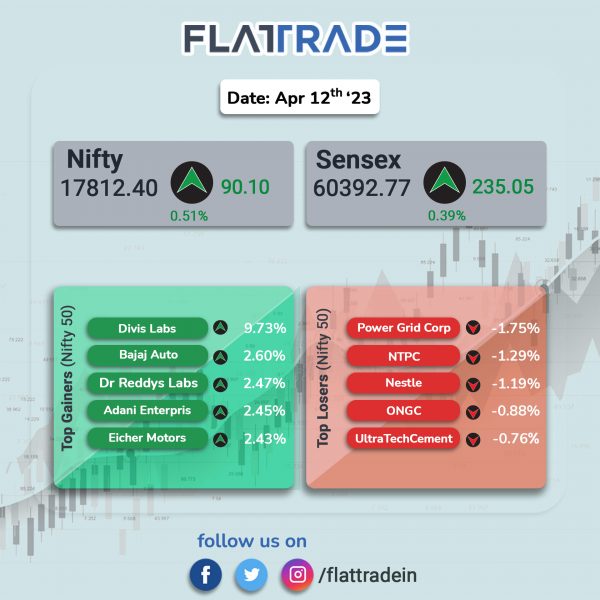

Benchmark equity indices ended higher as investors await crucial inflation data from the US and India scheduled to be released today. The Sensex rose 0.39% and the Nifty gained 0.51%.

In broader markets, the Nifty Midcap 100 index increased 0.65% and the BSE Smallcap rose 0.41%.

Top gainers were Pharma [2.23%], IT [1.06], Auto [0.94%], Financial Services [0.61%] and Private Bank [0.49%]. Top losers were PSU Bank [-0.64%], Media [-0.58%], FMCG [-0.34%] and Energy [-0.28%].

Indian rupee rose 5 paise to 82.08 against the US dollar.

Stock in News Today

Nestle India: The company announced that its board of directors has declared an interim dividend of Rs 27 per share for the year 2023. The total dividend payout for the company would Rs 260.32 crore. The record date for the said dividend payout is 21 April 2023.

HFCL: The telecom company announced that it has received the purchase orders aggregating to Rs 123.84 crore from Reliance Projects & Property Management Services for supply of optical fiber cables. The order involves supplying of various types of optical fiber cables as per customer specifications. The domestic order has to be executed by October 2023.

Adani Transmission: The company declared having surplus cash of Rs 800 crore as of Q4FY23. Adani Electricity Mumbai, also funded a Capex of Rs 1,310-crore in FY23 without any debt incurrence.

Bank of India: The public lender said that its board would be considering the proposal of raising capital for the FY24 at their meeting proposed on 18 April 2023, aggregating up to Rs 6,500 crore. The board will consider raising up to Rs 4,500 crore by issue of fresh equity capital in the form of FPO / QIP / rights issue / preferential issue and / or Basel III compliant Additional Tier-1 (AT-1) bonds (domestic and foreign currency). The company may issue Basel III compliant Tier-2 bonds upto an amount of Rs 2,000 crore.

Puravankara: The company’s sale value increased by 21% to Rs 1,007 crore in Q4FY23 from Rs 831 crore in Q4FY22. Volumes rose by 2% YoY to 1.21 million square feet (msft) while realization improved by 19% YoY to Rs 8,321 per square feet in Q4FY23. Average price realization improved by 14% to Rs 7,768 per squar feet during FY23 from 6,838 per square feet in FY22. Puravankara said that it had achieved the highest ever sale value of Rs 3,107 crore for FY23, the highest in any financial year since inception. Customer collections from the real estate business increased to Rs 2,258 crore in FY23 from Rs 1,440 crore in FY22, up 57% YoY.

Suzlon Energy: The company announced that it has received an order for the development of a 50.4 megawatt (MW) wind power project for Sembcorp’s renewables subsidiary, Green Infra Wind Energy. The renewable energy company will install 24 wind turbine generators (WTGs) with a hybrid lattice tubular (HLT) tower and a rated capacity of 2.1 MW each. The project is located in Karnataka and is expected to be commissioned in 2024.

Bigbloc Construction: The company’s wholly owned subsidiary Bigbloc Building Elements has commenced commercial production at its 5 lakh cubic meter per annum AAC Blocks plant at Wada in Palghar, Maharashtra. The company expects to strengthen its position in the markets including Maharashtra, Gujarat, Madhya Pradesh and Rajasthan with the commercial operation of the Wada plant. At full capacity, Wada plant is expected to generate revenues of Rs 200 crore per year and total capex for the Wada project is estimated to be around Rs 70 crore for setting up 5 lakh cubic meter (cbm) per annum plant.

Lupin: The pharma company announced that the launch of its regional reference laboratory in Bengaluru, Karnataka, as part of the expansion of its diagnostics network. The laboratory offers a comprehensive range of diagnostics services, including molecular diagnostics, cytogenetics, flow cytometry, cytology, microbiology, serology, haematology, histopathology, immunology, routine biochemistry, among others. The company now has existing network of 25 laboratories and over 410 collection centers across the country.

Container Corporation of India (CONCOR): The company said that total throughput increased by 4.71% to 11,19,034 twenty-foot equivalent units (TEUs) in Q4FY23 from 10,68,721 TEUs recorded in Q4FY22. While the export-import (EXIM) throughput improved by 2.21% year on year to 8,51,261 TEUs in quarter ended 31 March 2023. Domestic (DOM) throughput jumped 13.53% to 2,67,773 TEUs in Q4 FY23 over Q4 FY22. CONCOR operates 59 terminals across the country along with two strategic tie-ups.

Venus Pipes & Tubes: Investor Ashish Kacholia picked about 2% stake in the company via bulk deal on the BSE. As per the bulk deal data on the BSE, Ashish Rameshchandra Kacholia on 11 April 2023 bought 4 lakh equity shares, or 1.98% equity, of Venus Pipes at Rs 750 per share. At the same time, Nuvama Wealth Finance sold 1.3 lakh equity shares, or 0.68% equity, at Rs 750.02 per share.