What is a Bracket Order? A Smart Way to Trade with Confidence!

If you’ve been trading for a while or even just getting started—you’ve probably heard the term Bracket Order thrown around. It sounds technical, but trust us, once you understand how it works, you’ll wonder why you didn’t use it earlier.

A bracket order is a single order that combines an initial order (either buy or sell) with two opposite-side orders: a stop-loss order and a target (or profit-taking) order. This allows traders to automatically manage both potential losses and profits from a single trade. When one of the bracketed orders (either the stop-loss or the target) is executed, the other is automatically cancelled.

Bracket Orders: A Safety Net for Traders

A Bracket Order (BO) is basically a trading strategy that lets you place three orders at once:

- Entry Order – Where you buy/sell the stock.

- Target Order – Where you lock in profit.

- Stop-Loss Order – Where you limit your losses if the trade goes the other way.

These three work together like a protective shell (or “bracket”) around your main trade. The beauty is, once your entry is executed, the other two are placed automatically. And the best part? Once either your target or stop-loss is hit, the other one is cancelled. Totally hands-free!

Why use Bracket Orders?

Here’s why bracket orders are loved by both beginners and pros:

- No emotional trading – Your exit plan is fixed when you enter.

- Automated risk management – Set it and forget it.

- Perfect for intraday – Get in, get out with precision.

- Avoids constant monitoring – Especially helpful if you’re working or multitasking.

Bracket Orders on Flattrade:

At Flattrade, executing Bracket orders is a very simple and also an effective way to trade in the market. Kindly follow the below steps to see how it works in our platform effortlessly,

You just need to,

- Select your stock from the watchlist.

- Choose BO from the order type.

- Input your buy/sell price, stop-loss, and target.

- Confirm and place.

The system takes care of the rest. And since Flattrade charges zero brokerage on delivery and keeps intraday costs absolutely zero, it’s perfect for those who like tight control over cost and risk.

To avoid making emotional and far-fetched risks, we also have a feature called as Trailing Stop loss in our platform that will help gauge your investment amount by adjusting the loss percentage around your preferred risk range and sticks with it.

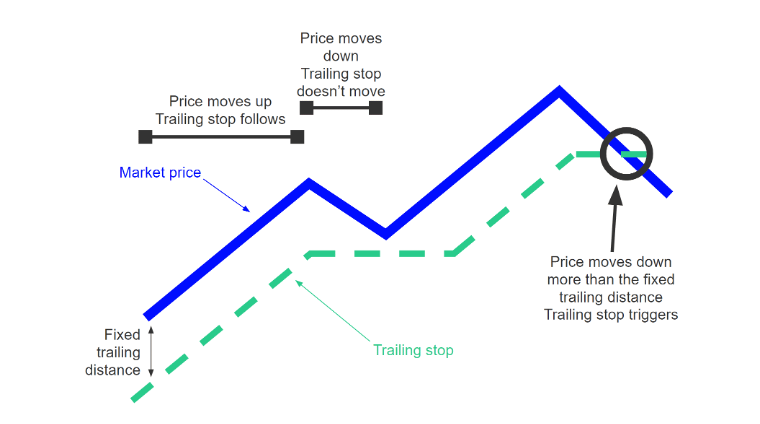

What is Trailing Stop Loss?

To understand the Trailing Stop loss, let’s understand the Stop loss first,

A Stop loss is a set threshold amount by the user. If the stock price moves below the threshold, the stock will automatically get sold off to protect the user from experiencing loss of investment. This feature basically supports the user to set a threshold amount to define their risk range and risk affordability.

For e.g. Let’s say a company named ZZZ’s stock price is currently at Rs. 100. A person named Ram wants to buy this stock. He is defining the stop loss at Rs. 10. This means, if the company ZZZ’s stock price lowers below Rs.90, say Rs. 89, Ram’s stocks will automatically square off and sell.

Here,

Stop Loss – Rs. 10

Now, if it’s a trailing stop loss, this is how it goes,

- Ram bought a stock at ₹100

- Ram set a trailing stop loss of ₹10

Here’s what happens:

- If the stock goes up to ₹120, the stop loss moves up with it.

→ Now the stop loss is ₹110 (₹120 – ₹10) - If the stock then drops to ₹110, it will trigger a sell and lock in the profit.

- But if the stock never goes above ₹100, the stop loss stays at ₹90.

So, the Trailing stop loss is an advance stop loss feature that trails behind the stock prices movements and adjusts your Stop loss range accordingly as per the said above example.

Example: Trading Reliance Using a Bracket Order

Let’s say Reliance is trading at ₹2,500.

- You want to buy at ₹2,500.

- Your target is ₹2,540.

- Your stop-loss is ₹2,480.

So, you enter a buy bracket order with those values. The moment your buy is executed, Flattrade places both the stop-loss and the target sell order. If Reliance hits ₹2,540, boom-you exit in profit. If it drops to ₹2,480, your loss is capped, and you’re out safely.

No panic, no revenge trades, no recovery trades. Just clean, disciplined trading.

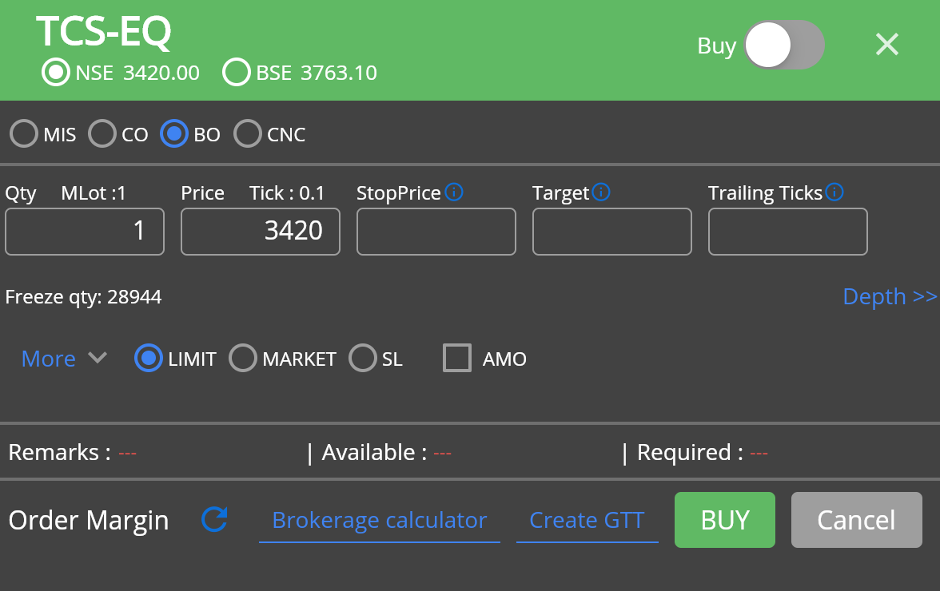

In the below screenshot, you can see an example of TCS equity, in BO selected option which is Bracket Order;

When you click the BO option – the following options automatically appear such as,

- StopPrice – Stop price is the lest threshold amount of stock price where you want your stock to stop trading below this price. For e.g. For the below stock TCS – the current price is 3420. If you set the StopPrice at 3418, TCS stock would automatically sell off if it goes below the 3418 price saving you from much losses.

- Target – This is the target price that you wish to sell in for a good profit. For e.g, TCS below is currently at 3420, we can set the target price at 3429 which means if the TCS stock moves to 3429, it will sell off automatically

- Trailing Ticks – Trailing ticks is nothing but trailing stop losses. A Trailing Stop Loss is a dynamic stop-loss order that moves with the market price to lock in profits while limiting losses.

Important Notes:

- Bracket orders are typically only for intraday transactions.

- If those specified orders are not executed by the end of day, it stands cancelled.

Trading is often scary in the means of losing your money over emotional outbursts such as seeing huge profits and huge losses making one vulnerable to make emotional mistakes. But using this Bracket order execution tool, one can simulate the way of executing a well pre planned trading situation with discipline leading to emotional relief and neat trade execution.

Whether you’re new to trading or refining your strategy, with absolute zero brokerage and easy execution of orders, our Flattrade platform offers the best services.

If you are still yet to sign up, you are missing out on our amazing services with absolute zero brokerage

After all, trading isn’t just about making money-it’s about managing risk like a pro.

Sign up and start your zero brokerage trading from link below,