A CNC (Cash and Carry) order is a commonly used order type for investors who prefer holding shares without worrying about daily price fluctuations. Also known as a delivery order, CNC is a non-intraday product used in the equity segment of NSE and BSE for buying and selling shares meant for delivery.

When you place a CNC order, the full value of the shares must be paid upfront, as no leverage is provided. Shares bought through CNC are credited to your demat account after T+2 settlement, and shares sold are debited from your demat account to meet exchange obligations.

How CNC Orders Work ?

Shares purchased using a CNC order can be held for days, months, or even years, depending on your investment objective. You can sell them anytime once they are available in your demat account.

If BTST (Buy Today, Sell Tomorrow) is permitted, shares may also be sold on T+1. If shares are bought and sold on the same day using CNC, the trade may be treated as intraday by some brokers.

At Flattrade, delivery trades attract ₹0 brokerage, and intraday trades are also charged at zero brokerage, making it cost-efficient for investors who are conscious of costs and risk.

Example: CNC Investment

Mr. A believes that XYZ Ltd is a strong company and suitable for long-term investment.

- He buys 50 shares at ₹900 using a CNC order

- Total investment: ₹45,000

- Shares are credited to his demat account

- He holds them for two years

- Later sells them at ₹1,300

Profit: ₹20,000 (before taxes)

This is a classic example of investing through a CNC order.

CNC vs Intraday (MIS)

| CNC Order | MIS Order | |

| Purpose | Long-term investment | Same-day trading |

| Holding | Long period | Must close same day |

| Funds Required | 100% of trade value | Margin Allowed |

| Auto Square-Off | No | Yes |

| Demat Credit | Shares credited to the Demat account | No demat delivery |

For example,

Mr.B buys company XYZ shares at ₹1,500 using MIS in the morning and sells at ₹1,520 by afternoon itself.

He earns ₹20 per share, but must close the position the same day.

If he had used CNC, he could have held it for months.

When Should You Use CNC?

CNC orders are ideal for:

- Long-term equity investors

- Portfolio builders

- Investors seeking dividends, bonuses, or corporate actions

- Anyone who wants to avoid intraday risk and auto square-offs

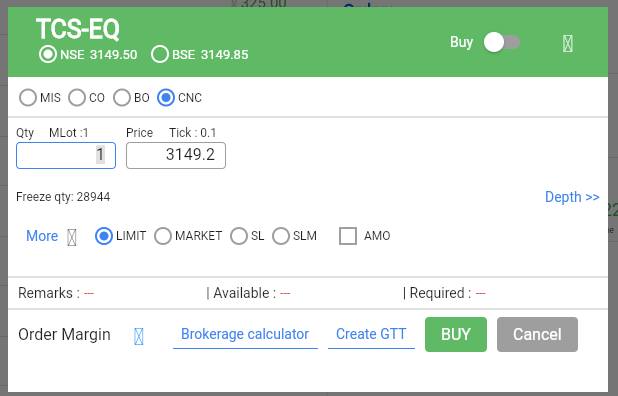

How to Place a CNC Order on Flattrade?

Placing a CNC order on Flattrade is simple:

- Log in to your Flattrade App or Web platform

- Search for the stock you want to buy or sell

- Click Buy or Sell

- Select CNC as the product type

- Enter quantity and choose Market or Limit order

- Click Submit

Once executed, the shares will be credited or debited from your demat account accordingly.

Charges on CNC Orders

Flattrade offers ₹0 brokerage on CNC (delivery) trades, making long-term investing more cost-effective.

Things to Remember About CNC Orders

- The entire trade value must be available before placing the order

- No leverage or margin is provided for CNC trades

- Shares bought are credited to your demat account and can be held as long as you wish

- Once credited, shares can be pledged to obtain margin for trading or investing in other segments

If your goal is long-term investing rather than short-term trading, CNC is the preferred order type. With Flattrade, delivery investing is simple, transparent, and cost-efficient. Zero brokerage on delivery trades, easy order placement, and secure demat holdings make it easier to build a portfolio with confidence – whether you’re just starting or investing for the long run.