Solarworld Energy Solutions IPO is a bookbuilt issue of ₹490.00 crore. It combines a fresh issue of 1.25 crore shares aggregating to ₹440.00 crore and an offer for sale of 0.14 crore shares aggregating to ₹50.00 crore.

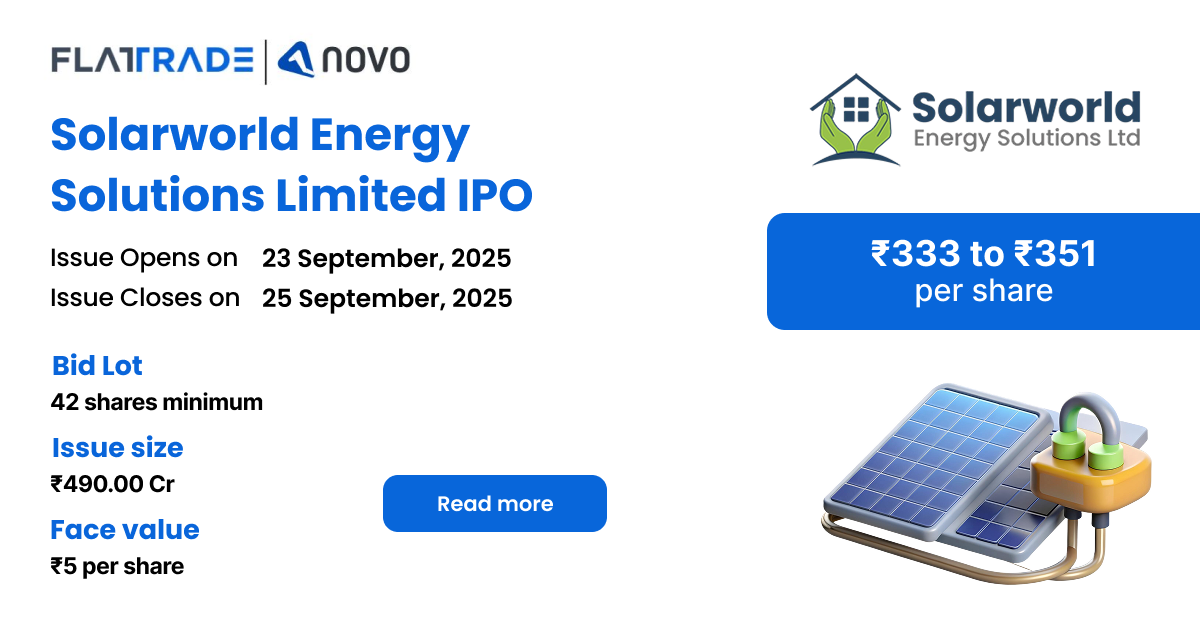

The IPO opens for subscription on September 23, 2025, and closes on September 25, 2025. The allotment is expected to be finalized on Friday, September 26, 2025. The price band for the IPO is set at ₹333 to ₹351 per share, and the minimum lot size for an application is 42 shares.

Company Summary

Incorporated in 2013, SolarWorld Energy Solutions Limited is a solar energy solutions provider specializing in engineering, procurement, and construction (EPC) services for solar power projects.

On May 14, 2024, SolarWorld Energy Solutions Limited entered into an equity cooperation agreement with ZNSHINE PV-Tech Co. Ltd., a Bloomberg NEF tier-1 solar panel supplier from China. This partnership aims to establish a solar panel manufacturing facility.

The company’s customer base includes SJVN Green Energy Limited, Haldiram Snacks Private Limited, Ethnic Food Manufacturing Private Limited, and Samiksha Solarworld Private Limited.

As of July 31, 2025, the company had 277 employees.

Business Models

- Capital Expenditure (CAPEX) Model:

- Provides end-to-end solar project solutions, including design, installation, setup, and commissioning.

- The ownership of the project remains with the customer.

- Renewable Energy Service Company (RESCO) Model:

- Customers can adopt solar power without any upfront investment.

- Helps businesses reduce their carbon footprint with minimal financial burden.

Company Strengths

- Established track record and strong in-house execution capabilities for end-to-end solar EPC solutions

- Strong financial performance driven by an asset-light business model

- Strong customer relationships built on reliable delivery of projects with a significant focus on quality.

- Experienced management team and qualified personnel with significant industry experience.

Company Financials

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 598.02 | 155.02 | 120.43 |

| Total Income | 551.09 | 505.5 | 235.05 |

| Profit After Tax | 77.05 | 51.69 | 14.84 |

| EBITDA | 106.75 | 71.09 | 22.88 |

| Net Worth | 309.07 | 73.6 | 21.91 |

| Reserves and Surplus | 272 | 73.28 | 21.59 |

| Total Borrowing | 114.55 | 61.1 | 64.67 |

| Amount in ₹ Crore | |||

Objectives of IPO

- Investment in the Subsidiary, KSPL for partfinancing the establishment of the Pandhurana Project

- General corporate purposes

Promoters of the company

Kartik Teltia, Rishabh Jain, Mangal Chand Teltia, Sushil Kumar Jain, and Anita Jain are the company promoters.

IPO Details

| IPO Date | September 23, 2025 to September 25, 2025 |

| Listing Date | September 30, 2025 |

| Face Value | ₹5 per share |

| Price Band | ₹333 to ₹351 per share |

| Lot size | 42 shares |

| Total Issue size | 1,39,60,113 shares (aggregating upto ₹490.00 Cr ) |

| Fresh Issue | 1,25,35,612 shares (aggregating upto ₹440.00 Cr ) |

| Offer for Sale | 14,24,501 shares of ₹5 (aggregating upto ₹50.00 Cr ) |

| Issue type | Bookbuilding IPO |

| Listing at | NSE, BSE |

| Share Holding Pre Issue | 7,41,37,042 shares |

| Share Holding Post Issue | 8,66,72,654 shares |

Lot Allocation Details

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 42 | ₹14,742.00 |

| Retail (Max) | 13 | 546 | ₹1,91,646.00 |

| S-HNI (Min) | 14 | 588 | ₹2,06,388.00 |

| S-HNI (Max) | 67 | 2,814 | ₹9,87,714.00 |

| B-HNI (Min) | 68 | 2,856 | ₹10,02,456.00 |

Allotment Schedule

| Basis of Allotment | Fri, 26 Sep, 2025 |

| Initiation of Refunds | Mon, 29 Sep, 2025 |

| Credit of Shares to Demat | Mon, 29 Sep, 2025 |

| Tentative Listing Date | Tue, 30 Sep, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on September 25, 2025 |

IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Offer |

| Retail Shares Offered | Not more than 10% of the Issue |

| NII Shares Offered | Not more than 15% of the Offer |

To check allotment, click here