Market Opening - An Overview

SGX Nifty futures were trading 0.36% higher at 16,172.50, signalling Dalal Street was headed for a positive start.

Asian markets were mixed as investors were worried over the Fed’s monetary policy tightening and probable recession in the US. Japan’s Nikkei 225 fell 0.13% and Topix was flat. China’s Hang Seng slipped 0.06% and CSI 300 dropped 0.16%.

Indian rupee fell 6 paise to 77.58 against the US dollar on Tuesday.

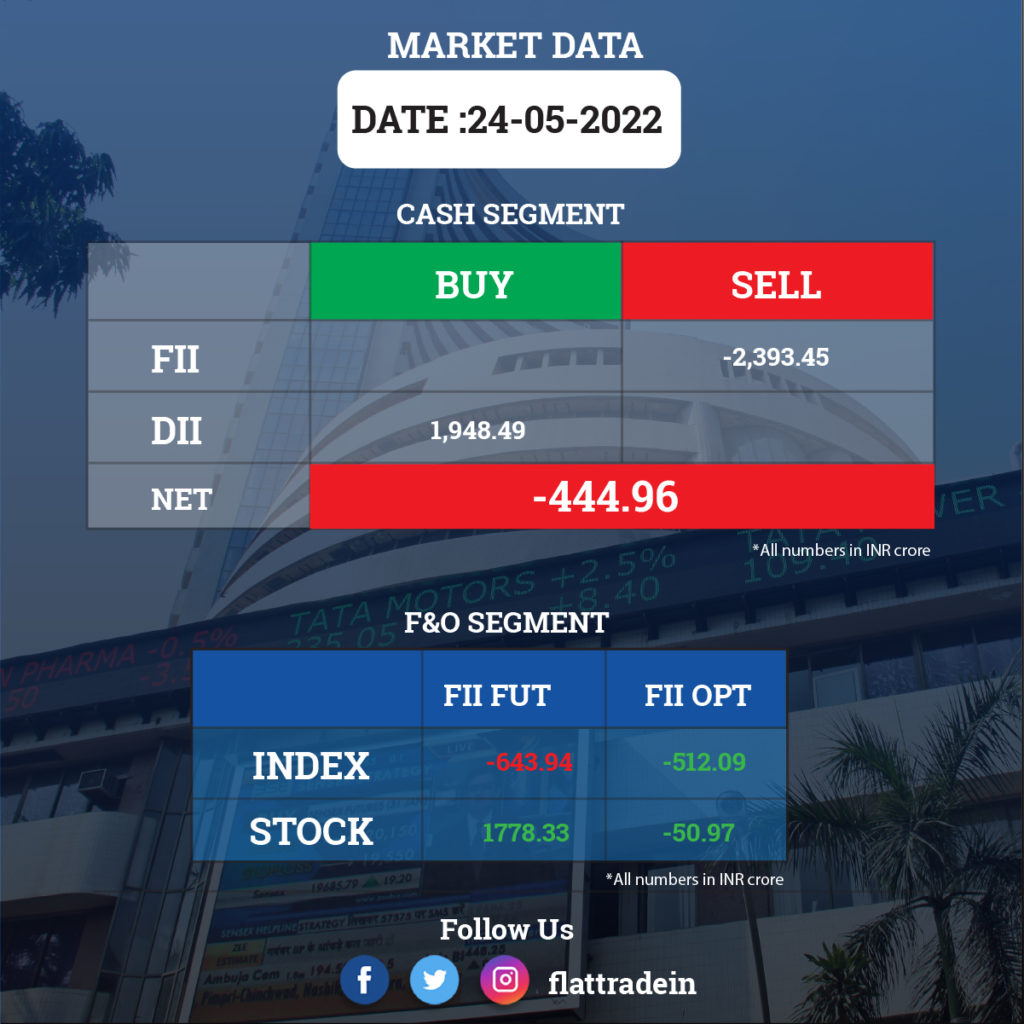

FII/DII Trading Data

Upcoming Results

BPCL, Coal India, Apollo Hospitals, Bata India, National Aluminium, NHPC, Deepak Fertilisers, Delta Corp, Easy Trip Planners, AIA Engineering, Fortis Healthcare, Power Finance Corporation, Religare Enterprises, Suzlon, Torrent Pharma, Voltamp Transformers and Whirlpool India.

Stocks in News Today

Adani Ports: The company’s Q4FY22 net profit fell 21.8% to Rs 1,033.02 crore as against Rs 1,320.69 crore in the corresponding quarter a year ago. Total income was up 8.5% at Rs 4,417.87 crore in the quarter under review from Rs 4,072.42 crore.

Tata Steel: The steel manufacturer is concerned New Delhi’s sudden decision to impose an export tax on some steel products could force it to review its production targets, if the levy remains in place for a long time, its CEO told Reuters. India imposed an export tax of 15% on some steel products over the weekend.

Indian Hotels Company Ltd (IHCL): The hospitality firm of Tata group said that its board has approved the re-appointment of Puneet Chhatwal as Managing Director and CEO for another term of five years. Chhatwal’s reappointment is for another term commencing from November 6, 2022 up to November 5, 2027 subject to shareholders’ approval.

Balrampur Chini Mills Ltd: The sugar manufacturer firm reported a 2% increase in its consolidated net profit at Rs 240.48 crore for the quarter ended March, compared with a net profit of Rs 235.50 crore in the year-ago period. Total income increased to Rs 1,291.37 crore in the fourth quarter of the last fiscal, as against Rs 1,027.24 crore in the corresponding period of the previous year.

Coal India: The state-run company will open one of the country’s biggest coal mines, Reuter reported citing officials. Output from the new Siarmal mine in eastern Odisha state would rise gradually, reaching capacity of 50 million tonnes in about five to seven years, Vinayak Jamwal, spokesman for Coal India unit Mahanadi Coalfields (MCL), told Reuters.

Future Group: The four listed firms of the Kishiore Biyani-led group expressed their inability to convene a board meeting before May 30 to approve their financial results for the quarter and year ended March 31 on account of vacant positions on their respective boards. The companies are Future Retail Ltd, Future Lifestyle Fashion Ltd, Future Supply Chain Solutions Ltd and Future Enterprises Ltd.

JSW Energy: The company will seek shareholders’ approval to raise up to Rs 5,000 crore through equity shares, bonds and other such securities during the annual general meeting to be held on June 14. The funds is likely to be used for financing the requirements of capital and revenue expenditure, including working capital, to meet the long-term capital requirements of the company and its subsidiaries, among others.

Bayer CropScience: The company reported a more than two-fold jump in profit to Rs 152.7 crore for the quarter ended on March 2022, compared to a profit of Rs 61.9 crore during the corresponding period of FY21. Its revenue from operations grew 31.29% to Rs 963.3 crore compared to Rs 733.7 crore in the corresponding quarter of the previous year.

Ipca Laboratories Ltd: The company reported a 19% decline in consolidated net profit after tax to Rs 130.23 crore in the fourth quarter ended March 2022, impacted by higher expenses. Its consolidated net profit after tax stood at Rs 161.34 crore in the same quarter previous fiscal. Consolidated net total income in the reported quarter stood at Rs 1,303.64 crore as against Rs 1,134.58 crore in the year-ago period.

The company will merge its two wholly owned subsidiaries – Tonira Exports and Ramdev Chemical with itself.

Grasim Industries Ltd: Aditya Birla Group firm reported a 55.56% jump in its consolidated net profit at Rs 4,070.46 crore for the fourth quarter ended March 2022, as against a net profit of Rs 2,616.64 crore in the year-ago period. Its revenue from operations was up 18.07% at Rs 28,811.39 crore during the quarter under review as against Rs 24,401.45 crore in the corresponding period of the previous fiscal.

Minda Industries: The company’s consolidated revenue increased 8% to Rs 2,415.08 crore in Q4FY22 from Rs 2,238.27 crore in the year-ago period. Net profit was up 2.9% to Rs 144.37 crore in the reported quarter as against Rs 140.32 crore in the same period last fiscal.

The company’s board recommended a final dividend of Re 1 per share of face value of Rs 2 each. It also approved an investment of Rs 25 crore in Tokai Rika Minda, a joint venture between Japan based Tokai Rika and the company. In addition, the company’s board also approved merger of Harita Fehrer and Minda Storage Batteries with the company.

Latent View Analytics: The company posted a 49.6% surge in net profit at Rs 35.57 crore in the quarter ended March 2022, compared to Rs 23.78 crore in the year-ago period. Total income also jumped 49.3 per cent on YoY basis to Rs 125.36 crore.

Metropolis Heathcare: The company’s net profit grew 2.5 times to Rs 63.11 crore in the quarter ended March 2022 when compared with Rs 24.86 crore in the quarter ended March 2021. Total income rose 22.8 per cent to Rs 262.48 crore from Rs 213.68 crore.

RITES: The company’s Q4 net profit slipped 3.5 per cent to Rs 129.88 crore in the quarter ended March 2022 as against Rs 134.56 crore in the same quarter a year ago. Total income, however, was up 20.9 per cent at Rs 764.69 crore from Rs 632.42 crore.

Eveready Industries: The open offer to acquire 1.88 crore shares representing 26% stake, will begin on June 3 and close on June 16. The offer price is set at Rs 320 per share.

Dr. Reddy’s Laboratories: The company along with US based Senores Pharmaceuticals launched Ketorolac Tromethamine Tablet, a therapeutic generic equivalent of the reference listed drug Toradol Tablets.

Dalmia Bharat Sugar and Industries: The company’s consolidated revenue jumped 75.2% YoY to Rs 856 crore in Q4FY22 from Rs 488.6 crore in the year-ago period. Its consolidated net profit rose modestly by 7.21% to Rs 55.6 crore in the reported quarter from Rs 51.86 crore in the corresponding quarter last fiscal. EBITDA increased 2.81%YoY to Rs 130.80 crore in Q4FY22. The company’s board recommended a final dividend of Re 1 per share of face value of Rs 2 each.

RITES: The company’s consolidated revenue fell 1.18% to Rs 766.02 crore in Q4FY22 from Rs 775.2 crore in the prior quarter of FY22. Its consolidated net profit declined 1.05% QoQ to Rs 142.36 crore in the reported quarter. EBITDA rose 4.41% to Rs 204.47 crore in the quarter under review from Rs 195.83 crore in the previous quarter. The company’s board recommended a final dividend of Rs 3.5 per share of face value of Rs 10 each.

Zee Media Corporation: The company’s Q4FY22 consolidated revenue was up 2% QoQ at Rs 247.73 crore against Rs 242.81 crore in the previous quarter. Its consolidated net loss stood at Rs 51.45 crore against a consolidated net profit of Rs 45.46 crore in the previous quarter. EBIT fell 43.57% to Rs 37.38 crore in the reported quarter from Rs 66.24 crore in the prior quarter.