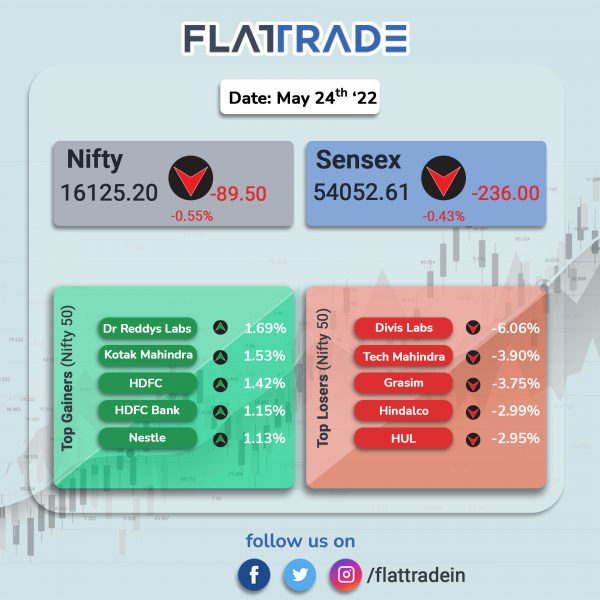

Domestic stock indices fell, tracking global cues, amid rising fears over higher prices and global economic growth slowdown. The Sensex dropped 0.43% and the Nifty fell 0.55%.

In broader markets, Nifty Midcap 100 lost 0.65% and BSE Smallcap tanked 1.14%.

Top losers in Nifty sectoral indices were Media [-2.57%], IT [-1.88%], Pharma [-1.53%] and FMCG [-1.3%]. Top gainers was Financial Services [0.32%].

Indian rupee fell 6 paise to 77.58 against the US dollar on Tuesday.

Stock in News Today

Adani Group: The company has signed a Memorandum of Understanding (MoU) with the government of Andhra Pradesh at the World Economic Forum with respect to an investment of Rs 60,000 crore by Adani Green Energy. It will set up a 3,700 MW Hydro Storage Plant and 10,000 MW solar energy project in Andhra Pradesh.

Aditya Birla Fashion and Retail Limited (ABFRL): The company’s board approved raising of up to Rs 2,195 crore by way of preferential issuance of equity and warrants to an affiliate of GIC, Singapore’s sovereign wealth fund, according to a media release.

GIC will invest Rs 770 crore now towards subscription of equity and warrants, followed by up to Rs 1,425 crore in one or more tranches within 18 months upon exercise of warrants. After the completion of the deal, GIC will own about 7.5% equity stake in ABFRL, and Aditya Birla Group will hold about 51.9% stake in the company.

Sugar stocks: Shares of sugar manufacturers declined after news reports said that Indian government planned to restrict sugar exports to prevent a surge in domestic prices, according to a government source. Government is planning to cap sugar exports at 10 million tonnes for the marketing year that runs through September, Bloomberg reported citing sources.

Jyothy Labs: Net profit of the company rose 42.88% to Rs 38.52 crore in the quarter ended March 2022 as against Rs 26.96 crore during the year-ago period. Sales rose 10.28% to Rs 537.37 crore in the quarter ended March 2022 as against Rs 487.27 crore during the same period last fiscal.

Rupa & Company: Shares of the company tanked more than 16% after the company reported a disappointing operational performance in Q4FY22, due to higher raw material cost.The company’s consolidated profit after tax (PAT) declined 25% YoY at Rs 49.3 crore, on the back of flat revenues at Rs 455.5 crore over the previous year quarter. EBITDA fell 18% YoY at Rs 74.2 crores, while margins contracted 370 bps to 16.3 per cent from 20% in Q4FY21. Meanwhile, Dinesh Kumar Lodha, chief executive officer (CEO) of Rupa & Company has tendered his resignation on account of personal reasons.

Bank of India (BOI): The PSB posted a 142.3% rise in net profit at Rs 606 crore in Q4FY22, on improvement in net interest margins. It had posted a net profit of Rs 250 crore in Q4FY21. The board recommended a dividend of Rs 2 per equity share.

Alembic Pharmaceuticals: The company said it has received approval from the US health regulator to market Pirfenidone tablets used to treat lung disease in the American market.

VA Tech Wabag: The firm signed a concession agreement with Ghaziabad Nagar Nigam to design, build, finance and operate a new MLD recycle and re-use tertiary treatment reverse osmosis (TTRO) plant. WABAG will be the technical partner of the project and will execute the Design-Build-Operate contract with special purpose vehicle worth Rs 594 crore.

Vaibhav Global: The company’s shares tumbled 6.6% after the company reported a 51.4% fall in consolidated net profit to Rs 27.21 crore in Q4FY22 as against Rs 56.02 crore in Q4FY21. Net sales for the reported quarter rose 2.9% to Rs 685.19 crore as against Rs 665.88 crore in the same period last year.

Piramal Enterprises: The company’s board approved the issuance of secured, rated, listed non-convertible debentures up to Rs 50 crore along with an option to retain oversubscription of up to Rs 550 crore aggregating up to Rs 600 crore on private placement basis. Shares of the company ended 4.1% lower.

Venus Pipes & Tubes: The company had a good stock market debut, with shares of the company getting listed at Rs 337.50 apiece, a 4% premium against its issue price of Rs 326 per share on the National Stock Exchange. Venus Pipes was locked in the 5% upper circuit at Rs 354.35 apiece on the NSE.

Delhivery: The logistics company saw its shares rising nearly 10 percent in early trade after making a muted listing. The stock opened at Rs 495.20 on the NSE, against an issue price of Rs 487. Shares closed at Rs 536.35 apiece.