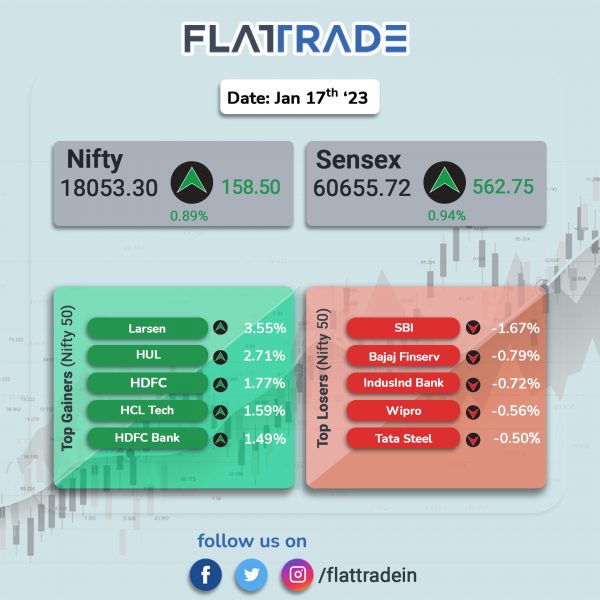

Sensex and Nifty gained nearly 1%, a day after government data showed wholesale inflation dropping to a 2-year low of 4.9% in December 2022. FMCG and Realty stocks led today’s rally as both the indices climbed over 1%. Energy and IT stocks made significant gains. The Sensex jumped 0.94% and the Nifty 50 index rose0.89%.

Broader markets underperformed headline indices. The Nifty Midcap 100 index fell 0.11% and the BSE Smallcap index dropped 0.13%.

Top gainers among Nifty sectoral indices were FMCG [1.2%], Realty [1.17%], Energy [1.17%], Oil & Gas [1.05%] and IT [0.80%]. Top losers were PSU Bank [-1.84%] and Media [-0.86%].

Indian rupee depreciated 15 paise to 81.77 against the US dollar on Tuesday.

India’s exports contracted 12.2% to $34.48 billion in December 2022, mainly due to global headwinds, and the trade deficit widened to $23.76 billion during the same period, according to official data. Imports in December 2022 also declined 3.5% to $58.24 billion as against $60.33 billion in the year-ago period. In December 2021, exports stood at $39.27 billion and the trade deficit was at $21.06 billion.

Stock in News Today

Adani Power: The company and D B Power have mutually agreed to further extend the long stop date as 15 February 2023, for achieving the closing the transaction for acquisition of D B Power. Adani Power had agreed to acquire D B Power, which owns and operates a running 2×600 MW thermal power plant at District Jangir Champa in Chhattisgarh.

HDFC Bank: The lender announced that Financial Services Commission, Mauritius has granted its approval for the proposed transfer of shares of Griha Investments, a wholly-owned subsidiary of HDFC Holdings Limited and a foreign step-down subsidiary of HDFC Limited, from HDFC Holdings Limited to HDFC Bank as a result of the proposed amalgamation of HDFC and HDFC Bank.

Bank of India: The state-run bank’s net profit increased 12% to Rs 1,151 crore on 26.3% rise in total income to Rs 14,159.60 in Q3FY23 over Q3FY22. Net interest income (NII) increased by 64% YoY to Rs 5,596 crore for Q3FY23 as against Rs 3,408 crore for Q3FY22. Net interest margin improved to 3.72% in Q3FY23 as compared to 2.51% in Q3FY22. The ratio of gross NPAs was 7.66% in Q3FY23 as against 8.51% in Q2FY23. The ratio of net NPAs was 1.61% in the reported quarter as compared with 1.92% in Q2FY23.

Mastek: The IT company’s consolidated net profit tumbled 18.86% QoQ to Rs 64.18 crore in Q3FY23 as against Rs 79.10 crore recorded in Q2FY23. Revenue from operations rose 5.34% QoQ to Rs 658.66 crore in the reported quarter from Rs 625.30 posted in Q2FY23. On a year on year (YoY) basis, the Mastek’s net profit declined 12.85% while revenue jumped 19.34% in Q3 FY23. Operating EBITDA was at Rs 113.7 crore in Q3FY23, up 5.9% QoQ and down 2.2% YoY. Operating EBITDA margin stood at 17.3% in Q3FY23 as against 17.2% in Q2 FY23 and 21.1% in Q3 FY22. The company added 31 new clients in Q3FY23. Total active clients during Q3FY23 were 444 as compared to 449 in Q2FY23.

TV18 Broadcast: The company’s net profit declined 79.22% to Rs 41.64 crore in the quarter ended December 2022 as against Rs 200.34 crore during the quarter ended December 2021. Sales rose 12.80% to Rs 1,767.71 crore in the quarter ended December 2022 as against Rs 1,567.08 crore during the quarter ended December 2021. The media company said that the continued softness in the macro-economic environment dampened the advertising demand and impacted its revenue.

Network 18 Media & Investments: The company’s net loss stood at Rs 7.68 crore in the quarter ended December 2022 as against a net profit of Rs 97.10 crore during the quarter ended December 2021. Sales rose 11.65% to Rs 1,850.49 crore in the quarter ended December 2022 as against Rs 1,657.43 crore during the quarter ended December 2021.

Metro Brands: The footwear retailer’s net profit rose 10.55% to Rs 111.95 crore in the quarter ended December 2022 as against Rs 101.27 crore during the quarter ended December 2021. Sales rose 23.76% to Rs 598.71 crore in the quarter ended December 2022 as against Rs 483.77 crore during the quarter ended December 2021.

Wheels India: The company has launched the Flow Form technology in Cast Alloy Wheel, one of the most advanced manufacturing technologies in the wheel industry. The company, which operates a state-of-the-art cast aluminum plant in Thervoy Kandigai, near Chennai, recently began exporting the flow forming wheel to the US market and the company expects to launch the product soon in the Indian market.

JSW Ispat Special Products: The company reported a consolidated net loss of Rs 96.87 crore in Q3FY23 as against a net loss of Rs 28.24 crore in Q3FY22. Net sales tumbled 25.19% to Rs 1,097.55 crore in quarter ended December 2022 from Rs 1,465.32 crore in the year-ago period.

Equitas Holdings: The company announced that the National Company Law Tribunal, Division II, Chennai Bench (NCLT) has sanctioned the scheme of amalgamation of Equitas Holdings (transferor company) and Equitas Small Finance Bank (transferee company) and their respective shareholders and creditors. The appointed date for the said amalgamation is 01 January 2023 and the scheme shall become effective upon filing of the certified copy of the order passed by NCLT with the Registrar of Companies, Chennai, Tamil Nadu, by the transferor and transferee companies.

Ashoka Buildcon: The company has declared November 19, 2022, as the Commercial Operation Date (CoD) for its Hybrid Annuity Mode (HAM) project of National Highways Authority of India (NHAI). The project calls for four laning of NH-161 in Telangana under Bharatmala Pariyojna on hybrid annuity mode. The project is executed by Ashoka Kandi Ramsanpalle Road (SPV) a wholly-owned subsidiary of the company.

Newgen Software Tech: The software company’s consolidated net profit jumped 59.23% sequentially to Rs 48.20 crore on 12.74% QoQ increase in revenue from operations to Rs 254.92 crore in Q3FY23 over Q2 FY23. Its EBITDA rose 56.8% QoQ to Rs 58.9 crore in the reported quarter.

Glenmark Pharmaceuticals: The drugmaker launched the sacubitril + valsartan tablets in India, for the treatment of heart failure marketed under the brand name ‘Sacu V’. According to IQVIA sales data for the 12‐month period ending December 2022, the total cardiology market is estimated to be Rs 20,730 crore.