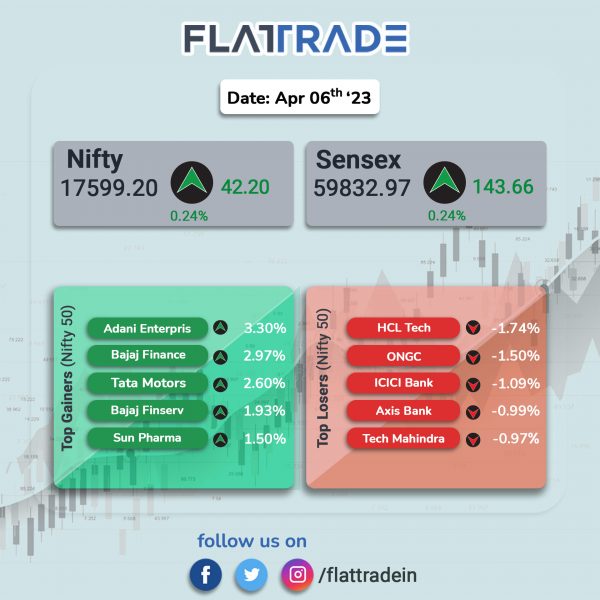

Benchmark stock indices closed higher as the central bank kept key repo rate unchanged at 6.5%. The Sensex and the Nifty indices rose 0.24%, each.

In broader markets, the Nifty Midcap 100 index closed 0.64% higher and the BSE Smallcap rose 0.7%.

Top gainers among Nifty sectoral indices were Realty [2.84%], Auto [0.90%], Pharma [0.76%], Oil & Gas [0.65%] and Metal [0.58%]. Top losers were IT [-0.73%] and FMCG [-0.54%]. Private Bank index closed flat.

Indian rupee rose 11 paise to 81.88 against the US dollar on Thursday.

To read about the key highlights of the RBI monetary policy decision, click here

Stock in News Today

Ramkrishna Forgings and Titagarh Wagons: The consortium has received orders to manufacture and supply around 15,40,000 forged wheels of different rolling stocks to the Railways over a period of 20 years in accordance with the terms and conditions of agreement.

Dabur India: The FMCG major announced that its India business is expected to report mid-single digit revenue growth, however, the International business is expected to deliver high single-digit growth in constant currency in Q4 FY23. Dabur said that the demand trajectory across both urban and rural markets in India showed a slight improvement sequentially, although it falls short of a full recovery. While urban markets have returned to positive volume growth, rural markets still remain muted. It has also strategically increased it’s spends behind the brands, leading to short term pressure on the operating margin, which is expected to be lower by around 200-250 bps as compared to Q4 FY22.

Kalyan Jewellers India: The company said that it witnessed strong operating momentum in its business in the recently concluded quarter despite sharp rise in gold prices during the second half of the quarter. The company recorded consolidated revenue growth of approximately 17% in Q4 FY23. Revenue from Indian operations rose about 16%. While momentum in footfall was broad-based across geographies, non-south markets recorded higher revenue growth largely due to the greater number of showrooms launched in that region over the last twelve months. As on 31st March 2023, total number of showrooms across India and the Middle East stood at 182.

Angel One: The brokerage company said its client base jumped 49.5% to 13.78 million in March 2023 as against 9.21 millions recorded in March 2022. Gross client acquisition stood at 0.45 million in March 2023, down 1.8% over February and down 6.9% over March 2022. Angel’s overall average daily turnover (ADTO) was at Rs 20,828 crore in March 2023, up 18.5% MoM and up 135.5% YoY. The company’s ADTO from the F&O segment stood at Rs 20,453 crore in March 2023, up 18.5% MoM and up 138.2% YoY. The company’s retail turnover market share in overall equity segment was 23.8% in March 2023 as against 22.6% in February 2023 and 21.1% in March 2022.

KEC International: The company announced that it has secured new orders of Rs 1,213 crore across its various businesses. With these orders, our total order inflow for FY23 stands at an all-time high of Rs. 22,378 crore, a substantial growth of about 30% over last year. In the transmission & distribution (T&D) business, the company has secured orders for T&D projects in India, SAARC, Middle East, East Asia Pacific and Americas. The Civil business of KEC has bagged an order in the urban infra segment in India.

Macrotech Developers (Lodha): The realty firm announced that it had achieved pre-sales of Rs 3,025 crore in Q4FY23, recording a decline of 12% on a YoY basis. The company’s FY23 pre-sales stood at Rs 12,064 crore, up by 34% from Rs 9,024 crore recorded in FY22. The company said that FY23 has witnessed addition of 12 new projects having approximately 14 million sq. ft. of saleable area with GDV of approximately Rs 19,800 crore across various micro-markets of MMR, Pune and Bengaluru.

TTK Healthcare: The company said in an exchange filing that the company’s board of directors will meet on April 20 to consider delisting. To prevent insider trading, the trading window has been closed April 1, 2023 onwards and it will continue to remain closed for 48 hours after declaration of the board meet or the Q4FY23 financial results, whichever is later.

Zydus Lifesciences: The drug maker announced that it has received final approval from the USFDA manufacture and market Acetazolamide as well as Carbidopa and Levodopa tablets. Carbidopa and Levodopa is used to treat symptoms of Parkinson’s disease or Parkinson-like symptoms. Acetazolamide is used to treat glaucoma, a condition in which increased pressure in the eye can lead to gradual loss of vision.

Muthoot Finance: The company’s board has approved an interim dividend of Rs 22 per share per equity share for FY23. The record date for the same is 18 April 2023.

Punjab & Sind Bank: The bank’s gross advances increased by 15.85% to Rs 81,544 crore as on 31 March 2023 as against Rs 70,387 crore as on 31 March 2022. The bank’s total business stood at Rs 1,91,212 crore as on 31 March 2023, registering a growth of 10.83% from Rs 1,72,524 crore in the same period last year. Total deposits for the quarter ended 31 March 2023 was at Rs 1,09,668 crore, up 7.37% from Rs 1,02,137 crore as on 31 March 2022. CASA deposits rose 6.68% year on year (YoY) to Rs 36,834 crore as on 31 March 2023. Credit-deposit (CD) ratio stood at 74.36% as on 31 March 2023 as against 68.91% reported in the corresponding quarter previous year.

Tatva Chintan Pharma Chem: The company announced that it has successfully commenced its commercial production from the new facility at its Dahej manufacturing plant.

Capacite Infraprojects: The company received an order worth Rs 474.08 crore from Godrej Group Residency, part of Godrej Group, for construction of residential towers at Mahalaxmi, Mumbai.

IIFL Finance: The company’s board approved allotment of non-convertible debentures (NCDs) aggregating to Rs 125 crore on private placement basis. The NBFC allotted 12,500 Secured Redeemable NCDs series D23 having face value of Rs 1 lakh aggregating to Rs 125 crore. The debentures having a coupon rate of 8.50% p.a. have tenure of upto 1 year and 10 days. These instruments will be listed on National Stock Exchange of India.