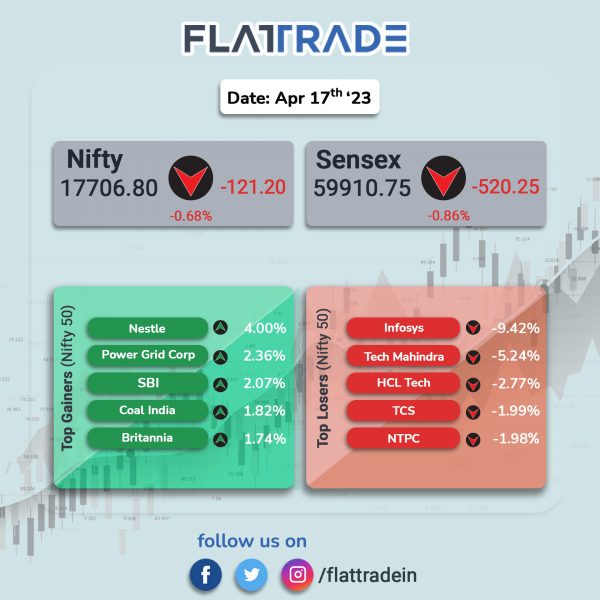

Benchmark indices closed lower, weighed by losses in IT stocks after Infosys reported weak fourth-quarter results. In addition, HDFC twins also weighed on headline indices. The Sensex fell 0.86% and the Nifty was down 0.68%.

In broader markets, the Nifty Midcap 100 rose 0.39% and the BSE Smallcap gained 0.13%.

Top losers were IT [-4.17%], Pharma [-0.06%], Media [-0.39%], and Finanical Services [-0.14%]. Top gainers were PSU Bank [3.13%], FMCG [1.03%], Realty [0.99%], Oil & Gas [0.95%], and Energy [0.64%].

Indian rupee fell 12 paise to 81.97 against the US dollar on Monday.

Stock in News Today

ICICI Bank: The lender said that its board will meet on 22nd April and consider fund raising by way of issuance of debt securities including non-convertible debentures/bonds/notes/offshore certificate of deposits in single/multiple tranches in any currency through public/private placement. Further, the board will also consider buyback of securities within the limits that the board is authorised to approve under applicable law.

Ashok Leyland: The company announced that it has received an order from VRL Logistics to supply 1,560 trucks. This order is for AVTR 3120 and AVTR 4420 TT models of Ashok Leyland. These trucks have all the advanced features to bring more efficiency and profitability to VRL’s expanding fleet, said the company.

Adani Green Energy (AGEL): The company said its sale of energy for solar portfolio increased by 6% YoY at 2,872 million units in Q4FY23 as against 2,717 million units in Q4FY22. The increase in sale of solar energy was backed by 212 megawatt (MW) commissioned in Rajasthan during FY23 and 40 basis points (bps) improvement in capacity utilisation factor (CUF).

The sale of energy in wind portfolio jumped 69% YoY to 428 million units, on the back of capacity increase from 497 MW to 971 MW YoY. The firm’s CUF in this segment slipped to 20.4% in Q4 FY23 as against 23.6% in Q4 FY22. The wind portfolio CUF reduced due to lower wind speed and plant availability is lower primarily on account of proactive shutdown as part of preventive maintenance to enable uninterrupted operation during high wind season.

TVS Motor Company: The company announced that its subsidiary, TVS Motor (Singapore) has completed the acquisition of 25% stake in Kilwatt GmBH. TVS Motor Company considers Killwatt as a long-term partner to establish a strong presence in the e-mobility business. The acquisition is aligned with the company’s larger vision of becoming a leading player in the e-personal mobility space and providing its customers with sustainable mobility solutions, and it complements our other recent acquisitions.

Adani Transmission: The company’s Q4 system availability rose 99.70% in FY23 and the company added 1,704 circuit km to its operational power transmission network in FY23. Distribution business sold 90.5 crore units of power in FY23, compared with 79.7 crore, the year ago.

Bank Of Baroda: The lender’s board will meet on April 21 and consider raising foreign currency funds through the issuance of bonds, certificate of deposits or other borrowing methods.

Monte Carlo Fashions: The company said its sales for Q4FY23 grew 36% over Q4FY22 and its yearly sales have also increased 22% over FY22. Monte Carlo Fashions said it has experienced a significant increase in demand across all business segments. In Q4FY23, the company recorded a 36% YoY revenue growth, surpassing pre-Covid levels and representing the best quarter ever for the company. The company executed its retail expansion strategy in Q4 FY23 by opening 10 new exclusive brand outlets (EBOs) across different regions of India, increasing its total EBOs to 356 in 20 states and 4 union territories.

KIOCL: The company announced that National Mineral Exploration Trust (NMET), Ministry of Mines, Government of India, has approved two mineral exploration projects to be executed by the company. The first project involves reconnaissance survey (G-4) for polymetallic mineralization in Nagavanda Gold & Base Metal Block in parts of Dhanvangere, Haveri and Shimoga District, Karnataka. The project duration is 12 months, and the approved cost is Rs 1.48 crore. The second contract involves preliminary exploration (G-3) for Amalgamated Kalburgi Limestone blocks in Jevargi area, District Kalburgi. The project duration is 12 months, and the approved cost is Rs 2.33 crore.

Jubilant Ingrevia: The company said that it has commissioned new acetic anhydride plant, at its manufacturing facility at Bharuch, Gujarat. The plant adds around 60,000 MT of capacity, resulting in the company’s overall annual acetic anhydride capacity to 210,000 MT. This enhanced capacity will also help the company to increase its global presence in various geographies and achieve leadership position in the global merchant markets.

Gensol Engineering: The company’s consolidated revenue zoomed 144% to Rs 391.61 crore in FY23 as against Rs 160.41 crore recorded in the same period a year ago. The engineering services company said that the revenue growth was boosted by India’s renewed focus on renewable energy sector.

Lumax Industries: The company’s board has approved the appointment of Vishnu Johri as the chief executive officer (CEO) designated as key managerial personnel of the company with effect from 15 April 2023. The said appointment is based on the recommendation of the nomination and remuneration committee of the company. His last assignment was as COO – MATE (Motherson Group) with responsibility for Africa and Middle East and tooling division. He is a mechanical engineer from Birla Institute of Technology and Science (BITS), Pilani.

Transformers and Rectifiers (India): The company announced that it has received an order for transformers worth Rs 131 crore from a central utility. With this contract, the company’s current order book amounts to Rs 1691 crore.

Gujarat Gas: The company announced that its board has appointed Milind Torawane, IAS, as managing director (MD) of the company with effect from 13 April 2023. He had served as the managing director of Gujarat Alkalies and Chemicals (GACL) and Gujarat State Investment (GSIL). He has also served as director on the board of various companies likes Gujarat State Financial Services (GSFSL), Gujarat State Electricity Corporation (GSECL), Gujarat Mineral Development Corporation (GMDC), Gujarat Urja Vikas Nigam (GUVNL), etc. Gujarat Gas (GGL).

Dilip Buildcon: The civil construction company said it has incorporated two special purpose vehicle (SPV) companies as its wholly owned subsidiary in Andhra Pradesh on 15 April 2023 under hybrid annuity mode (HAM). The first SPV has been set up for the development of 6 lane access controlled Greenfield Highway from Kodur to Vanavolu [NH-544G] Bengaluru – Vijayawada Economic Corridor under Bharatmala Pariyojana Phase-I (Package-1) and the project cost stood at Rs 599.50 crore and construction period is 24 months and operation period is 15 years from commercial operation date (COD).

The second SPV has been set up for the development of 6 lane access controlled Greenfield Highway from Odulapalle to Nallacheruvu-palli of NH-544G, Bengaluru Vijayawada Economic Corridor under Bharatmala Pariyojana Phase-I (Package-4). The bid project cost stood at Rs 774.10 crore and construction period of the project is 24 months and operation period is 15 years from commercial operation date (COD).

Den Networks: The cable TV distributor reported a 167.2% jump in consolidated net profit to Rs 133.50 crore despite of 6.8% decline in net sales to Rs 283.91 crore in Q4FY23 over Q4FY22. EBITDA dropped 34% to Rs 36 crore in the quarter ended 31 March 2023 as compared to Rs 55 crore posted in the same quarter previous year. EBITDA margin stood at 13% in Q4 FY23 as against 18% in Q4 FY22.

RattanIndia: The company’s Revolt Motors announces low cost financing scheme for e-motorcycles at a low interest rate of 5.99% per annum. The financing scheme allows customers to purchase its motorcycles its Revolt website or authorized dealerships.

VA Tech Wabag: The water treatment company on Thursday announced that its board had granted approval for the sale of 100% stake in Wabag Wassertechnik AG, Switzerland. VA Tech Wabag received a consideration of 4.85 million CHF from the said stake sale in Wabag Switzerland.

Spandana Sphoorty Financial: The company’s board has considered and approved the issuance of non convertible debentures (NCDs), aggregating to Rs 200 crore in two tranches on private placement basis. In the first tranche, the company will issue 10,000 senior secured, rated, listed, fully paid, redeemable, NCDs having face value of Rs 1 lakh each, aggregating to Rs 75 crore, with green shoe option up to Rs 25 crore. The tenure of this instrument is 24 months and the coupon rate is 11.10% per annum. In the second tranche, the company will issue 10,000 senior, secured, rated, listed, partly-paid, redeemable, NCDs having face value of Rs 1 lakh each, aggregating up to Rs 100 crore on partly paid up and private placement basis. The tenure of the said instrument is 36 months and coupon rate is 11.10% per annum. The said NCDs will be listed on BSE.