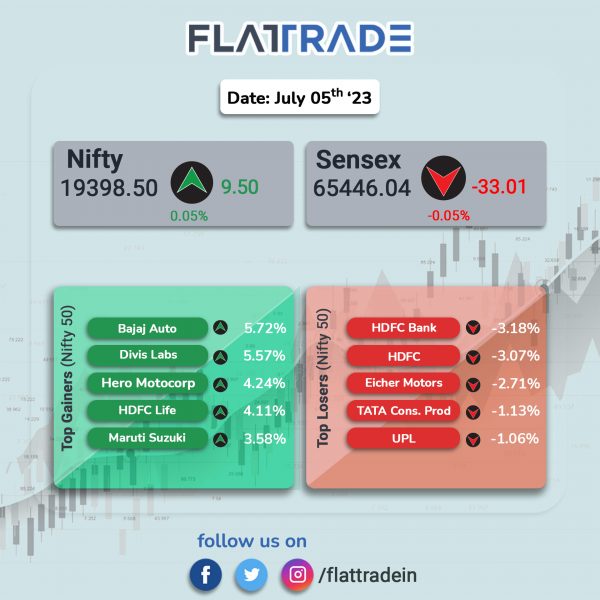

Benchmark equity indices closed flat as losses in HDFC twins weighed on the markets and investors remained cautious amid brewing trade tensions between the US and China. The Sensx fell 0.05% and the Nifty inched up 0.05%.

Broader markets outperformed headline indices. The Nifty Midcap 100 index rose 0.71% and the BSE Smallcap jumped 0.62%.

Top gainers were FMCG [1.82%], Auto [1.64%], Media [1.49%], PSU Bank [1.03%], Oil & Gas [0.84%]. Top losers were Financial Services [-0.82%] and Bank [-0.33%].

Indian rupee depreciated by 20 paise to close at 82.22 against the US dollar on Wednesday.

S&P Global India Services Purchasing Managers’ Index (PMI) declined to 58.5 in June from 61.2 in May. The latest reading is the lowest since April 2023 when it was 62.

Stock in News Today

HDFC Bank, HDFC: After the merger of HDFC and HDFC Bank, its combined loan book expanded by 13.1% year-on-year (YoY) to Rs 22.45 trillion at the end of Q1FY24. The merged entity’s deposits grew by 16.2% YoY at Rs 20.63 trillion at the end of the first quarter. The merged entity’s average Liquidity Coverage Ratio (LCR) was around 120% for the quarter ended June 30, 2023. Shares of HDFC Bank tanked 3.18% and HDFC plunged 3.07%.

Bajaj Auto: The company, in collaboration with British motorcycle major Triumph, launched the Speed 400 premium bike for the Indian market at an ex-showroom price of Rs 2.33 lakh. The introductory price will be applicable for the first 10,000 customers, Bajaj Auto-Triumph announced at the launch event. The online pre-booking for Speed 400 was kicked off in India last month, with a Rs 2,000 fully refundable payment window, after its world premiere in London. Shares of the company surged 5.7%

One97 Communications (Paytm): The company posted a 37% growth in gross merchandise value (GMV) at Rs 4.05 trillion in the April-June quarter of this year as against Rs 2.96 trillion in the same period a year ago. The value of loan disbursed through Paytm grew over 2.5 times to Rs 14,845 crore, from Rs 5,554 crore a year ago and the volume grew by 51% to 12.8 million in April-June 2023 period, from 8.5 million during the same period last year. The average monthly transacting users grew 23 per cent on a year-over-year basis to 92 million during the reported quarter from 75 million in the June 2022 quarter.

Larsen & Toubro (L&T): The infrastructure conglomerate said that its Buildings & Factories (B&F) Business of L&T construction has secured an EPC order in Mumbai for an Office Space Development using Composite Steel Construction Technology. As per its classification, the value of the order lies between Rs 1000 crore to Rs 2,500 crore. The commercial office space will have an approximate built-up area of 14.85 Lakhs Square feet.

IndusInd Bank: The private lender’s net advances improved to Rs 3,01,041 crore as of 30 June 2023, a growth of 21% as compared to Rs 2,47,960 crore as of 30 June 2022. The bank reported a 15% YoY growth in deposits to Rs 3,47,356 crore as of 30 June 2023 from Rs 3,03,078 crore as of 30 June 2022. CASA ratio reduced to 39.9% for the quarter ended June 2023 compared to 43.2% in the year-ago period.

IDFC First Bank: The lender said its advances increased 24.5% to Rs 1,71,420 crore as of 30 June 2023 from Rs 1,37,663 crore as of 30 June 2022. Total customer deposits jumped 44.4% to Rs 1,48,508 crore as on 30 June 2023 as against Rs 1,02,868 crore as on 30 June 2022. CASA deposits increased 26.7% on a year-on-year basis. CASA ratio stood at 46.5% at the end of June 2023 quarter, as against 49.8% at the end of the preceding quarter. It maintained average liquidity coverage ratio at 125.4% for the quarter ended on 30 June 2023.

Macrotech Developers: The realty firm reported a 17% growth in its sales bookings at Rs 3,350 crore in the first quarter of this fiscal year, mainly on better housing demand. This was the company’s best-ever first quarter pre-sales performance.

AU Small Finance Bank (AU SFB): The lender’s gross advances increased 29% YoY to Rs 63,635 crore in Q1FY24, while deposits grew 27% to Rs 69,315 crore, the lender said in its June quarter business update.

TTK Healthcare: Shares of the company jumped 5.9% in intraday trade after it revised the floor price to Rs 1,201.30 per share for delisting. Earlier, the floor price was set at Rs 1051.31 per equity share.

Poonawalla Fincorp: The financial services company posted 41% YoY in Assets Under Management (AUM) at Rs 17,770 crore in Q1FY24. Sequentially, AUM grew by 10% over the March 2023 quarter. The company’s disbursements in the first quarter were up by 143% YoY to reach Rs 7,050 crore, from Rs 2,901 crore in the same quarter a year ago. Sequentially, the disbursements rose 11% from Rs 6,371 crore in the quarter ended March 2023, according to the company’s regulatory filing.

Godrej Consumer Products: The company said in an exchange filing that the overall consumer demand remained steady as seen in the previous few quarters. The company’s organic business continued to deliver robust performance with double-digit volume growth. The performance was broad based with double-digit volume growth in Home Care and higher than mid-single digit volume growth in Personal Care. At a consolidated level (organic), the company expects to deliver high-single digit volume growth, teens growth in constant currency terms translating to close to double-digit sales growth in INR terms. Sales growth, including inorganic growth, to be in double digits.

Dabur India: The company said that five additional brands, which include Honitus, Real Drinks, Odomos and Dabur Herb’l, crossed sales of over Rs 100 crore. With this, the company’s portfolio now consists of 17 brands with sales between Rs 100 crore to Rs 500 crore. Further, it has two brands that are over Rs 500 crore but less than Rs 1,000 crore in size, and another four brands have a turnover of more than Rs 1,000 crore. The company’s chairman high inflation emerged as the new challenge, which pushed up commodity prices in many countries. However, with reduced prices for most of its commodities, the FMCG major expects to see expansion in gross margins in the current fiscal.

G R Infraprojects: The company’s wholly owned subsidiary — GR Varanasi Kolkata — has executed a concession agreement with National Highways Authority of India (NHAI) for Rs 1,248.37 crore. The agreement constitutes construction of six‐lane Greenfield Varanasi‐Ranchi‐Kolkata highway from Anarbansalea village to Sagrampur village under bharatmala pariyojana in Bihar on hybrid annuity mode. The completion of the project is expected to be within 730 days from appointed date and the operational period is for 15 years from commercial operation date.

APL Apollo Tubes: The company said that CRISIL Ratings has revised its rating outlook on the long-term bank facilities of APL Apollo Tubes to ‘positive’ from ‘stable’ and reaffirmed the rating on the same at ‘CRISIL AA’. The agency has reaffirmed the rating on the short-term facilities and commercial paper of the company at ‘CRISIL A1+’. CRISIL said that the outlook revision factors in the healthy scale-up of APL Apollo driven by strong volume growth. The rating agency said volume growth will remain healthy at 25-30% in fiscal 2024, while Ebitda per tonne will improve to Rs 5,000.

Indian Energy Exchange (IEX): The company achieved 8,946 MU overall volume in June 2023, registering a growth of 8% YoY. On a sequential basis, the company’s total volume increased 8% MoM in June 2023. The overall volume in June 2023 was including green market trade of 272 MU, 5.33 lac RECs (equivalent to 533 MU) and 2.44 lac ESCerts (equivalent to 244 MU). The power exchange said that supply side scenario during the quarter improved due to enhanced coal supply, reduction in e-auction coal prices, and consistently declining imported coal and gas prices.

Equitas Small Finance Bank: The lender said that its gross advances surged 36% to Rs 29,603 crore as on 30 June 2023 as against Rs 21,688 crore as on 30 June 2022. Total deposits grew 36% YoY to Rs 27,709 crore as on 30 June 2023. During the quarter, CASA deposits stood at Rs 10,642 crore, up 1% YoY. CASA ratio stood at 38% on 30 June 2023 as compared to 42% on 31 March 2023 and 52% on 30 June 2022.

Lemon Tree Hotels: The hospitality company has signed a license agreement for a 48 room property in Udaipur, Rajasthan, under the company’s brand Keys Select by Lemon Tree Hotels. Carnation Hotels, a wholly owned subsidiary and the hotel management arm of the company will be operating this hotel. It is expected to be operational by Q4FY24. This hotel will feature 48 well-appointed rooms, banquet facilities, a restaurant, a bar, meeting rooms, a banquet hall, a fitness center and other public areas.

Som Distilleries: The board of the company will meet on 8 July 2023 to discuss and decide on fund raising activities to meet the company’s capital expenditure and working capital requirements. The board aims to address these financial needs through the issuance of convertible equity warrants on a preferential basis to the promoters, promoters group, and prospective investors.

Angel One: The brokerage company said that its client base jumped 44.7% to 15.06 million in June 2023 as against 10.41 millions recorded in June 2022. Gross client acquisition stood at 0.48 million in June 2023 as against 0.34 million in June 2022. Angel’s overall average daily turnover (ADTO) was at Rs 24,05,100 crore in June 2023, up 9.1% MoM and up 146.3% YoY. The company’s ADTO from the F&O segment stood at Rs 23,63,300 crore in June 2023 (up 9.1% MoM and up 146.9% YoY). ADTO from the cash segment was at Rs 3,700 crore (up 8.5% MoM while up 22% YoY) and ADTO from the commodity segment stood at Rs 28,000 crore (up 16.6% MoM and up 157.9% YoY) in June 2023.

Yes Bank: The bank reported 13.5% rise in deposits to Rs 219,369 crore as on 30 June 2023 from Rs 193,241 crore as on 30 June 2022. CASA ratio was at 29.4% as on 30 June 2023 as against 31.6% as on 30 June 2022. Loans & Advances for the period ended 30 June 2023 aggregated to Rs 200,308 crore, up 7.5% YoY. Credit to deposit ratio was at 91.3% as on 30 June 2023 as against 96.4% as on 30 June 2022.

Suryoday Small Finance Bank (Suryoday SFB): The lender said that its gross advances improved to Rs 6,400 crore as on 30 June 2023, a growth of 25% from Rs 5,132 crore as on 30 June 2022. Disbursements for the quarter ended June 2023 stood at Rs 1,190 crore, up 14% YoY. Total deposits jumped 42% YoY to Rs 5,705 crore reported in Q1FY24. CASA ratio declined to 15% in Q1FY24 as against 17% in Q4FY23 and 20% in Q1FY23.

KPI Green Energy: The company received an order for executing solar power project of 6.70 MW capacity under captive power produce (CPP) segment of the company. The company’s wholly owned subsidiary, Sun Drops Energia has also received an order to execute solar power project of 1 MW capacity. The project is scheduled to be completed in the current fiscal.

Man Industries (India): The company announced the receipt of BIS certification for its ERW (electric resistance welded) plant, which is located at Anjar, Gujarat.