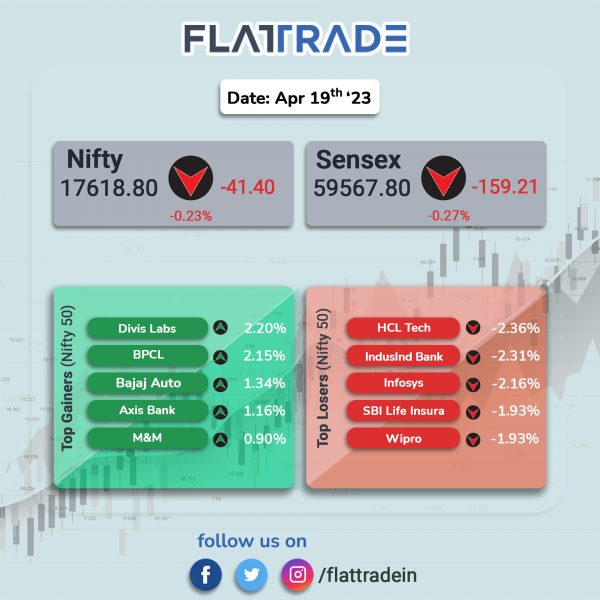

Nifty and Sensex closed lower weighed by losses in IT and public sector bank stocks. The Sensex was down 0.27% and the Nifty fell 0.23%.

In broader markets, the Nifty Midcap 100 index slipped 0.09% and the BSE Smallcap rose 0.12%.

Top losers were Nifty IT [-1.77%], Media [-1.71%], PSU Bank [-0.84%], Private Bank [-0.28%], and Bank [-0.26%]. Top gainers Metal [0.53%], Oil & Gas [0.21%], Realty [0.16%], and Pharma [0.14%].

Indian rupee fell 18 paise to 82.22 against the Us dollar on Wednesday.

Stock in News Today

IndusInd Bank: The lender announced that its GIFT City IBU branch has entered into a $100 million long-term loan agreement with the Japan Bank for International Cooperation (JBIC) to facilitate the growth of Japanese construction equipment companies in India. The funds raised will be used by the bank to foster the growth of Japanese construction equipment companies in India through need-based credit facilities to the upstream and downstream companies. Mizuho Bank, Japan, the Shizuoka Bank, Singapore and the Joyo Bank, Japan will also co-finance in this facility. Under this initiative, IndusInd Bank will provide credit facilities to companies that comprises the supply chain of the Japanese original equipment manufacturers (OEMs) in India.

Tata Elxsi: The company announced that it has signed a memorandum of understanding (MoU) with the Indian Institute of Technology (IIT), Guwahati to jointly work on developing and commercialising solutions for the electric mobility market. Tata Elxsi stated that one key area of work under this collaboration will be the digital analysis of electrical signature data for traction motors which underpins EV mobility across segments, including automotive and rail. The solution will provide deep insights for proactive fault prediction, maintenance schedule formulation, and design and manufacturing defects traceability, it added.

AU Small Finance Bank (AUSFB): The lender said that it has received approval from Reserve Bank of India (RBI) for Authorized Dealer Category-I (AD-I) licence to deal in foreign exchange, subject to compliance of applicable regulations

CMS Info Systems: The company announced that the deployment of its proprietary security application ‘ALGO OTC’ across 30% ATMs in India. This application helps banks to implement RBI guidelines on OTC lock activation to ensure the mitigation of risks during ATM operations and enhancing security, the company said. ALGO OTC is a fully automated, artificial intelligence powered and mobility-based ATM security software application. The software is equipped with geo fencing and GPS-enabled user face recognition which helps in reducing risks and fraud during cash replenishment cycle at ATMs across India.

Jindal Stainless: The company announced that its board has approved the re-appointment of Abhyuday Jindal as managing director (MD) of the company for a term of five consecutive years effective from 1 May 2023. Further, the company’s board also approved payment of special interim dividend of Re 1 per equity share for the financial year 2022-23 upon successful completion of the merger process and consequent listing of new shares of the merged entity. Accordingly, the board has fixed Wednesday, 26 April 2023 as record date for the same and its payment will be completed by 17 May 2023.

Glenmark Pharmaceuticals: The company announced the settlement of patent litigation for generic, Zetia, a cholesterol treatment drug in the United States . With a view to reducing uncertainty, the company said that it has agreed to enter into a settlement with the direct purchaser plaintiff group. Under this settlement, the drug maker must pay an amount of $48 million to the direct purchasers, in accordance with the agreement entered into with them. The lawsuits alleged that in 2010, Glenmark entered an anticompetitive agreement to settle patent infringement litigation involving a patent related to ezetimibe (the active ingredient in Zetia) with Schering Corporation and MSP Singapore Company LLC.

ITC: The company said ITC Infotech India, a wholly owned subsidiary (WOS) of ITC, incorporated a WOS in Mexico under the name of ‘ITC Infotech de México, S.A. de C.V.’ on 17 April 2023. Consequently, ITC Mexico has become a step-down wholly owned subsidiary of the diversified FMCG company effective from the same date.

NMDC: The iron ore miner is exploring lithium reserves in Western Australia, approximately 124.3 miles (200 km) off the coast of Perth. D K Mohanty, director of production at NMDC, shared the news with the media during an industry conference on Wednesday. He reportedly stated that the company is currently in the process of carrying out this exploration, but the timeline for commencing mining activities remains uncertain.

Rice Producers: Shares of rice producers rose after the media reported that rice production is expectd to fall in 2023. The media reports indicated that the production shortage in 2023 is due to ongoing conflict in Ukraine and weather issues in rice-producing countries like China and Pakistan. This shortage will cause global rice prices to increase, and the Asia-Pacific region, which consumes the majority of the world’s rice, will be hit the hardest. The shortage will affect major importers, and rice prices are expected to remain high until 2024.

IIFL Securities: The company said that its board is scheduled to meet on Monday, 24 April 2023, to consider issuance of secured or unsecured redeemable non-convertible debentures, in one or more tranches through private placement on an annual basis. The board of directors of the company will also consider standalone and consolidated audited financial results for the quarter and year ended 31 March 2023.

Marksans Pharma: The company announced that it has acquired manufacturing site situated in Goa from Tevapharm India. As a part of the agreement, Marksans will continue to supply existing products until the end of 2023 to Teva’s affiliates, ensuring high-quality standards. The acquired facility will enable Marksans Pharma to potentially double the existing Indian capacity from 8 billion units per annum currently. Marksans plans to manufacture tablets, hard and soft gel capsules, ointments, liquids and creams from the new capacity.

eClerx Services: The company announced that its wholly owned subsidiary, eClerx has appointed Kapil Jain, as its chief executive officer (CEO), with effect from 1 May 2023. In his new role, Jain will focus on driving growth, improving operational management, and investing in further capability development to serve eClerx’s key strategic initiatives.

Bajaj Healthcare: The company’s board has approved the reappointment of Sajankumar Bajaj as the chairman & managing director of the company for a period of three years, effective from 1 April 2023. Bajaj holds a degree of Bachelors in Commerce and has long experience in finance, marketing, and material procurement, which led to the growth of the company in a very short time.