Market Opening - An Overview

GIFT Nifty Futures on the NSE IX was trading 0.21% higher at 20,278, signalling that Dalal Street was headed for positive start on Thursday.

Asian shares were trading mixed after data showed that China’s factory activity contracted indicating a weak economic recovery. The Nikkei 225 index fell 0.26% and teh Topix was down 0.11%. Meanwhile, the CSI 300 index rose 0.27% and teh Hang Senf index gained 0.15%.

The Indian rupee closed flat at 83.33 against the US dollar on Wednesday.

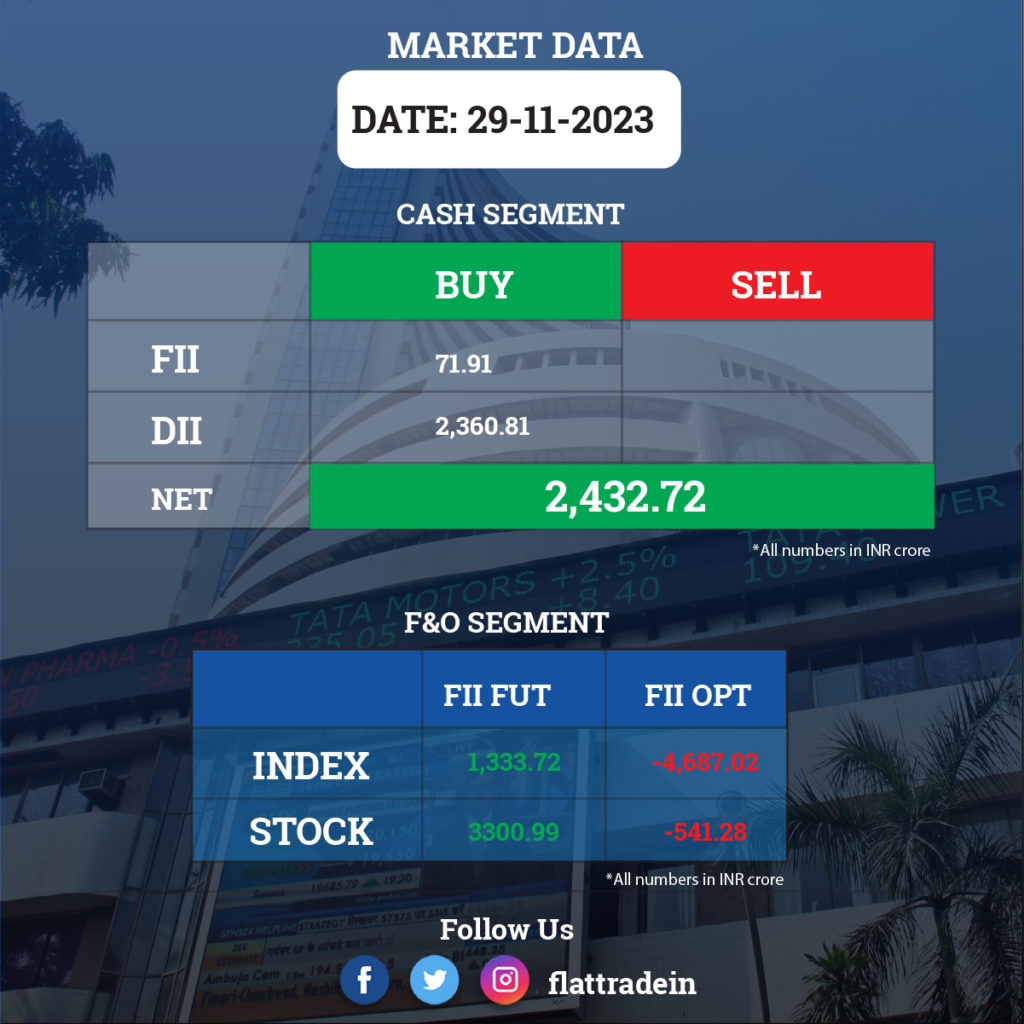

FII/DII Trading Data

Stocks in News Today

UltraTech Cement: The cement major has acquired a 0.54 mtpa cement grinding assets of Burnpur Cement, at Patratu in Jharkhand for Rs 169.79 crore. This investment marks the company’s entry in Jharkhand. The company’s capacity in India now stands at 133 mtpa.

Metro Brands and FSN E-Commerce Ventures (Nykaa): Foot Locker, the New York-based specialty athletic retailer, announced the signing of a long-term licensing agreement with Metro Brands Limited (MBL) and Nykaa Fashion. Under the terms of the agreements, MBL is granted exclusive rights to own and operate Foot Locker stores within India and to sell authorized merchandise in Foot Locker stores. Nykaa Fashion will serve as the exclusive e-commerce partner and operate Foot Locker’s India website and retail authorized merchandise on Foot Locker branded shop on Nykaa’s existing ecommerce platforms.

ICICI Bank: The lender’s board has approved the draft scheme of arrangement for the delisting of equity shares of ICICI Securities, thereby making ICICI Securities a wholly-owned subsidiary of the bank.

Thomas Cook (India): The company’s promoter Fairbridge Capital (Mauritius) plans to offload 8.5% or 4 crore equity shares in Thomas Cook via offer for sale on November 30 and December 1. The OFS comprises a base offer size of 6.8% shares and a greenshoe option of 1.7% shares. The issue will open for non-retail investors on November 30, and retail investors can participate on December 1. The floor price for the offer will be Rs 125 per share.

Dixon Technologies (India): ICRA reaffirmed the company’s ratings and revised the outlook on the long-term rating from stable to positive. The revision in outlook to positive reflects ICRA’s expectation of a sustained improvement in Dixon Technologies’ credit profile going forward, led by enhanced operating performance across its business segments in the backdrop of healthy growth in order inflow and customer diversification in the last 12-18 months. In addition, continued focus on backward integration and increase in Original Design Manufacturing (ODM) business are expected to support its profitability indicators and leverage metrics over the medium term.

Man Infraconstruction: The company’s board has approved a fundraising of Rs 550 crore through the issuance of convertible equity warrants via preferential issue, subject to the necessary statutory and regulatory approvals. The funds will be raised through the issue and allotment of up to 3.55 crore warrants, each warrant convertible into one equity share of the face value of Rs 2 each on a preferential basis at an issue price of Rs 155, including a premium of Rs 153 per warrant. The funds will be used to support and drive growth.

Shivalik Bimetal Controls: The company has signed a Memorandum of Understanding (MoU) with Switzerland-headquartered Metalor Technologies International SA to study the feasibility of setting up a joint venture in India to produce electrical contacts. This strategic collaboration aims to enhance Shivalik’s manufacturing capability for producing electrical contacts.

JSW Infrastructure: The company has issued a corporate guarantee of $126 million in favour of Axis Trustee Services. Its subsidiary, Masad Infra Services, has entered into a concession agreement with the Karnataka government’s Karnataka Maritime Board for the development of an all-weather, deep-water, greenfield port at Keni in Karnataka.

Apar Industries: The company closed its qualified institution placement (QIP) issue and raised Rs 1,000 crore as it allocated 18,99,696 equity shares to qualified institutional buyers at an issue price of Rs 5,264 per share, a discount of 4.99% to the floor price of Rs 5,540.33 per equity share.

Max Estates: The company’s subsidiary, Max Estates Gurgaon Limited (“MEGL”), proposes to develop a Group Housing Project on the land admeasuring 11.80 acres, located in village Harsaru, Sector 36‐A, Sub‐Tehsil Harsaru, Gurugram, Haryana. It also proposes 33% of the available FAR for the said project, translating to approximately 6.07 lakh sq. ft. to be allocated for development of senior living units and associated facilities/amenities including any club for the said senior living development for which Antara Senior Living Limited (“ASLL”) has been engaged by MEGL.

Jupiter Wagons: The company has launched its qualified institutional placement to raise up to Rs 700 crore. The board authorised the opening of the issue and set the floor price at Rs 331.34 per share.

PCBL: The company’s board has approved the term sheet for entering into a joint venture with Kinaltek Pty limited. The Company shall own 51% of the shareholding in the joint venture company (“JV Company”), and shall be infusing a consideration of $16 million in the JV Company and a commitment to infuse funds up to $28 million in stages in the JV Company, for setting up a manufacturing facility for nano silicon-based products.