POST-MARKET REPORT

Indian benchmark indices were trading in the green but remained rangebound on Thursday, on the back of mixed corporate earnings reports and the Federal Reserve’s commentary saying no rate hikes would be rolled out this year.

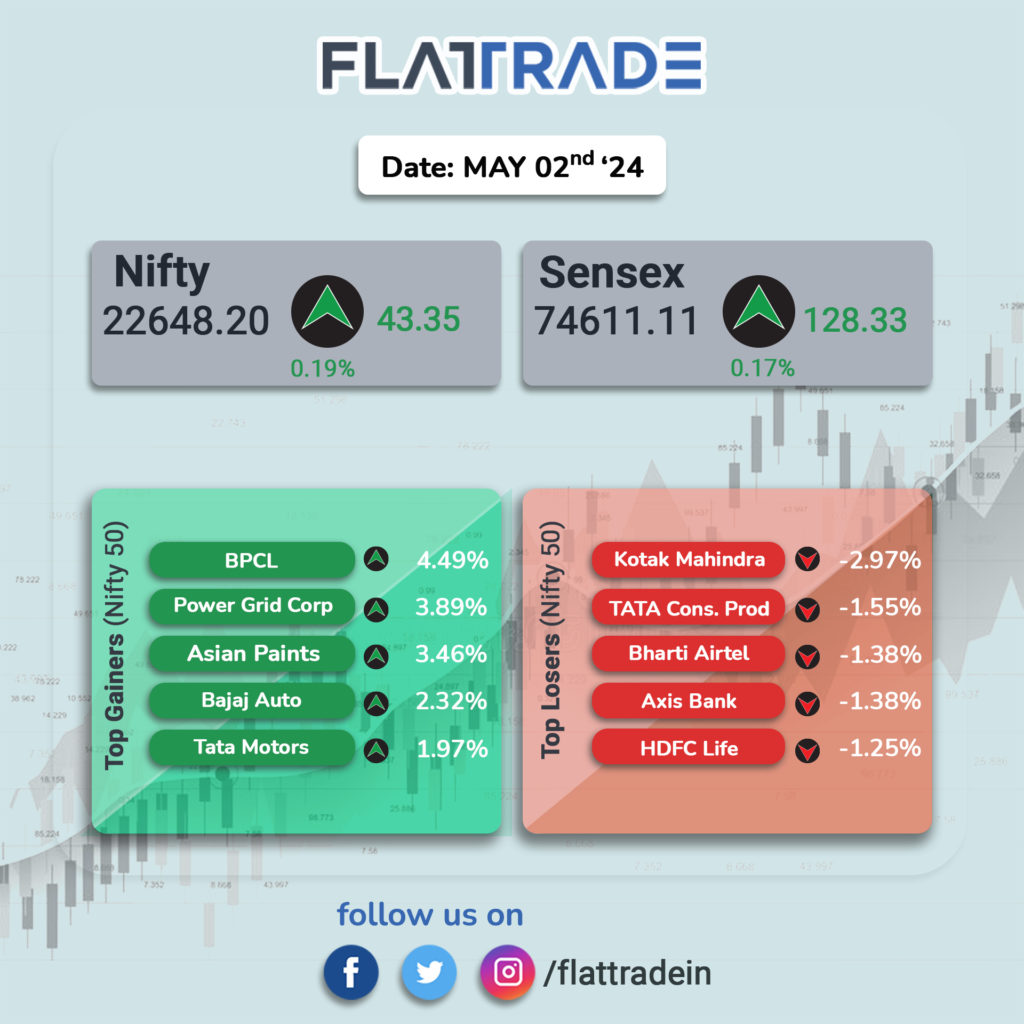

At close, the Sensex was up 128.33 points or 0.17 percent at 74,611.11, while the Nifty was up 43.35 points or 0.19 percent at 22,648.20.

Gainers and Losers on Nifty

21 of the 50 stocks on the Nifty 50 were in the red. Kotak Mahindra Bank, Bharti Airtel, Tata Consumer Products, Axis Bank, and HDFC Life were the top losers, while BPCL, Power Grid Corp., Asian Paints, Bajaj Auto, and Tata Motors, were the top gainers.

Gainers and Losers on Sensex

12 of the 30 stocks on the BSE Sensex were in the red. Kotak Mahindra Bank, Bharti Airtel, Axis Bank, Wipro, and ICICI Bank were the top drags, while Power Grid Corp., Asian Paints, Tata Motors, NTPC and Tata Steel were the top gainers.

Sectoral indices performance

The Bank, Realty and Consumer Durables indices were under pressure; they were down 0.33%, 0.04%, and 0.01%, respectively.

Among the gainers, the Auto, Metal, Oil & Gas, Pharma, and Healthcare indices had gained the most.

Broader market indices performance

The broader market was in the green, with the BSE SmallCap index up 0.31%, and the BSE MidCap index up 0.92%

STOCKS TODAY

Adani Enterprises: Q4 FY24 net profit fell 38 percent year-on-year to Rs 451 crore, mainly due an exceptional expenditure, and the rise in raw materials operating costs. The Adani Group flagship firm’s revenue from operations rose nearly 1 percent on-year to Rs 29,180 crore in the fiscal fourth quarter, showed the company’s exchange filing. The company also declared a dividend of Rs 1.3 per share for the full fiscal year 2023-24.

Ashok Leyland: Shares of Ashok Leyland surged 4 percent after the company’s combined sales of M&HCV and LCV units (including exports) amounted to 14,271 units, marking a 10 percent increase from the same period last year. The stock also hit its all-time high in the session.

PFC: Power Finance Corporation stock rallied six percent, extending the stock’s gains to a fourth straight session. Analysts said the robust funding potential in the renewable energy space due to assets like airports, roads, data centers, and EV charging stations, along with a strong order book across firms, will also be catalysts for the stock.

Bajaj Auto: Shares of Bajaj Auto advanced 2 percent after the company posted robust monthly sales in April. The company reported a 17 percent year-on-year rise in sales to 3,88,256 units in April. As for two-wheelers, April sales rose 19 percent YoY to 3,41,789 units. Both domestic and export sales in this segment also saw a healthy growth of 19 and 18 percent, respectively.

Maruti Suzuki: Shares of Maruti Suzuki fell over 1 percent intraday after the company reported its mini cars and compact car sales witnessed a notable decline in April. Sales of mini segment cars, comprising Alto and S-Presso, declined to 11,519 units as against 14,110 units in April 2023. Compact cars, essentially Baleno, Dzire, Celerio, and Ignis, also slumped 24 percent to 56,953 in April from the year-ago period. The stock regained from the lows and closed 0.36 percent in the red.

REC: REC stock surged 8 percent after the company reported strong earnings for the quarter ended March 2024. Its consolidated net profit jumped 33 percent on year to Rs 4,079 crore, helped by healthy growth in core income and a provision write-back.

BHEL: BHEL stock rose 4 percent after the state-run company entered into a Strategic Partnership Agreement (SPA) for the railway signaling business with HIMA Middle East FZE, Dubai, a wholly-owned subsidiary of HIMA Paul Hildebrandt GmbH, Germany.