Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.28 per cent higher at 17,835.50, signalling that Dalal Street was headed for a positive start on Tuesday.

Asian shares were mixed as traders were cautious over global economic growth. Japan’s Nikkei 225 index fell 0.03% and Topix was down 0.19%. China’s Hang Seng rose 0.13% and CSI 300 index advanced 0.24%.

The Indian rupee fell 2 paise to 79.66 against the US dollar on Friday.

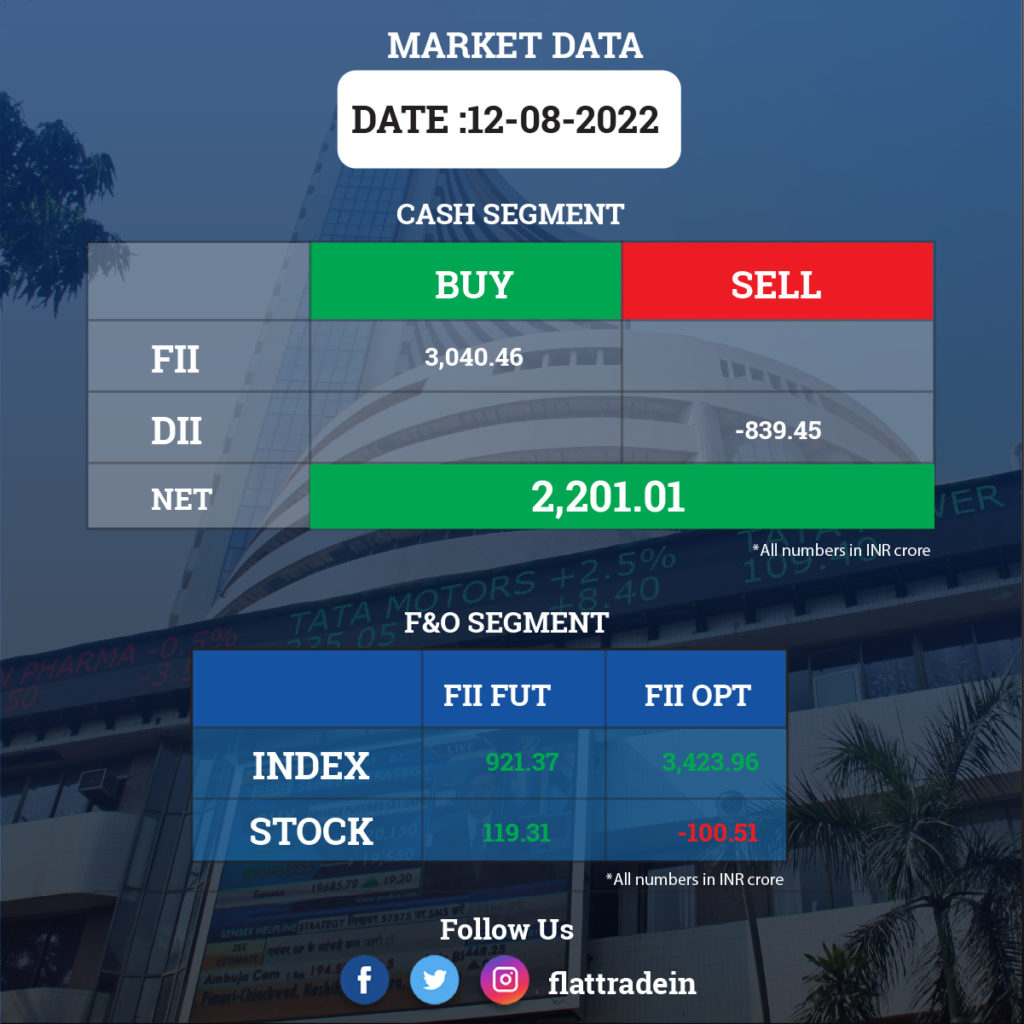

FII/DII Trading Data

Stocks in News Today

Hero MotoCorp: The two-wheeler manufacturer reported over two-fold rise in consolidated profit after tax at Rs 585.58 crore in the first quarter ended June 2022, on the back of higher revenue. It had posted a consolidated profit after tax of Rs 256.46 crore in the same period last fiscal. Its consolidated revenue from operations in the first quarter stood at Rs 8,447.54 crore as compared to Rs 5,502.80 crore in the corresponding period a year ago.

State Bank of India (SBI): India’s largest lender has increased its marginal cost of funds based lending rate or MCLR on loans, a decision that will make EMIs expensive for borrowers. The overnight to three-month SBI MCLR rate has been hiked to 7.35%, from 7.15%. The SBI six-month MCLR goes up to 7.65% from 7.45%, one-year to 7.7%, from 7.5%, two-year to 7.9% from 7.7% and three-year to 8% from 7.8%.

Reliance Industries Ltd (RIL): The tax on windfall energy profits of oil refiners like Reliance Industries is not only levied on the diesel they export but also on the supplies they make to fuel retailers within India, PTI news agency reported citing sources. The windfall tax was targeted mainly at RIL and Russian oil major Rosneft-backed Nayara Energy, as the government believed that both the companies were making a killing on exporting large volumes of fuel made from discounted Russian oil, at the cost of the domestic market, three sources said.

Life Insurance Corp: The largest life insurer’s standalone net profit rose to Rs 682.89 crore in Q1FY23 compared to a profit of Rs 2.94 crore in the same quarter last year. On year-on-year, LIC’s overall business witnessed a strong momentum with marketing activity picking up pace. The insurer’s total premium income climbed 20.35% to Rs 98,351.76 crore in Q1FY23 compared to Rs 81,721.41 crore during Q1 of last fiscal. During the quarter, LIC sold 36.81 lakh policies in the individual segment registering a rise of 59.56% compared to 23.07 lakh policies sold in Q1FY22.

Oil and Natural Gas Corporation (ONGC): The company reported a standalone profit of Rs 15,206 crore for the quarter ended June 2022, up 251 percent YoY driven by strong operating performance and revenue growth. Standalone revenue for the June FY23 quarter grew by 84 percent YoY to Rs 42,321 crore. EBITDA came in at Rs 24,731 crore for the June FY23 quarter, a rise of 125 percent YoY.

Max Healthcare: The US-based private equity major KKR will sell 27 percent stake in hospital chain Max Healthcare on Tuesday, and is likely to raise Rs 9,000 crore through the transaction. The company would be offloading a total of 26.7 crore shares it holds in Max Healthcare, at a price band of Rs 350-361.9 per share, as per the deal terms released on August 15.

Bharti Airtel: The company’s shareholders have approved the re-appointment of Gopal Vittal as managing director of the company for a period of five years with effect from February 1, 2023. Over 97 per cent of total votes polled were in favour of the resolution, and the same “has been passed with requisite majority”, the telco said in a regulatory filing. The shareholders also approved a special resolution related to payment of remuneration to Vittal as managing director and CEO of the company, with 89.57 per cent votes in favour and 10.42 per cent against the proposal.

HDFC Bank and HDFC: Fair trade regulator Competition Commission of India (CCI) has approved the merger proposal of HDFC Bank and its parent HDFC Ltd. The proposed combination envisages the merger of HDFC Investments and HDFC Holdings with HDFC Ltd in the first step and subsequently, the merger of HDFC Ltd into HDFC Bank.

Mahindra & Mahindra (M&M): The company inaugurated its new design centre of excellence, Mahindra Advanced Design Europe (M.A.D.E), which will serve as the conceptual hotbed for the company’s portfolio of EV products. M.A.D.E is located at the global automotive and EV hub of Banbury, Oxfordshire. “Oxfordshire offers access to new and emerging technologies like artificial intelligence, autonomics, advanced robotics, etc. that promise to shape the future of mobility,” said M&M in a statement.

Bharat Petroleum Corporation Ltd (BPCL): The state-owned company will invest Rs 1.4 lakh crore in petrochemicals, city gas and clean energy in the next five years as it looks to non-fuel businesses for growth. “BPCL is recalibrating its strategies to leverage emerging opportunities while mitigating risks,” said its CMD, Arun Kumar Singh, in the firm’s latest annual report.

NMDC: The state-owned miner targets to achieve 46 million tonnes of Iron ore production in the current fiscal, 10 per cent higher than that of last year, Chairman and Managing Director, Sumit Deb said. The company achieved production of 42.19 MT and sales of 40.56 MT in FY22 with a turnover of Rs 25,882 crore.

Godrej Industries: The company reported 38 per cent rise in consolidated net profit at Rs 257.60 crore for the quarter ended June 30, 2022. The company had posted a net profit of Rs 185.99 crore for April-June period a year ago. Revenue from operations was Rs 4,024.55 crore in the quarter as against Rs 2,890.49 crore.

Lupin: The pharm firm is rationalising its product portfolio in the US, transitioning from simple oral solid medicines to more complex generics to overcome the impact of price erosion witnessed in the market, according to the company’s CEO Vinita Gupta. With its planned product pipeline for complex generic medicines in the next two years, she said in the years to come the company hopes to have up to 40 per cent of its revenue coming from such medicines in the US market.

Bajaj Electricals: The company reported a consolidated net profit of Rs 41.19 crore for the first quarter ended June 30. The company had posted a net loss of Rs 24.97 crore during the April-June quarter of the previous fiscal. Its net sales rose 42.25 per cent to Rs 1,202.10 crore during the quarter under review against Rs 845.04 crore in the corresponding period of the preceding fiscal.

Zee Entertainment Enterprises: The company reported 48.94 per cent fall in consolidated net profit at Rs 106.60 crore for June quarter 2022-23 due to unfavourable macroeconomic conditions. The company had reported a net profit of Rs 208.78 crore in April-June period a year ago. Total income during the quarter under review was Rs 1,879.53 crore against Rs 1,808.56 crore in the year-ago period.

Sun TV Networks: The company reported a 35.32 per cent rise in consolidated profit after tax to Rs 493.99 crore in the first quarter ended June. The company had reported a profit after tax of Rs 365.03 crore in the April-June period a year ago. Its revenue from operations rose 48.88 per cent to Rs 1,219.14 crore in the reported quarter as against Rs 818.87 crore in the year-ago period.

Apollo Tyres: The tyre manufacturer Friday reported 49.21 per cent increase in consolidated net profit at Rs 190.68 crore for the quarter ended June 2022, driven by higher sales. It had posted a net profit of Rs 127.78 crore for the year-ago period. Revenue from operations during the period under review stood at Rs 5,942 crore as against Rs 4,584.47 crore in the year-ago quarter. Its board has approved raising Rs 1,000 crore through issuance of non-convertible debentures (NCDs) on private placement basis in one or more tranches.

Muthoot Finance: The NBFC posted a net profit of Rs 802 crore during the first quarter of FY23, down 17 per cent from Rs 971 crore during the first quarter of FY22. Total income for the quarter under review fell 8 per cent YoY to Rs 2,509 crore as against Rs 2,715 crore during the same quarter in FY22. During the quarter, loan assets stood at Rs 56,689 crore as compared to Rs 52,614 crore in the same quarter last year, registering a growth of 8 per cent year-on-year.

Power Finance Corporation (PFC): The state-owned company posted a marginal rise in consolidated net profit at Rs 4,579.53 crore for the quarter ended June 2022. The net profit of the company was Rs 4,554.98 crore in the year-ago period. Total income was at Rs 18,544.04 crore as against Rs 18,970.39 crore in the same period a year ago.

SJVN: The state-owned power producer posted more than 78 per cent jump in consolidated net profit to Rs 609.23 crore in the June quarter, driven by higher revenues. The consolidated net profit of the company stood at Rs 342.13 crore in the year-ago period. The company’s total income rose to Rs 1,072.23 crore in the latest June quarter from Rs 704.90 crore in the same period a year ago.

Matrimony.com Ltd: The online matrimonial services provider has reported a marginal decline on its standalone net profit for the April-June 2022 quarter at Rs 12.88 crore. The company had reported standalone net profit at Rs 14.10 crore during corresponding quarter previous year. For the year ending March 31, 2022 the standalone net profit was at Rs 56.98 crore. Total income during the quarter under review grew to Rs 119.79 crore, from Rs 109.21 crore registered in the same period previous year.

Varroc Engineering: The auto parts maker and supplier reported narrowing of net loss to Rs 84.51 crore on a consolidated basis in the June quarter. The company had posted a net loss of Rs 229.28 crore in the year-ago period. Revenue from continued operations surged 36.25 per cent to Rs 1,628.28 crore in the latest June quarter. The same stood at Rs 1,194.99 crore in the corresponding quarter of FY22.

Future Consumer Ltd: The company reported a widening of its consolidated net loss to Rs 95.14 crore for the first quarter ended June 30, 2022. The company had posted a net loss of Rs 31.54 crore in the April-June quarter a year ago. Its total income was down 65.12 per cent to Rs 109.77 crore during the period under review as against Rs 314.73 crore in the corresponding period last fiscal.

Coffee Day Enterprises: The company reported narrowing of its consolidated net loss to Rs 18 crore for the quarter ended June 30, 2022. The company had posted a net loss of Rs 117.28 crore in the April-June period a year ago. Its revenue from operations climbed over two-fold to Rs 210.49 crore as against Rs 81.52 crore in the corresponding quarter last fiscal.

MTNL: State-owned telecom company reported narrowing of consolidated loss to Rs 653 crore in the April-June 2022 quarter. The company had posted a loss of Rs 688.69 crore in the same period a year ago. The consolidated revenue from operations of MTNL fell by about 17 per cent to Rs 250.72 crore in the first quarter of the current fiscal, according to a regulatory filing.

ESAF Small Finance Bank: The lender posted a profit of Rs 106 crore for the first quarter ended June 2022, helped by a rise in interest income and a decline in bad loans. The lender had booked a loss of Rs 15.85 crore during the corresponding quarter of the last fiscal year. Total income increased by 66.35 per cent to Rs 738.32 crore from Rs 443.83 crore in the corresponding quarter of the last fiscal year. The bank’s net interest income increased to Rs 449 crore in the quarter ended June 30, 2022, from Rs 223 crore in the same quarter a year ago.

Reliance Infrastructure: The company reported a narrowing of its consolidated net loss to Rs 66.11 crore for the quarter ended June 30, 2022. The company had clocked a consolidated net loss of Rs 95.15 crore in the corresponding period of the previous fiscal. Its total consolidated income during the quarter under review rose to Rs 6,349.34 crore as against Rs 4,623.17 crore in the year-ago period.

Suzlon Group: The company plans to raise raise up to Rs 1,200 crore through a rights issue of shares by the fiscal-end to pare the refinanced debt of Rs 3,000 crore, according to its Chief Financial Officer Himanshu Mody. The company’s debt of Rs 3,000-crore has been refinanced by REC.