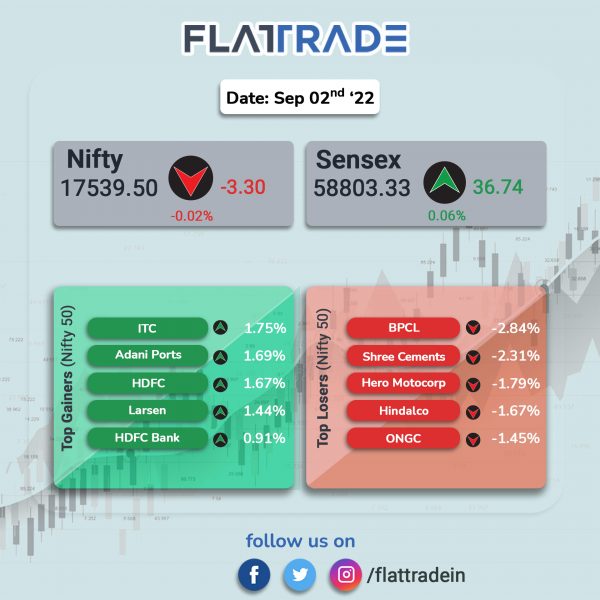

Major domestic equity indices were little changed in a volatile session as investors remained on the sidelines due to lack of triggers. The Sensex rose 0.06% and the Nifty 50 index slipped 0.02%.

Broader markets also mirrored benchmark indices. The Nifty Midcap 100 index fell 0.36% and the BSE SmallCap inched up 0.04%.

Top Nifty sectoral gainers were Financial Services [0.51%], Media [0.5%], FMCG [0.39%] and Bank [0.3%]. Top losers were Oil & Gas [-1.03%], Energy [-0.75%], PSU Bank [-0.67%] and Pharma [-0.39%]

The Indian rupee fell 24 paise to 79.80 against the US dollar on Friday.

Stock in News Today

Adani Ports & SEZ: The company’s cargo volume increased by 18% YoY to 29.3 MMT in August 2022. The average cargo run rate during of April-August period continued to be strong at 30.3 million tonnes. APSEZ handled 29.3 MMT of cargo in August 2022. Out of the total handled cargo volume, dry bulk cargo volume grew by 44% YoY while container volume rose by 8% YoY in August 2022.

Adani Enterprises: Shares of the company rose to a record high of Rs 3,290 after they gained 2% on the NSE in Friday’s intra-day trade. The spurt comes after the NSE announced the company’s inclusion in the benchmark Nifty 50 index. Adani Enterprises will join the benchmark index from September 30 and will replace Shree Cement.

Tata Consultancy Services (TCS): The IT services major said that it won’t be rolling out salary hikes to employees who have completed one year with the tech firm, Livemint news reported. The company in an email to its employees said that the hikes for them will be rolled out in 2023.

GMR Infrastructure: The company’s subsidiary, GMR Airports International, has entered into definitive agreements with Aboitiz InfraCapital Inc (AIC) and AIC will acquire shares in GMR-Megawide Cebu Airport Corp. GMR will divest its entire 40% stake in Cebu international airport in Philippines for an upfront payment of Rs 1,330 crore as well as earnout to be received over a period of more than four years. The company plans to rebalance its airport portfolio to focus on high growth opportunities.

ITC: The cigarette-to-FMCG conglomerate regained the market capitalisation of Rs 4 trillion on Friday as the company’ shares continued to rally. The company has risen over 50% since February’s closing price.

V-Guard Industries: The company said that it has completed the acquisition of balance 26% of equity share of Guts Electromech for Rs 6.2 crore, as per the share purchase and subscription agreement signed earlier. Guts Electro-Mech has become a wholly owned subsidiary of V-Guard Industries.

Suven Pharmaceuticals: The drugmaker traded in the green after the company’s board approved a special dividend of Rs 5 per share and an interim dividend of Re 1 per share in its meeting.

Escorts Kubota: Shares of the company jumped 3.4% after the company’s total tractor sales rose 7.3% YoY to 6,111 units in August. Domestic tractor sales rose 7.9% year-on-year to 5,308 units, while exports jumped nearly 4% YoY to 803 units The company expected better sales in September on the back of early start of the festivals.

Cochin Shipyard: Shares of the company jumped nearly 4% in early trade as Prime Minister Narendra Modi commissioned India’s first indigenously designed and built aircraft carrier INS Vikrant at Cochin Shipyard Limited in Kochi. However, the shares pared gains to close lower 0.1%.

HBL Power: The battery and power electronic products maker signed first contract with Easter Railway under Mission Raftar project, for deployment of Kavach (TCAS – Train Collision Avoidance System) over 260 kms of track and 120 locomotives, from Howrah to Pradhankhanta. HBL Power Systems said that the contract price is Rs 286.69 crore, including taxes. HBL’s work share in the contract is worth Rs 205.88 crore. The contract is to be completed in 700 days.