Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.27% higher at 17,700, signalling that Dalal Street was headed for positive start on Thursday.

Asian stocks were mixed as investors were cautious and awaited cues from the companies reporting results. The Nikkei 225 index rose 0.09%, while the Topix was down 0.06%. The Hang Seng gained 0.11% and the CSI 300 index fell 0.46%.

Indian rupee fell 18 paise to 82.22 against the Us dollar on Wednesday.

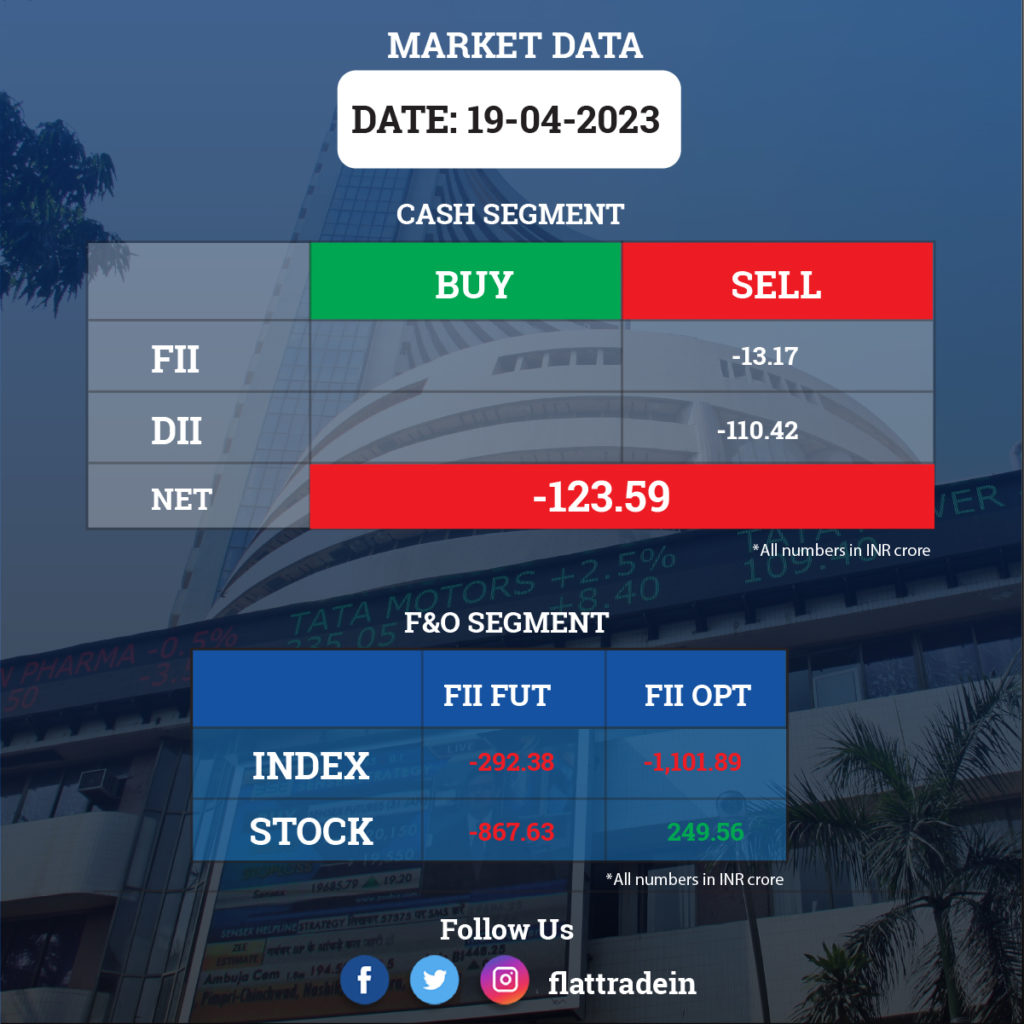

FII/DII Trading Data

Upcoming Results

HCL Technologies, ICICI Prudential Life Insurance Company Cyient, Sterling and Wilson Renewable Energy, Bodhi Tree Multimedia, Orient Green Power Company, Oriental Hotels, Rajnish Wellness, and Reliance Industrial Infrastructure will release quarterly results today.

Stocks in News Today

ICICI Securities: The company has reported a 22.81% year-on-year decline in consolidated profit at Rs 262.7 crore for the quarter ended March FY23, impacted by lower revenue as well as operating performance. Consolidated revenue for the quarter dropped 0.77% YoY to Rs 885 crore compared to the year-ago period, dented by lower fees and commission income. Ebitda was down 2.69% YoY at Rs 547.98 crore. The company recommended a final dividend of Rs 9.25 per share for the recently concluded fiscal.

Tata Communications: The company has registered a 10.7% year-on-year decline in consolidated profit at Rs 326 crore for Q4FY23, dented by lower other income and weak operating performance. Revenue for the quarter grew by 7.2% YoY to Rs 4,569 crore, driven by the data services business. Total expense rose to Rs 4285.05 crore in the quarter ended March 2023 as against Rs 3,896.18 in the year-ago period.

Mastek: The IT services company said its consolidated revenue was up 21.95% YoY at Rs 709.18 crore. Net profit was down 9.17% YoY at Rs 72.57 crore. Ebitda rose 4% YoY at Rs 125.52 crore in the reported quarter. Ebitda margin was at 17.7% in the reported quarter as against 20.75% in the year-ago period. The board recommended a final dividend of Rs 12 per share for the 2023 fiscal.

UltraTech Cement: The cement major has announced an increase in the capacity of its grinding unit at Patliputra, Bihar to 4.7 mtpa with the successful commissioning of its 2.2 mtpa brownfield expansion. Its total grey cement manufacturing capacity in India now stands at 129.15 mtpa.

Adani Ports and Special Economic Zone (APSEZ): The company’s board will meet on April 22 to consider first and a partial buyback of certain of its debt securities denominated either in Indian rupees or US dollar during the current financial year.

Tata Motors: Jaguar Land Rover, the luxury automotive subsidiary of Tata Motors, said in a statement it will invest £15 billion (Rs 1.53 lakh crore) over the next five years for an electric-first future.

HDFC: The mortgage lender’s subsidiary HDFC Capital Advisors will acquire additional 1.8% to 2.4% stake in Loyalie IT-Solutions for Rs 89.81 per compulsorily convertible preferential share, taking its overall shareholding to 9% to 9.6%.

Emkay Global Financial Services: The financial services company has received in-principle approval from the regulator SEBI for sponsoring a mutual fund.

Equitas Small Finance Bank: The Reserve Bank of India has granted Authorized Dealer Category-I (AD-I) licence to Equitas to deal in foreign exchange.

NBCC (India): The company received an order worth Rs 207.92 crore for planning, designing and execution of disable accessible platform and providing tertiary treatment plant works for Public Works Department, Puducherry.

Bombay Burmah Trading Corporation: The company will sell the plantation land and assets forming part of all the three tea estates in Tanzania, spanning 3,957 acres, for $1.2 million (Rs 9.86 crore).

Bank of Maharashtra: The board of the lender will consider raising Rs 7,500 crore on April 24. The proposed methods to raise funds include follow-on public offer, rights issue, qualified institutional placement, preferential issue or any other mode or combination, or through issue of Basel III compliant or similar securities.

India Grid Trust: The company appointed Navin Sharma as its chief financial officer, with effect from April 19, 2023.

ITC: The company signed the transaction documents, including the Securities Subscription Purchase Agreement and the Shareholders Agreement, to acquire entire stake of Sproutlife Foods. The transaction is expected to be closed in three to four years.

SoftTech Engineers Limited : The company said it has secured a substantial deal to deliver technology service and drive digitalization for YIT in partnership with Tech Mahindra

Bannari Amman: The board has approved raising of funds in multiple ways for an aggregate amount of up to Rs 150 crore.