POST-MARKET REPORT

Indian benchmark indices paused their rally on Tuesday, after investors adopted a cautious stance ahead of Wednesday’s Federal Reserve’s policy decision, even as various companies mixed Q4 results.

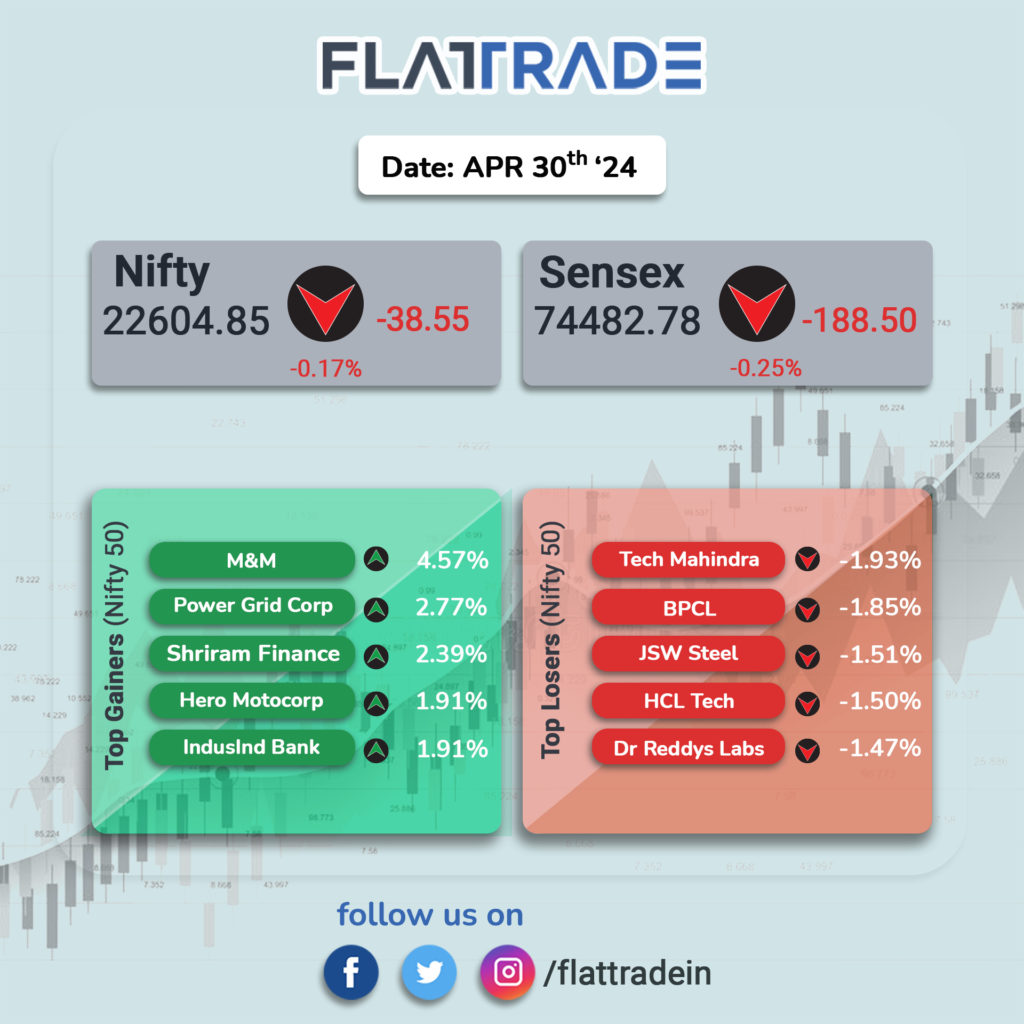

At close, the Sensex was down 188.50 points or 0.25 percent at 74,482.78, and the Nifty was down 38.60 points or 0.17 percent at 22,604.80.

Gainers and Losers on Nifty

Nearly half the stocks on the Nifty 50 were in the red. Tech Mahindra, Dr Reddy’s, Tata Steel, Hindalco, and HCLTech were the top drags, while Mahindra & Mahindra, Hero MotoCorp, Power Grid Corp., Bajaj Auto, and Shriram Finance, were the top gainers.

Gainers and Losers on Sensex

11 out of the 30 stocks on the Sensex were in the red. Tech Mahindra, Tata Steel, HCLTech, JSW Steel, and Sun Pharma, were the top drags, while Mahindra & Mahindra, Power Grid Corp., IndusInd Bank, Bajaj Finserv, and Axis Bank were the top gainers.

Sectoral indices performance

More than half of the sectoral indices were in the red. The top losers were the IT, Media, and Metal indices, which were down 1.22%, 1.15%, and 1.04%, respectively.

The Bank index was down 0.13%, while the Pharma and Healthcare indices were down 0.67% and 0.58%, while the Oil & Gas index was down 0.59%.

Among the gainers, the Auto index had gained the most; it was up 1.78%, followed by the Realty index, which was up 1.41%.

Broader market indices update

Shrugging off the downtrend seen in the benchmark indices, the broader market indices were trading in the green, with the BSE midcap index up 0.48%, and the BSE SmallCap index up 0.16%.

STOCKS TODAY

Jana Small Finance Bank: Shares of Jana Small Finance Bank hit a 20 percent upper circuit as investors rejoiced the lender’s plans to apply for a universal bank license by May-June 2025. The development comes a few days after the Reserve Bank of India (RBI) released a circular regarding the voluntary transition of Small Finance Banks to Universal Banks. The circular introduced additional criteria for banks interested in making this transition.

Tata Chemicals: Shares of Tata Chemicals fell as much as 3 percent, bogged down by the company’s weak earnings performance in the January-March quarter. The chemical maker recorded a net loss of Rs 841 crore in the March quarter as against a net profit of Rs 692 crore clocked in the same period a year ago. Revenue fell 21.1 percent to Rs 3,475 crore in Q4FY24 as compared to Rs 4,407 crore reported in the year-ago period.

SBFC Finance: Shares of SBFC Finance fell 5 percent after a block deal worth Rs 534 crore took place on the exchanges. Around 6 crore shares, representing a 5.6 percent stake in SBFC Finance changed hands on the bourses at a floor price of Rs 89 apiece. CNBC-TV18 reported citing sources that the company’s promoter group was looking to unload a 5.45 percent stake in SBFC Finance, aiming to earn Rs 536.50 crore from the transaction.

Trent: Shares of Trent surged almost 3 percent after the Westside operator reported a stellar set of earnings for Q4 FY24. The company posted a multifold on-year rise in net profit at Rs 712 crore for the quarter ended March 31, 2024. Revenue increased 51 percent to Rs 3,298 crore from Rs 2,183 crore in the same quarter last fiscal.

Mahindra & Mahindra: Shares of Mahindra & Mahindra (M&M) surged over 4 percent to hit a fresh record high after it launched its compact SUV – XUV 3XO at an aggressive starting price of Rs 7.49 lakh, competing with the likes of Maruti Suzuki Brezza, Tata Nexon, and Hyundai Venue.

KEC International: KEC International’s share price gained nearly 3 percent after the company secured new orders of Rs 1,036 crore across its various businesses. The orders were secured by two of the company’s flagship verticals, namely, transmission and distribution, and railways.

Birlasoft Ltd: Shares of the company plunged 4 percent after the software player reported revenue of $163.9 million, growing 1.6 percent on a sequential basis in constant currency terms. In rupee terms, revenue came in at Rs 1,362.54 crore, up 1.45 percent QoQ while net profit was up 11.81 percent at Rs 180.8 crore.