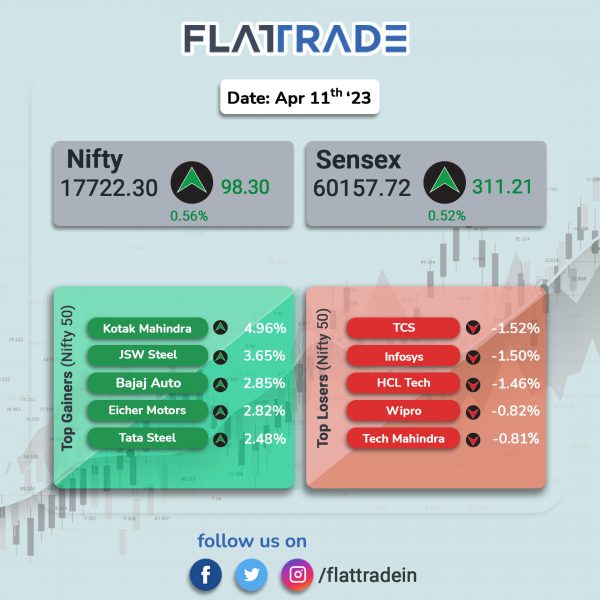

Benchmark indices remained in the positive region throughout the session and ended higher, led by gains in bank, metal and energy stocks. The Sensex rose 0.52% and the Nifty gained 0.56%. IT stocks came under pressure ahead of their quarterly results this week.

In broader markets, the Nifty Midcap 100 index rose 0.5% and the BSE Smallcap advanced 0.62%.

Top gainer were Metal [1.76%], PSU Bank [1.61%], Bank [1.30%], Private bank [1.15%], Financial Services [1.08%], Energy [1.03%], and Auto [0.99%]. Top losers were IT [-1.26%] and Realty [-0.28%].

Indian rupee fell 14 paise to 82.12 against the US dollar on Tuesday.

Stock in News Today

Life Insurance Corporation of India (LIC): The life insurer announced the appointment of Ratnakar Patnaik as chief investment officer (CIO) and Pratap Chandra Paikray as chief risk officer (CRO) of the corporation with effect from 10 April 2023. Ratnakar Patnaik will be replacing P R Mishra as chief investment officer and key management person of the corporation, who has been transferred and posted to another assignment.

Tejas Networks: Credit rating agency ICRA reaffirmed its rating on the bank facilities of Tejas Networks, which amounted to Rs 559.86 crore. ICRA has reaffirmed the long-term rating at “[ICRA] A+” and short-term rating at “[ICRA] A1+”. The outlook on the long-term rating is ‘stable’. ICRA said that the reaffirmation of Tejas Networks’ ratings factors in the financial flexibility emanating from the strong parentage of Panatone Finvest Limited (PFL), which is a subsidiary of Tata Sons Private Limited (TSPL) and an investment holding company of the Tata Group for investment in telecommunication.

Bank of Baroda (BoB): The state-run lender announced that it will be revising its Marginal Cost of Funds Based Lending Rate (MCLR) with effect from 12th April 2023. This revision will affect various loan tenors offered by the bank. As per the revision, overnight tenor has increased by 5 basis points from 7.90% to 7.95%, and one-year tenor has increased by 5 basis points from 8.55% to 8.60%. The remaining three tenors have remained unchanged with one-month, three-month, and six-month tenors at 8.20%, 8.30%, and 8.40%, respectively.

BCPL Railway Infrastructure: The company announced that it has received an electrification project from Northern Railway, Electrical Division, Jalandhar City, Punjab. The project involves the design, supply, erection, testing and commissioning of 25 KV OHE for the work of “Doubling between Ludhiana-Mullanpur including Ludhiana Yard Remodeling over Firozpur Division” covering 69 Track kilometers. The total cost of the project is estimated to be Rs 23.66 crore, and it is expected to be completed within a span of 18 months.

EKI Energy Services: The company announced that its board has appointed Pankaj Pandey as the chief operating officer (COO) of the company. The COO will form a part of the senior management of the company. Earlier, Pankaj Pandey was heading the community-based projects and the business development team at EKI Energy Services (EKIESL). He will continue with his previous responsibilities and now, will also head a Climate Change study department at EKI.

Kolte-Patil Developers: The Pune-based real estate company announced that it will raise Rs 140 crore through NCDs. The company will allot 14,000 secured, unlisted, redeemable non-convertible debentures on a private placement basis. The face value NCDs is Rs 1 lakh each, and will aggregate to a total of Rs 140 crore. The funds raised from this issuance will be utilized towards acquisition of land and for general corporate purposes of the company. The tenure of the debentures will be 120 months, unless redeemed earlier. The coupon/interest offered on the debentures is a coupon of 0.001% per annum compounded annually on the principal amount of each debenture.

Ugro Capital: The NBFC on Tuesday announced that its board has approved raising of funds through issuance of equity shares aggregating up to Rs 240 crore to Danish Sustainable Development Goals Investment Fund K/S, on a preferential basis. The capital from the funds raised will primarily be used for lending to micro, small & medium enterprises (MSME) segment and take credit to the last mile. This capital raise will further enhance the firm’s strong capital position and strengthen the balance sheet, it added. Meanwhile, Ugro Capital said that it is simultaneously raising up to Rs 101 crore from long term shareholders like insurance companies, AIF, and other financial institutions through a qualified institutions placement (QIP) of up to Rs 101 crore.

Bannari Amman Spinning Mills: The company announced that its board will hold a meeting on Wednesday, 19 April 2023, to consider various proposals of raising funds by the company. Shares of the company rose 8.8%.

Radico Khaitan: The company said Magic Moments Vodka has surpassed the 5 million cases mark in sales in FY2023, an increase from the 3.8 million cases sold in the previous year. Meanwhile, 8PM Premium Black Whisky has also achieved a noteworthy milestone, selling over 3 million cases in the financial year 2023. This is a significant increase from the 2.1 million cases sold in the previous year, representing a growth of 42.8%.

Spandana Sphoorty: The company said in an exchange filing that its board has approved and allotted 2,500 senior, secured, rated, listed, redeemable, NCDs having face value of Rs 1 lakh each, at par, on a private placement basis in demat form, for consideration of an aggregate amount of Rs 25 crore.

Kirloskar Ferrous: The company has been declared the highest bidder for Oliver Engineering under corporate insolvency resolution process (CIRP). In an exchange filing, the company announced that it had participated in the corporate insolvency resolution process of the corporate debtor and has been declared as the highest bidder on 10 April 2023. The CIRP was initiated against Oliver Engineering by order of the NCLT Delhi passed on 26 April 2022 in the matter of Punjab National Bank vs Oliver Engineering Pvt Ltd.

Trident Limited: The company said that in the home textile division, production of bed linen improved to 3.12 million metres (MM) in March 2023, registering a growth of 8.33% YoY. Production of bath linen declined 2.23% to 3,556 metric tonnes (MT) in March 2023 as compared to 3,637 MT posted in March 2022. Production of yarn slipped 20.7% YoY to 8,675 MT in March 2023. In paper & chemicals division, production of paper was at 12,010 MT, down 12% YoY, and production of chemicals stood at 9,378 MT, up 2.44% during the period under review.

Wardwizard Innovations & Mobility: The company said it has recorded sales of 3,744 units of electric two wheelers in March 2023, compared to sales of 5,020 units in March 2022. The company sold 953 units in February 2023. The company sells electric two-wheelers under the brand name – Joy e-bike.