Vidya began investing because she didn’t want her hard-earned money to sit idle while her dreams felt out of reach. She wanted her future to grow alongside her efforts, not wait quietly for a distant ‘someday’ to arrive.

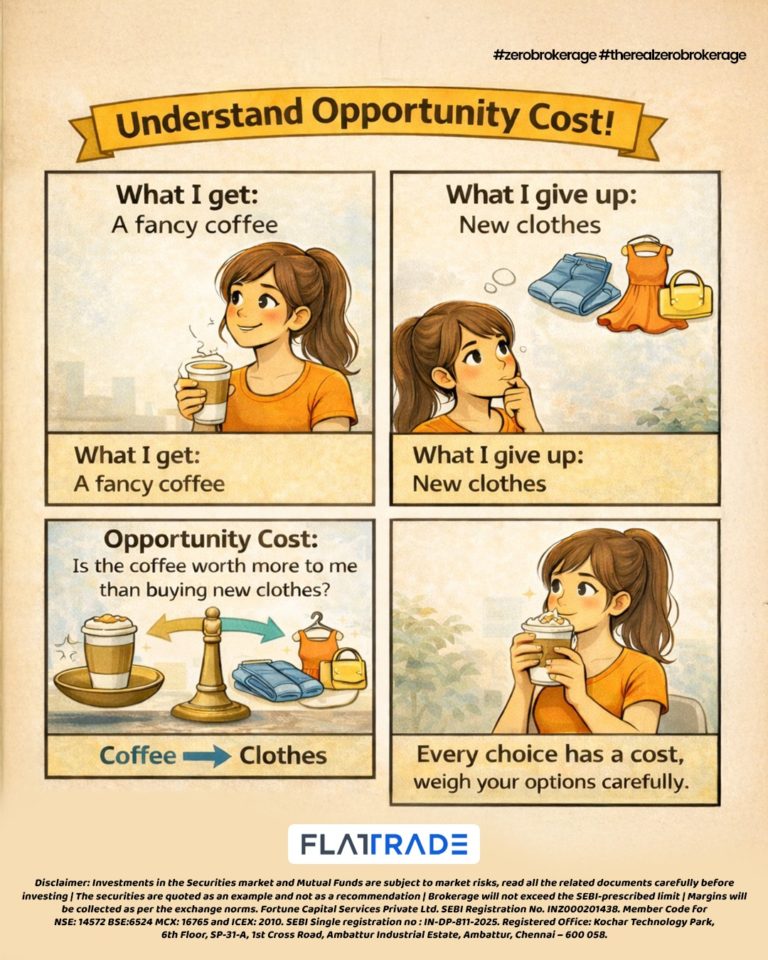

She believed that every choice meant gaining something. What she didn’t fully understand was that every choice also meant leaving something behind. It wasn’t visible. It didn’t make a noise. But it was always there – quietly present, like a shadow.

Vidya tracked the markets, followed financial news, and placed her trades carefully, convinced that each good decision brought her closer to freedom. She worked at a financial firm where screens glowed all day, and price movements shaped people’s moods. Over time, she began actively trading and investing her savings, hoping to grow wealth faster than a fixed salary ever could.

Every profit thrilled her.

Every missed opportunity stayed with her longer.

One evening, after the markets closed, she reviewed her trades for the week and noticed something she hadn’t paid attention to before. Every stock she bought meant she had chosen not to buy another. Every time she stayed with a safer trade, she gave up the chance to benefit from a riskier one.

That was when the real meaning of her decisions became clear.

This was her first real encounter with opportunity cost – the value of what you give up when you choose one option over another. The market taught her this lesson daily. Booking profits too early meant missing higher gains. Holding on too long meant risking what she had already earned.

There was no perfect timing. Only trade-offs.

As she reflected more, another memory surfaced. Back in college, she had once dreamt of becoming a photographer. Buying a camera and exploring creative freedom had mattered deeply to her then. Somewhere along the way, that dream had been quietly set aside.

Just like in trading, she realised she had chosen financial growth over creative expression.

The choice wasn’t wrong.

But it came at a cost.

Over time, Vidya began reviewing her decisions more thoughtfully. She slowed down. She became more selective. Her decisions carried more intent, and with that came confidence. The markets continued to offer new opportunities every day, but her approach changed. She no longer evaluated choices only by what they could deliver, but also by what they would replace.

Later, when she was offered a senior role with better pay but longer hours, she paused. This time, she didn’t just calculate the salary. She considered the time, energy, and peace she would give up.

She stopped chasing every opportunity and started choosing only those aligned with her long-term goals.

Opportunity cost, she realised, wasn’t just an economic concept.

It was a daily reality – in markets, in careers, and in life.