Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.18% higher at 15,695, signalling that Dalal Street was headed for a negative start on Friday.

Asian shares were trading lower, tracking the US markets overnight, as recession fears loomed. Japan’s Nikkei 225 index fell 0.88% and Topix lost 0.71%. China’s Hang Seng dropped 0.62% and CSI 300 index slipped 0.08%.

Indian rupee stood at 78.97 against the US dollar on Thursday.

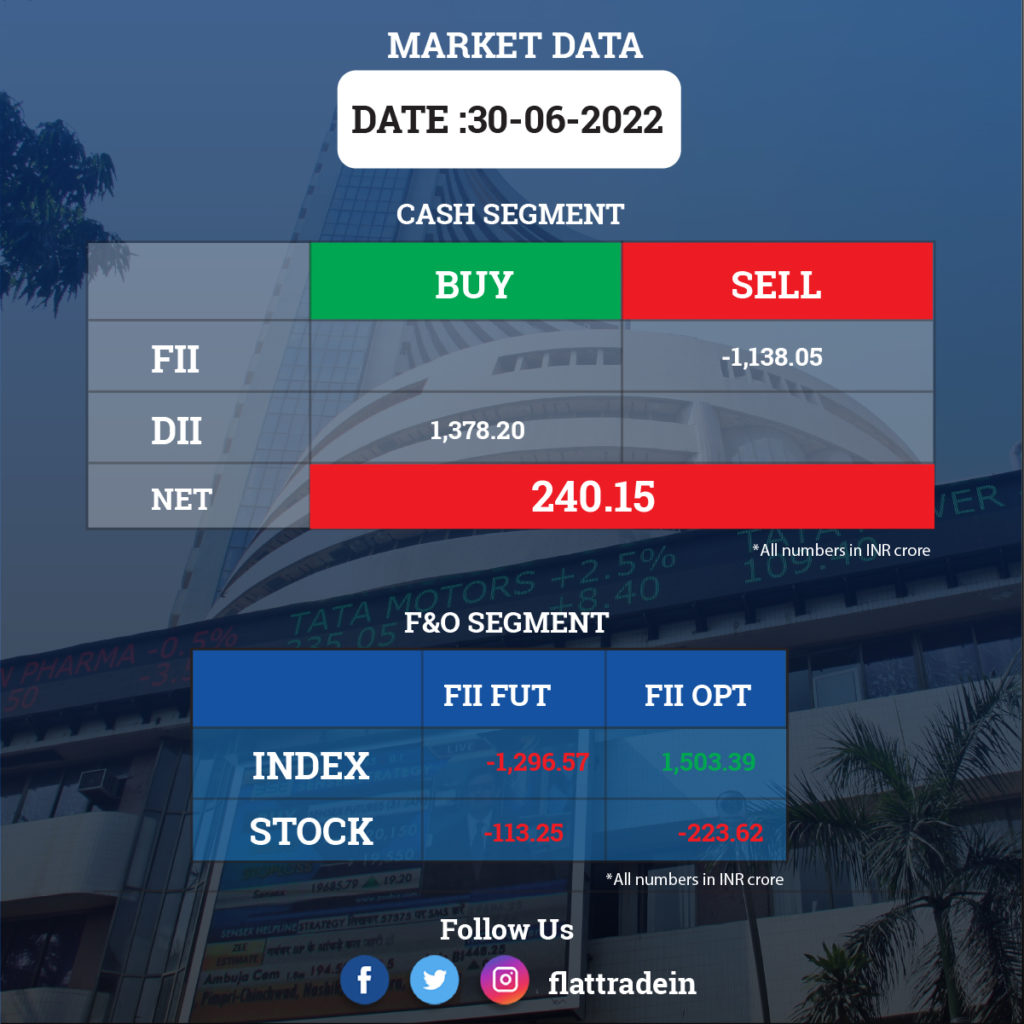

FII/DII Trading Data

Stocks in News Today

Bharti Airtel: The telecom operator chose four-year moratorium to repay around Rs 3,000 crore of adjusted gross revenue (AGR) dues to the government. However, they have backed out of conversion of interest on deferred dues into equity for the government.

Reliance Industries Ltd (RIL): The company announced a franchise partnership with Pret A Manger to launch and build the British sandwich and coffee chain in India, marking the company’s foray into the booming food and beverage industry. Reliance Brands Ltd (RBL) will open the food chain across the country, starting with major cities, it said in a statement.

SBI Card and Payment Services: The company along with Aditya Birla Finance announced the launch of a co-branded credit card ‘Aditya Birla SBI Card’. The card has been designed to give customers significant reward points on their spending across different sectors such as telecom, fashion, travel, dining, entertainment, and hotels, among others.

Hero MotoCorp: An arbitration tribunal has allowed the two-wheeler maker to use the ‘Hero’ trademark for selling its electric vehicles. Hero Electric had sought an injunction against the company in the matter.

Hindustan Copper: The board suggested to take shareholders’ approval to raise up to Rs 500 crore through debentures. The board has also recommended taking the approval of the shareholders in the ensuing annual general meeting for raising funds by issue of equity shares through Qualified Institutional Placement.

Union Bank: The board of the public sector lender has approved raising of Rs 8,100 crore and declared a dividend of Rs 1.9 per equity share.

Jubilant Pharmova: A wholly owned subsidiary in Canada announced that Government of Quebec has granted a loan of CAD 25 million (Rs 153.48 crore), including a forgivable portion of CAD 6.3 million, to fund capacity expansion at the Montreal facility.

Future Enterprises: The debt-ridden company has defaulted yet once again, this time on payment of interest of Rs 6.15 crore for its non convertible debentures. This is the fifth default in June by the Kishore Biyani-led Future Group firm.

Bosch Ltd: Leading supplier of technology and services, will expand their artificial intelligence of things (AIoT) activities in India and plan to transform their headquarters in Bengaluru into a new smart campus named Spark. In the last five years, Bosch has invested Rs 800 crore in developing the campus which has a capacity to house 10,000 associates.

SAIL: The company’s flagship arm, Bhilai Steel Plant, has supplied over 80,000 tonnes of steel for the Mumbai–Ahmedabad high-speed rail corridor project. The 508-km project, which is expected to be completed by October 2028, will connect Mumbai and Ahmedabad with a high-speed rail track, where trains would travel at a speed of 320 kms per hour.

Hindustan Unilever: The company in an exchange filing said that its CEO and Managing Director, Sanjiv Mehta will be appointed as the President Commissioner (Non-Executive Chairman) of PT Unilever Indonesia Tbk (Unilever Indonesia), a public company and member of the Unilever group.

Sundaram Fasteners: The auto components major plans to invest Rs 400 crore in fasteners and defence vertical over the next two years. Meanwhile, in the defence sector, the company plans to invest over Rs 100 crore in the next two years.

Globus Spirits: The company has entered into an agreement with Tilaknagar Industries for strategic, technical, manufacturing and marketing tie-up. It will offer integrated service to operate plant of 140 KLPD distillery asset located at Ahmednagar, Maharashtra. The company will also provide services from engineering to operations and maintenance for distillery assets owned by Tilaknagar Industries.

UPL: The company has acquired 100% holding in Nature Bliss Agro (NBAL) to become a wholly-owned subsidiary of the company. With this acquisition, they plan to manufacture and sale crop protection as well as allied products.

Lupin: The pharma company received the USFDA nod for Abbreviated New Drug Application (ANDA) – Paliperidone extended-release tablets. The product will be manufactured at Lupin’s facility in Goa and will be used in the treatment of schizophrenia.

Blue Star: Rating agency CARE has reiterated its long term and short term rating on credit facilities and non-convertible debentures of Blue Star at AA+. However, they have revised the outlook from ‘Negative’ to ‘Stable’ based on healthy recovery and demand for air-conditioning and refrigeration products.

Kridhan Infra: Rajeshree Indradev has resigned as Chief Financial Officer of the company on June 30. The company is in the process of hiring new person for the vacant position.