Tata Technologies Limited is planning to raise up to Rs 3,042.51 crore through an initial public offering (IPO). The subscription for the IPO will be open from November 22 to November 24, 2023. The price band has been fixed in the range of Rs 475 to Rs 500 per equity share of face value of Rs 2 apiece.

The IPO consists of only offer for sale of 6,08,50,278 shares aggregating up to Rs 3,042.51 crore. The size of one lot is 30 shares.

Company Summary

Tata Technologies Limited is a leading global engineering services company offering product development and digital solutions, including turnkey solutions, to global original equipment manufacturers (OEMs) and their tier 1 suppliers. The company has a deep domain expertise in the automotive industry and leverage this expertise to serve its clients in adjacent industries, such as in aerospace and transportation and construction heavy machinery (TCHM).

The company is a pure-play manufacturing based ER&D company, primarily focused on the automotive industry and it is currently engaged with seven out of the top 10 automotive ER&D spenders and five out of the 10 prominent new energy ER&D spenders in 2022.

Tata Technologies’ primary business line is services which includes providing outsourced engineering services and digital transformation services to global manufacturing clients helping them conceive, design, develop and deliver better products. In addition, they have Technology Solutions segment which includes Products and Education businesses.

Through their Products Business, the company resell third-party software applications, primarily, product lifecycle management (“PLM”) software and solutions and provide value-added services such as consulting, implementation, systems integration and support. Its Education Business provides “phygital” education solutions in manufacturing skills including upskilling and reskilling in relation to the latest engineering and manufacturing technologies to public sector institutions and private institutions and enterprises through curriculum development and competency center offerings through our proprietary iGetIT platform.

The company’s client portfolio includes Tata Motors, Jaguar Land Rover, Airbus, McLaren, Honda, Ford, and Cooper Standard as well as new energy vehicle companies such as VinFast, among others such as Cabin Interiors and Engineering Solutions, ST Engineering Aerospace.

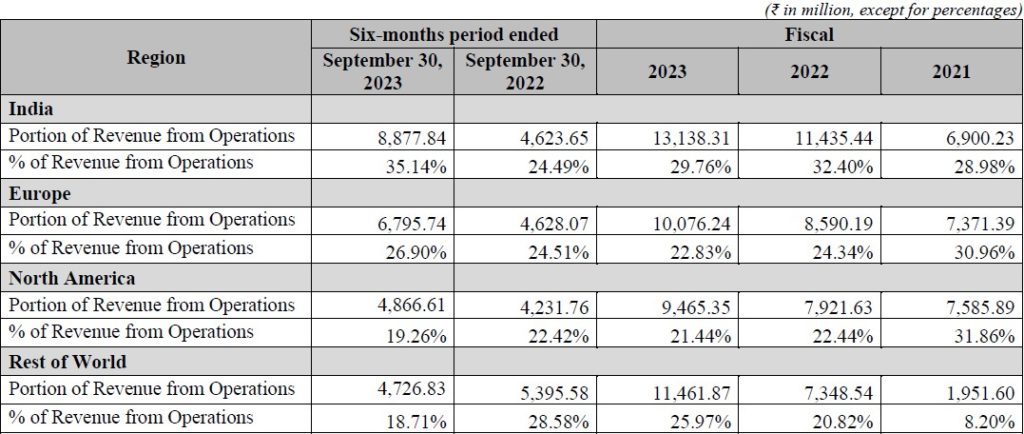

The table below shows the company’s revenue by end market geography:

Company Strengths

- Deep expertise in the automotive industry with comprehensive portfolio of services.

- Differentiated capabilities in new age automotive trends – electric vehicles, connected and autonomous.

- Strong digital capabilities bolstered by proprietary accelerators.

- Diversified global presence across Asia Pacific, Europe and North America and partner with many of the largest manufacturing enterprises in the world.

- Global delivery model enabling in-depth client engagement and scalability.

- Proprietary e-learning platform leveraging the company’s manufacturing domain knowledge to tap into the large upskilling and reskilling market.

- Well-recognized brand with experienced promoter, board of directors and management team.

Company Financials

Period Ended | Apr-Sept FY24 | FY23 | FY22 | FY21 |

Total Assets (Rs in crore) | 5,142.42 | 5,201.49 | 4,218.00 | 3,572.74 |

Total Revenue (Rs in crore) | 2,587.42 | 4,501.93 | 3,578.38 | 2,425.74 |

Revenue from Operations (Rs in crore) | 2526.70 | 4,414.17 | 3,529.58 | 2,380.91 |

Adjusted EBITDA (Rs in crore) | 464.75 | 820.93 | 645.66 | 385.71 |

Adjusted EBITDA Margin | 18.39% | 18.60% | 18.29% | 16.20% |

Profit After Tax (Rs in crore) | 351.9 | 624.04 | 436.99 | 239.17 |

PAT Margin | 13.93% | 14.14% | 12.38% | 10.05% |

Net Worth (Rs in crore) | 2,853.13 | 2,989.47 | 2,280.16 | 2,142.15 |

Purpose of the IPO

The purpose of the IPO is to carry out the Offer for Sale of up to 6,08,50,278 equity shares by the selling shareholders. Further, the company expects to achieve the benefits of listing the equity shares on the stock exchanges. The company also expects the proposed listing of its equity shares will enhance its visibility and brand image as well as provide a public market for the equity shares in India.

Company Promoters

Tata Motors Limited is the promoter of the company.

IPO Details

IPO Subscription Date | November 22 to November 24, 2023 |

Face Value | Rs 2 per share |

Price Band | Rs 475 to Rs 500 per share |

Lot Size | 30 shares |

Total Issue Size | 6,08,50,278 shares aggregating up to Rs 3,042.51 crore |

Offer for Sale | 6,08,50,278 shares of Rs 2 aggregating up to Rs 3,042.51 crore |

Issue Type | Book Built Issue IPO |

Listing At | BSE, NSE |

IPO Lot Size

Application | Lots | Shares | Amount |

Retail (Minimum) | 1 | 30 | Rs 15,000 |

Retail (Maximum) | 13 | 390 | Rs 1,95,000 |

Small HNI (Minimum) | 14 | 420 | Rs 2,10,000 |

Small HNI (Maximum) | 66 | 1,980 | Rs 9,90,000 |

Large HNI (Minimum) | 67 | 2,010 | Rs 10,05,000 |

Allotment Details

Event | Date |

Allotment of Shares | November 30, 2023 |

Initiation of Refunds | December 1, 2023 |

Credit of Shares to Demat Account | December 4, 2023 |

Listing Date | December 5, 2023 |

To check allotment, click here