POST-MARKET REPORT

The Indian equity indices ended with little change in the volatile session on February 1 after Finance Minister Nirmala Sitharaman presented the inline Interim Budget with no big announcements.

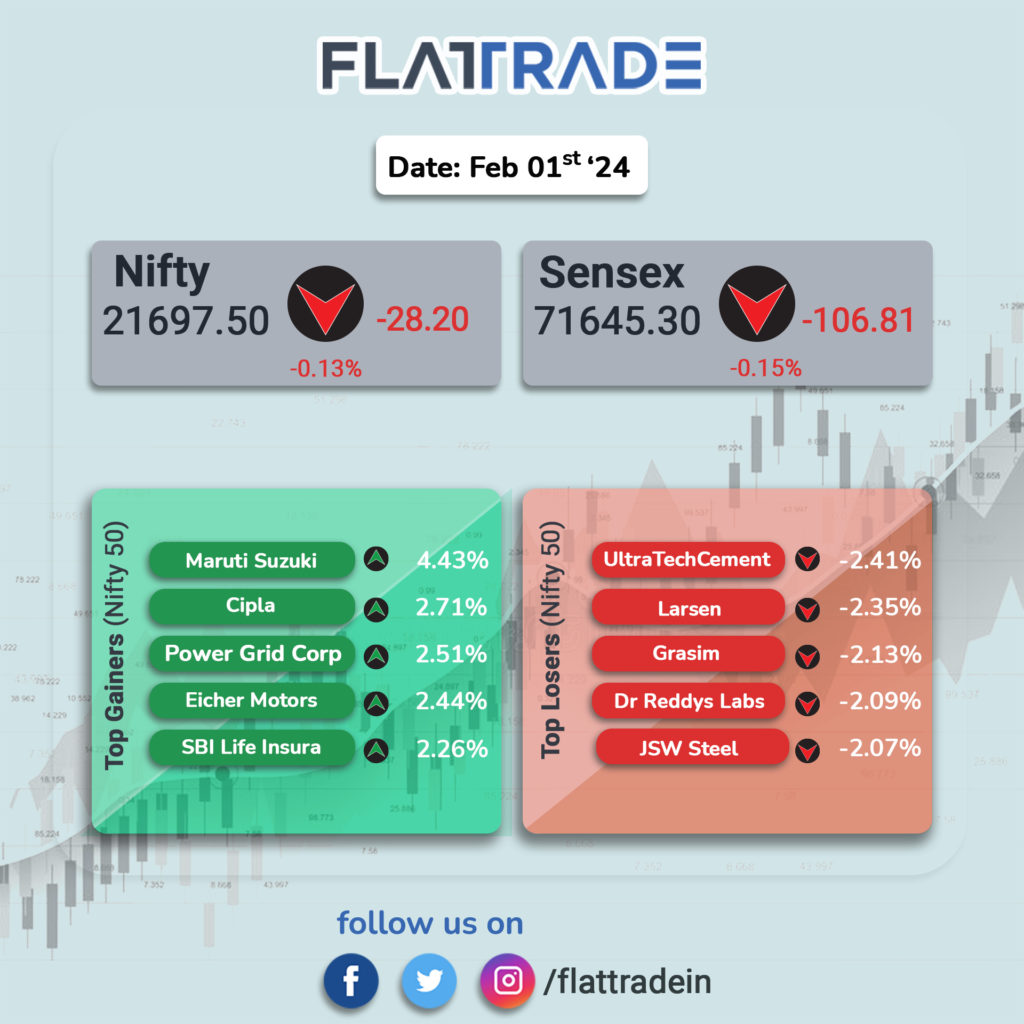

At close, the Sensex was down 106.81 points or 0.15 percent at 71,645.30, and the Nifty was down 28.20 points or 0.13 percent at 21,697.50.

Top Nifty gainers were Maruti Suzuki, Cipla, Eicher Motors, SBI Life Insurance and Power Grid Corporation, while losers included UltraTech Cement, L&T, Dr Reddy’s Laboratories, JSW Steel and Grasim Industries.

A mixed trend was seen on the sectoral front, with auto, bank, FMCG, and power added 0.2-0.8 percent, while capital goods, metal, and realty were down a percent each.

The BSE midcap index shed 0.4 percent, and the smallcap index ended 0.2 percent lower.

The Indian Rupee appreciated a little against the US dollar and stands at 82.98.

STOCKS TODAY

Adani Enterprises: Adani Enterprises reported its consolidated net profit of Rs 1888.4 crore for the quarter ended December 2023. Adani group’s flagship company had reported a net profit of Rs 820 crore in the year-ago period. The company’s revenue from operations rose 6.5 percent year-on-year to Rs 28,336.4 crore from Rs 26,612.2 crore.

Titan: The Company reported a standalone net profit of Rs 1,040 crore for the December quarter of FY24, up 9.5 percent from the same quarter of the previous financial year. Total revenue of the company is Rs 13,052 crore, increasing 20 percent from Rs 10,875 crore in the year-ago quarter, the company said in a regulatory filing.

Paytm: The stock slumped 20 percent after the Reserve Bank of India imposed major restrictions on the company’s lending business which also includes a prohibition on accepting fresh deposits and doing credit transactions after February 29.

IDBI Bank: The company gained on February 1 after the Union government set an FY25 divestment target of Rs 50,000 crore. Brokerages were expecting a divestment target for the next fiscal anywhere between Rs 30,000 crore and Rs 40,000 crore.

Fertilizer stocks: As Finance Minister Nirmala Sitharaman announced that the application of nano DAP on various crops will be expanded in all agro-climatic zones, fertilizer stocks jumped in trade. Coromandel International shares stock gained 1.5 percent, and GNFC or Gujarat Narmada Valley Fertilisers & Chemicals pare part losses following the announcement. Chambal Fertilisers and chemicals gained around 2 percent.

Defence stocks: Defence stocks had a mixed response today after Finance Minister Nirmala Sitharaman made no major announcements for the sector in her Interim Budget for 2024-25. Shares of major defence players such as HAL and BEL fell 0.48 percent and 2.04 percent while Bharat Dynamics fell 0.82 percent.