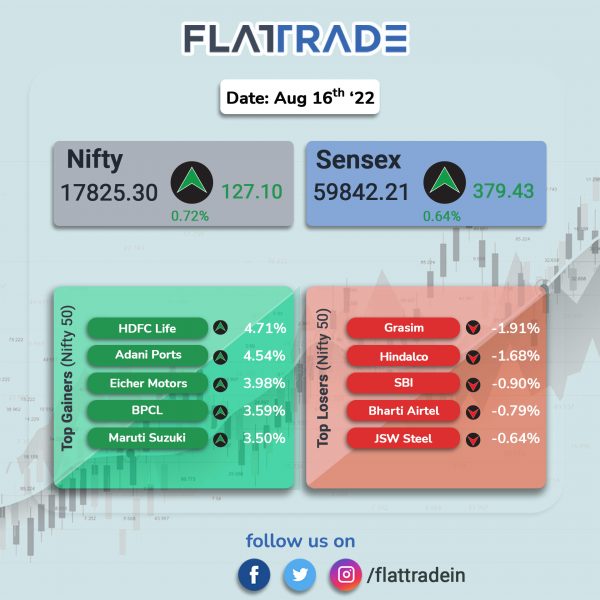

Benchmark indices ended higher as auto, Oil & Gas and FMCG stocks gained. The Sensex advanced 0.64% and the Nifty 50 index gained 0.72%.

The broader market outperformed their larger peers. The Nifty Midcap 100 gained 1.45% and S&P BSE SmallCap advanced 1.03%.

Top Nifty sectoral gainers were Auto [2.52%], Realty [1.97%], Oil & Gas [1.51%], FMCG [1.19%] and Energy [1.1%]. Top losers were PSU Bank [-0.37%] and Media [-0.3%]

The Indian rupee was flat at 79.66 against the US dollar on Tuesday.

Inflation measured by Whole-sale Price Index eased to 13.93% in July, according to data released by the Ministry of Commerce & Industry. The wholesale price index (WPI) had spiked to 15.18 per cent in June, while the WPI for May was revised to 16.63 per cent from 15.88 per cent, the data showed. The WPI in July 2021 was at 11.57 per cent. However, the WPI continues to remain in the double digits for the 16th consecutive month since April 2021.

Stock in News Today

Adani Ports & SEZ: The company’s subsidiary, Adani Logistics, has signed an agreement to acquire the ICD “Tumb” (Vapi) from Navkar Corporation Ltd for an enterprise value of Rs 835 crore. The deal includes acquisition of the operational ICD with capacity to handle 0.5 million TEUs. The associated 129 acres of land provides an additional expansion path to increase capacity and cargo in near future as additional industrial corridors and logistic parks get added along these DFC routes.

Mahindra & Mahindra (M&M): The automaker and Volkswagen Group have signed a term sheet for the supply of Modular Electric Drive matrix (MEB) electric components for M&M’s electric platform INGLO, the M&M’s new electric SUV family.M&M and Volkswagen will also explore other opportunities for collaboration, including e-mobility, vehicle projects, charging and energy solutions and cell manufacturing. The announcement comes after M&M unveiled its new electric SUV family at the Mahindra Born EV vision event in United Kingdom on Monday.

DFM Foods: The company announced that its promoters AI Global (Cyprus) Investments and AI Darwin (Cayman) proposed to acquire all shares held by public shareholders and voluntarily delist the shares from BSE, NSE. JM Financial has been appointed as the manager to the delisting proposal. The delisting is expected to provide increased operational flexibility to support the company and reduction of the substantial compliance costs.

SpiceJet: The low-cost carrier said that it has entered into a settlement agreement with aircraft lessor Goshawk Aviation Ltd and its affiliates related to three Boeing aircraft, Reuters reported. The airline said that the agreement ends all litigation proceedings between the parties. This will allow SpiceJet to add two more fuel-efficient Boeing 737 MAX aircraft and one Boeing 737-800 NG aircraft to its fleet.

In other news, the Supreme Court said it would consider a joint request for mediation of low-cost airline SpiceJet and media baron Kalanithi Maran and his Kal Airways for amicably settling all pending disputes between them including the row over the share-transfer issue. The bench presided by Chief Justice of India Justice NV Ramana adjourned the hearing for four weeks.

UTI AMC: Shares of the company soared nearly 17 percent to after CNBC TV reported Tata Asset Management Co is set to buy a significant stake in the company. The news report said that it is PNB, SBI, BOB and LIC will sell their stake in UTI AMC.

IndoStar Capital Finance: The NBFC reported a consolidated net profit at Rs 60.9 crore in the April-June quarter of this fiscal year on lower provisions in commercial vehicle loans. The NBFC had posted a net loss of Rs 36.8 crore in the same quarter a year ago. Its net revenues during April-June quarter of FY23 were up by 32 per cent at Rs 167 crore as against Rs 126.6 crore in same period a year ago.

Wockhardt: The pharma firm said that it has initiated a global Phase III clinical study of its new antibiotic candidate WCK 5222. The company has completed the first site initiation visit for the study, Wockhardt said in a statement. WCK 5222 is a drug targeted for treatment of hospitalised adults with complicated urinary tract infections, including acute pyelonephritis, the company added.

KEC International: The infrastructure firm has bagged new orders worth Rs 1,313 crore across its various businesses, Transmission & Distribution (T&D), Railways, Civil, Oil & Gas pipelines and Cables.