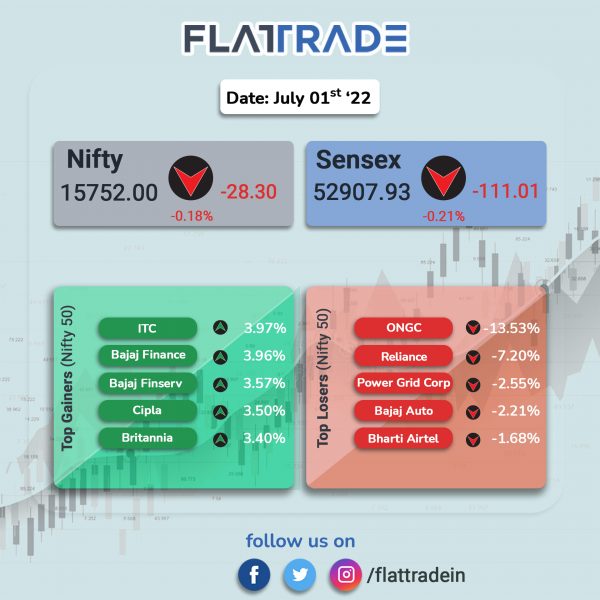

Benchmark equity indices ended lower due to losses in energy heavyweights RIL and ONGC after the Indian government imposed export duties on oil products. The Sensex fell 0.21% and the Nifty 50 dropped 0.18%.

Top Nifty sectoral gainers were FMCG [2.82%], Realty [1.58%], Financial Services [0.95%], Pharma [0.84%] and IT [0.79%]. Top loser among Nifty sectoral indices was Energy [-3.93%]

Indian rupee fell 5 paise to 79.05 against the US dollar on Friday.

Rating agency CRISIL lowered India’s real GDP growth forecast to 7.3 per cent in FY23 from 7.8 per cent estimated earlier. The agency attributed the downward revision to higher oil prices, slowing of export demand and high inflation.

The S&P Global Manufacturing Purchasing Managers’ Index fell to a nine-month low of 53.9 in June from 54.6 in May 2022. A reading of above 50 indicates expansion of the sector and below 50 signals contraction of the sector. The survey said that the manufacturing output expanded at its slowest pace during the said period due to elevated price pressures that dampened demand and output.

Stock in News Today

Reliance Industries Ltd (RIL) and ONGC: Shares of both the companies slumped after the government’s announcement of petroleum export duty hike. The government has raised excise duty on export of crude and petroleum products, levying a special additional excise duty of Rs 5 a litre on petrol and Rs 12 a litre on diesel, according to its statement. In addition, special additional excise duty of Rs 23,250 per tonne of petroleum crude and Rs 6 a litre of aviation turbine fuel was also levied. ONGC shares tanked 13.53% and RIL plunged 7.2%.

Maruti Suzuki India (MSI): The company’s passenger vehicles sales contracted marginally by 1.2 per cent to 122,685 units in June from 124,280 units in the same month a year ago owing to the shortage of semiconductors. “The shortage of electronic components had a minor impact on the production of vehicles, mainly in domestic models. The company took all possible measures to minimise the impact,” the company Maruti said in a statement.

State Bank of India (SBI): The country’s largest lender has crossed Rs 1 lakh crore in gold loans, said Chairman Dinesh Khara. He added the bank is witnessing good traction in the gold loan business and expect the segment to grow faster in FY23. He added that the bank will be launching a number of customer centric initiatives such as exclusive toll free number for HNIs and wealth customers and conversational IVR options to customers and end-to-end digital sales and collection services from the call centre.

Ashok Leyland: The commercial vehicles maker registered 125 per cent growth in total sales at 14,351 units in June as compared to the year-ago period. The company had posted a total sales of 6,448 units in June 2021, Ashok Leyland said in a statement. The total M&HCV sales, including exports, rose 238 per cent at 9,354 units in June 2022 as against 2,764 units in the corresponding period last year.

Escorts Kubota: The company said its agri-machinery segment sold 10,051 tractors in June, down 19.8% YoY compared to 12,533 tractors a year ago. Domestic tractor sales fell 22.5% YoY in June at 9,265 units, while exports rose 36.2% YoY at 786 units. The company expects demand to improve with the onset of monsoon along with likely good kharif crop production, rural liquidity and improvement in farmer sentiments.

Eicher Motors: The company reported 161% YoY sales growth in June 2022. Its total trucks and buses sales stood at 6,185 units, up 161% from 2,370 units in June 2021. Total domestic sales were at 5,584 units, up 217.3%, compared with 1,760 units in June 2021. Total exports were at 601 units as agaisnt 610 units in June 2021.

Bajaj Auto: The two-wheeler manufacturer’s sales remained flat at 3,47,004 units in June as compared to 3,46,136 units in the same month last year. Domestic sales, which includes two-wheelers and commercial vehicles, declined 15 per cent to 1,38,351 units last month from 1,61,836 units in June 2021.

Engineers India: The company’s shares rose 3.07% after the company signed an agreement with CSIR-CSIO for joint commercialisation of Earthquake warning system. The agreement is for a period five years starting from June 30, 2022.

Parag Milk Foods: The company reported a consolidated net loss of Rs 602.39 crore in Q4FY2021-22, as against Rs 6.71 crore in the year-ago period. Revenue rose to Rs 562.27 crore in the reported quarter from Rs 434.35 crore in the corresponding quarter last fiscal. Ebitda loss stood at Rs 585.38 crore as against Rs 18.44 crore in the year-ago period.