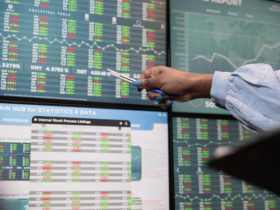

Benchmark equity indices registered modest gains in a volatile week as FMCG, Metal and Realty stocks advanced. For the week, the Nifty 50 index gained 0.34% to settle at 15,752.05, while the Sensex rose 0.34% to 52,907.93.

The BSE Midcap index rose 0.26% to 21,858.93 and the BSE Smallcap index gained 1.2% to 24,807.74.

Top gainers among Nifty sectoral indices were FMCG [2.51%], Metal [2.17%], Realty [2.14%], Auto [1.11%] and IT [1.03%]. Nifty Bank fell 0.26% during the week .

In cash segment, FIIs sold for Rs 6,836.6 crore and the DIIs bought for Rs 5,926.5 crore during the week.

Indian rupee depreciated to a record low and stood at 79.04 against the US dollar at end of the week (July 1, 2022).

Company News

Reliance Industries Ltd (RIL) and ONGC: Shares of both the companies slumped after the government’s announcement of petroleum export duty hike. The government has raised excise duty on export of crude and petroleum products, levying a special additional excise duty of Rs 5 a litre on petrol and Rs 12 a litre on diesel, according to its statement. In addition, special additional excise duty of Rs 23,250 per tonne of petroleum crude and Rs 6 a litre of aviation turbine fuel was also levied. ONGC shares tanked 13.53% and RIL plunged 7.2%.

Meanwhile, Billionaire Mukesh Ambani has resigned from Reliance Jio’s board and has named his elder son, Akash Ambani, as the non-executive director and chairman of Jio’s board.

In other news, RIL announced a franchise partnership with Pret A Manger to launch and build the British sandwich and coffee chain in India, marking the company’s foray into the booming food and beverage industry. Reliance Brands Ltd (RBL) will open the food chain across the country, starting with major cities, it said in a statement.

Infosys: The IT major has agreed with The House Fund III L.P., a venture capital (VC) fund based out of the US, for an investment of $10 million. The company said that the investment is expected to be completed by 30 June 2022. It is a minority holding not exceeding 20% of the fund size, it added.

Separately, the IT services company announced it has been selected by Australian express logistics business, Global Express, to separate the technology landscape post divestment from Toll Holdings. Infosys will leverage the blueprints and tools from Infosys Cobalt, a set of services, solutions and platforms for enterprises to accelerate their cloud journey.

Bharti Airtel: The telecom operator chose four-year moratorium to repay around Rs 3,000 crore of adjusted gross revenue (AGR) dues to the government. However, they have backed out of conversion of interest on deferred dues into equity for the government.

Bajaj Auto: The two-wheeler manufacturer’s board have approved share buyback of shares up to Rs 2,500 crore at a price not exceeding Rs 4,600 per share, via open market. The company added that indicative maximum number of shares to be bought back would be about 54,34,782 equity shares, comprising approximately 1.88% of the paid-up share capital of the company as of June 27, 2022.

Tejas Networks: Japan’s Renesas Electronics Corporation announced a strategic partnership with Tata Motors and Tejas Networks. The deal with the two Tata group companies pertains to the design, development and manufacturing of Renesas’ semiconductor solutions. Renesas will collaborate with Tejas for implementing next-generation wireless network solutions, including the design and development of semiconductor solutions for radio units used in telecom networks.

Asian Paints: Amit Syngle has been re-appointed as Asian Paints managing director and CEO of the company for 5 years from April 1, 2023 to March 31, 2028. Syngle was appointed CEO and MD in March 2020 for three years.

Jet Airways India: Airbus has emerged as the front-runner to win an aircraft order worth as much as $5.5 billion from the company, Bloomberg reported citing people familiar with the matter.

Maruti Suzuki India (MSI): The automaker has launched its much-awaited Maruti Suzuki Brezza 2022 in the Indian market at a starting price of Rs 7.99 lakh (ex-showroom). The top-spec ZXi dual-tone automatic variant is priced at Rs 13.96 lakh (ex-showroom). The carmaker has already commenced the bookings for the all-new 2022 Maruti Suzuki Brezza for an initial amount of Rs 11,000.

Meanwhile, the company’s passenger vehicles sales contracted marginally by 1.2 per cent to 122,685 units in June from 124,280 units in the same month a year ago owing to the shortage of semiconductors. “The shortage of electronic components had a minor impact on the production of vehicles, mainly in domestic models. The company took all possible measures to minimise the impact,” the company Maruti said in a statement.

Future Group: The Singapore International Arbitration Centre (SIAC) denied Future Group’s plea to terminate the arbitration proceedings initiated by e-commerce major Amazon against Future Retail’s deal with Reliance Industries.

TVS Motor: The company’s managing director, Sudarshan Venu, said that the two-wheeler manufacturer was going to invest heavily on electric vehicles. It plans to focus on electric vehicles (EVs) and will come up with different products in its two and three-wheeler segments under the 5 to 25 kilowatt range. They will also design digital applications for service and will book for digital appointments.

Economy News

The seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) stood at 53.9 in June compared to 54.6 in May. The latest reading showed the slowest pace of growth since last September.

Meanwhile, Index of Eight Core Industries reported a growth of 18.1% in May this year as against the 16.4% in the corresponding month last year. The production of cement, coal, fertilizers, electricity, refinery products, steel, natural gas and crude oil industries increased in May 2022 over the corresponding period of last year.

The Goods and Services Tax (GST) revenue in June rose to Rs 1.44 lakh crore, registering a 56% increase over the same month last year and the fourth month in a row to be above Rs 1.4 lakh crore. GST revenue for May stood at nearly Rs 1.41 lakh crore.

Global Markets

Major Wall Street indices fell during the week as investors feared that the US central bank’s fight against inflation would push the country’s economy into recession. . For the week, the S&P 500 fell 2.21%, the Dow lost 1.28% and the Nasdaq shed 4.13%.

In the economic data front, the US consumer spending rose less than expected in May as motor vehicles sales remained tepid, while higher prices weighed on consumption of other goods.

Consumer spending, which accounts for more than two-thirds of the US economic activity, gained 0.2% in May. Consumer spending adjusted for inflation fell 0.4% in May.

The personal consumption expenditures (PCE) price index rose 0.6% in May after gaining 0.2% in April. In the 12 months through May, the PCE price index jumped 6.3% after a similar gain in April, due to higher prices for goods and services. The so-called core PCE price index advanced 4.7% on a year-on-year basis in May.

Core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, increased 0.5% in May and core capital goods shipments rose 0.8%. Durable goods orders gained 0.7% in May and its shipments was up 1.3% in May.

Chinese markets rose after data showed strong manufacturing activity and easing coronavirus restrictions. for travelers. The Shanghai Composite index rose 1.3%, and the blue chip CSI 300 index gained 1.6%.

On the economic front, the manufacturing and services purchasing managers’ index (PMI) both rose above 50 in June as the government eased coronavirus restrictions. The manufacturing PMI reached 50.2 in June, up from 49.6 in May, while the nonmanufacturing PMI rose to 54.7 in June from 47.8 in May.

Meanwhile, the Caixin/Markit PMI survey, a private survey that focuses more on smaller firms in coastal regions, showed manufacturing activity expanded at the fastest pace in 13 months in June. A separate report showed that profits at China’s industrial firms fell 6.5% in May from a year ago, compared to 8.5% YoY drop recorded in April 2022.

Japan’s stock markets declined during the week, as the Nikkei 225 index fell 2.1% and the broader Topix index was down 1.16%. The decline was due to higher risk of a global recession as many major central banks aggressively increased interest rates to curb inflation.

Core consumer prices in Tokyo rose 2.1% year on year in June. The Japanese yen depreciated against the US dollar and finished the week at the low end of the JPY 135 range due completely different monetary policies of the Bank of Japan (BoJ) and the U.S. Federal Reserve.