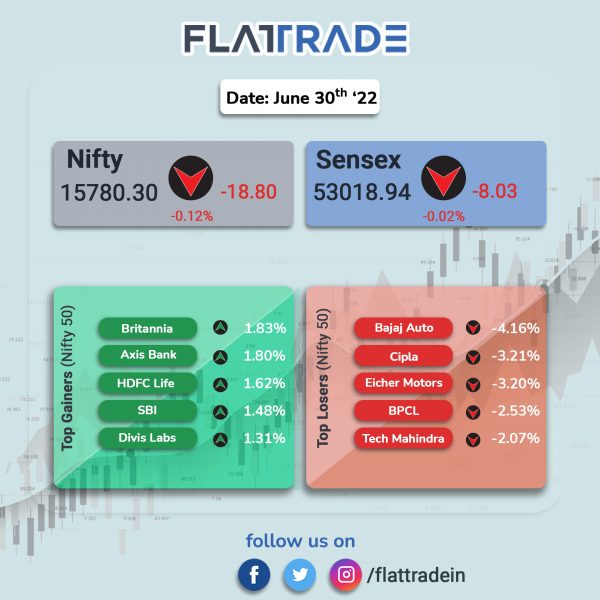

Benchmark equity indices slipped to negative territory in a volatile trading session weighed by losses in metal and auto stocks on June F&O expiry day. The Sensex inched down 0.02% and the Nifty 50 fell 0.12%.

The broader markets underperformed the benchmark indices. The Nifty Midcap 100 index dropped 0.82% and the BSE Smallcap lost 0.54%.

Top Nifty sectoral gainers were Energy [0.54%], Bank [0.47%] and Financial Services [0.42%]. Top losers were Metal [-1.99%], Auto [-1.26%], Realty [-1.19%], PSU Bank [-1.05%] and IT [-1.05%].

Indian rupee was little changed and stood at 78.97 against the US dollar on Thursday.

Stock in News Today

Infosys: The IT major has agreed with The House Fund III L.P., a venture capital (VC) fund based out of the US, for an investment of $10 million. The company said that the investment is expected to be completed by 30 June 2022. It is a minority holding not exceeding 20% of the fund size, it added.

Tata Consultancy Services (TCS): The IT behemoth has launched the TCS Servitization Engine on Oracle Cloud to help customers create subscription-first business models and provide outcome-based solutions with intelligent service capabilities. The engine offers an industry package with bundled combinations of products, services, support, self-service, and knowledge base that companies can leverage to add value to their core product offerings, along with robust front-end customer-facing solutions.

Maruti Suzuki India (MSI): The automaker has launched its much-awaited Maruti Suzuki Brezza 2022 in the Indian market at a starting price of Rs 7.99 lakh (ex-showroom). The top-spec ZXi dual-tone automatic variant is priced at Rs 13.96 lakh (ex-showroom). The carmaker has already commenced the bookings for the all-new 2022 Maruti Suzuki Brezza for an initial amount of Rs 11,000.

Asian Paints: Amit Syngle has been re-appointed as Asian Paints managing director and CEO of the company for 5 years from April 1, 2023 to March 31, 2028. Syngle was appointed CEO and MD in March 2020 for three years.

Power Grid Corporation of India: The company will consider raising funds up to Rs 6,000 crore through issuance of bonds during FY2023-24 in up to twenty tranches, on July 6. The company’s board will also consider sanctioning a rupee term loan of up to Rs 5,000 crore from Commercial Bank to meet capital expenditure requirements.

IDFC First Bank: The lender said that rating agency CRISIL has re-affirmed its ‘CRISIL AA / Stable’ rating on the existing Tier II Bonds (Under Basel III) of IDFC FIRST Bank amounting to Rs. 5,000 crore, and have also re-affirmed ‘CRISIL A1+’ rating on the Bank’s existing Certificate of Deposits amounting to Rs. 45,000 crore.

Wonderla Holidays: Shares of the company rose after the company announced that it has signed a lease agreement with Government of Odisha to develop amusement park in Bhubaneswar in 50 acres of land.

Dr Reddy’s Laboratories: The company said it has settled patent litigation with Indivior Inc and Aquestive Therapeutics on a medication used to treat opioid dependence or addiction. The US Court dismissed all claims and counterclaims pending in the case with prejudice, pursuant to a joint stipulation of dismissal filed by the parties, the Hyderabad-based drug major said in a statement.

Zydus Lifesciences: The drug manufacturer gets final approval from the US FDA to market Lacosamide injection USP, 200 mg/20 mL single-dose vials. The drug is used to treat partial-onset seizures and primary generalised tonic-clonic seizures.

Ratnamani Metals & Tubes: Shares of the company zoomed over 16% after the stock turned ex-bonus on Thursday. The company will issue one bonus share for every two shares held by the existing shareholders. The bonus issue of shares was announced on May 18, 2022. Record date for the bonus issue is July 1.

Sobha Ltd: The realty firm said that it has entered into a joint development agreement (JDA) to build a housing project in Chennai. Property consultant Savills India has facilitated a joint development deal for a land parcel of 2.5 acre for Sobha Ltd in Chennai.

MTAR Technologies: The Hyderabad-based equipment maker for nuclear and space industry, has won an export order for $22.12 million (Rs 174.6 crore) in clean energy segment. The orders are expected to be executed between January 2023 and June 2023.

Ahluwalia Contracts: Shares of the company rose over 4% after the it secured new order worth Rs 209 crore from DC Development Noida for the construction of Adani Connex Data Centers in the city, according to an exchange filing. With this, the total order inflow for Ahluwalia Contracts for FY2022-23 stands at Rs 713 crore.