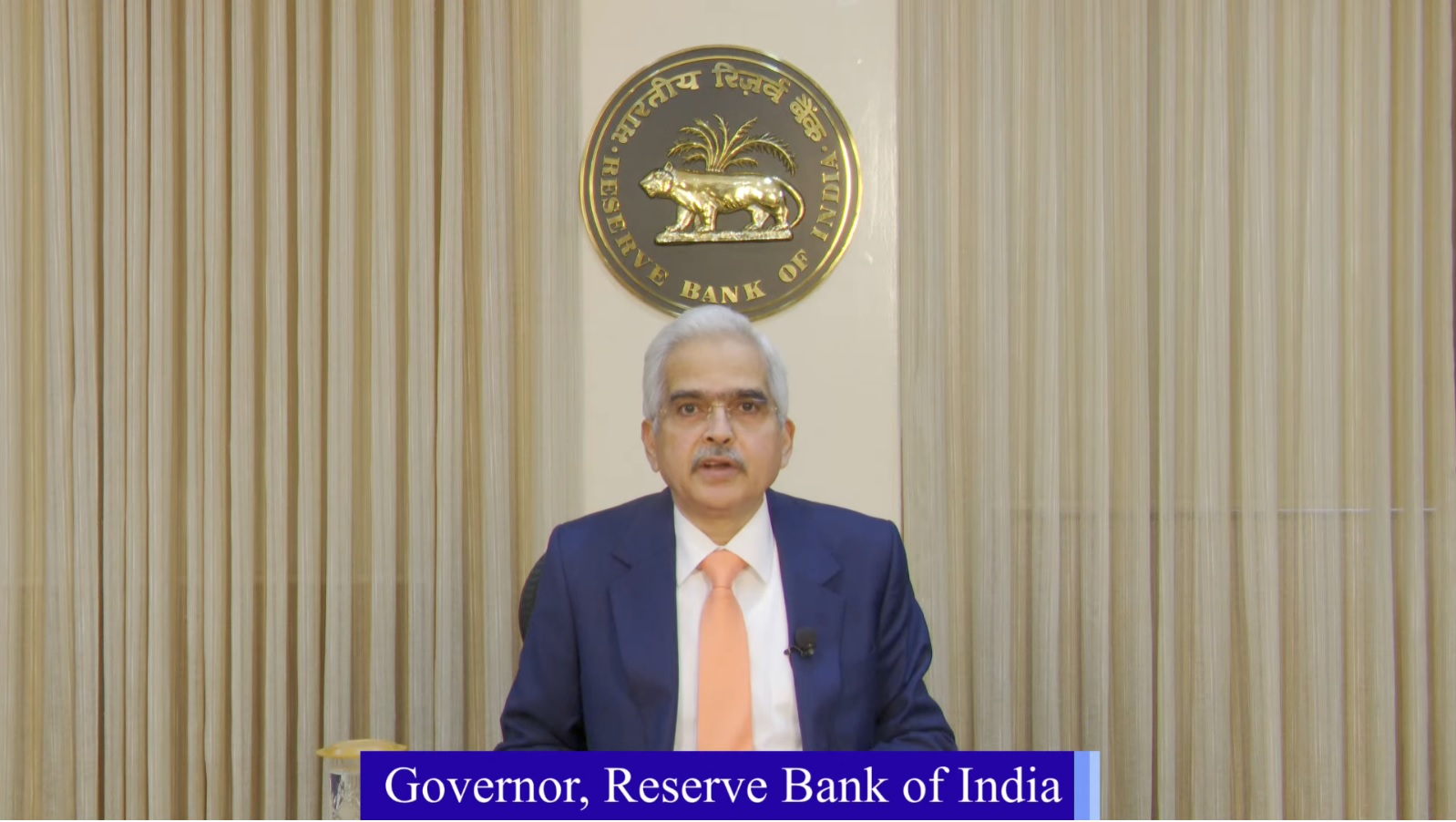

The Reserve Bank of India’s Monetary Policy Committee (MPC) met on 3rd, 5th and 6th April 2023 and assessed the macroeconomic situation and its outlook. Following are the key highlights of the monetary policy meeting.

• The Monetary Policy Committee (MPC) has decided unanimously to keep the policy repo rate unchanged at 6.5% in this meeting with readiness to act, should the situation so warrant.

• The MPC also decided by a majority of 5 out of 6 members to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

• The policy repo rate has been increased cumulatively by 250 bps in the last 11 months starting May 2022.

• Consequently, the standing deposit facility (SDF) rate will remain unchanged at 6.25% and the marginal standing facility (MSF) rate as well as the Bank Rate will be at 6.75%.

• The real GDP growth is expected to have been 7% in FY2022-23. Real GDP growth for FY2023-24 is projected at 6.5%. Quarterly GDP growth forecast for FY24 are as follows:

Q1 FY24 at 7.8%

Q2 FY24 at 6.2%

Q3 FY24 at 6.1%

Q4 FY24 at 5.9%

• On the supply side, rabi foodgrains production is estimated to increase by 6.2% in 2022-23.

• PMI manufacturing remained robust at 56.4 in March 2023, recording expansion for the 21st consecutive month. PMI services remained in expansion zone at 57.8 in March 2023

• Consumer price inflation has increased since December 2022, driven by price pressures in cereals, milk and fruits. Core inflation remains elevated.

• CPI-based inflation is projected to moderate to 5.2% for FY2023-24; Quarterly CPI-based inflation forecast for FY24 are as follows:

Q1 FY24 at 5.1%

Q2 FY24 at 5.4%

Q3 FY24 at 5.4%

Q4 FY24 at 5.2%

• Current account deficit (CAD) for the first three quarters of 2022-23 stood at 2.7% of GDP.

CAD in Q3FY23 — 2.2%

CAD in Q2FY23 — 3.7%

• Foreign exchange (Forex) reserves have rebounded from USD 524.5 billion on October 21, 2022 and now stand in excess of USD 600 billion taking into account RBI’s forward assets.

• Banks in India with IFSC Banking Units (IBUs) is now permitted to offer non-deliverable foreign exchange derivative contracts (NDDCs) involving INR to resident users in the onshore market. This step is expected to further deepen the forex market in India and provide enhanced flexibility to residents in meeting their hedging requirements.

• Inward gross remittances from gulf cooperation council (GCC) countries touched an all-time high of USD 107.5 billion during calendar year 2022.

• RBI has decided to have a secured web based centralised portal named as ‘PRAVAAH’ (Platform for Regulatory Application, Validation And AutHorisation) to streamline processes such as seeking license / authorisation or regulatory approvals from the RBI.

• To improve and widen the access of depositors / beneficiaries to information on unclaimed deposits, RBI shall develop a web portal to enable search across multiple banks for possible unclaimed deposits. This will help depositors/beneficiaries in getting back unclaimed deposits.

• To enhance consumer protection, the RBI has brought Credit Information Companies (CICs) under the purview of the Reserve Bank Integrated Ombudsman Scheme (RBI-OS) and put in place a few measures as follows:

i) a compensation mechanism for delayed updation/rectification of credit information reports;

ii) a provision for SMS/email alerts to customers whenever their credit information reports are accessed;

iii) a timeframe for inclusion of data received by CICs from Credit Institutions;

iv) disclosures on customer complaints received by CICs.

• To expand the scope of UPI by permitting operation of pre-sanctioned credit lines at banks through the UPI.