| Expected Date of Listing | August 9, 2021 |

IPO Lot Size

Application | Lots | Shares | Amount (Cut-off) |

Minimum | 1 | 16 | Rs 14,400 |

Maximum | 13 | 208 | Rs 187,200 |