POST-MARKET REPORT

The market extended the losses on the third consecutive session on October 17, with benchmark Nifty 50 closing a little below 24,750 amid selling across sectors barring Information Technology.

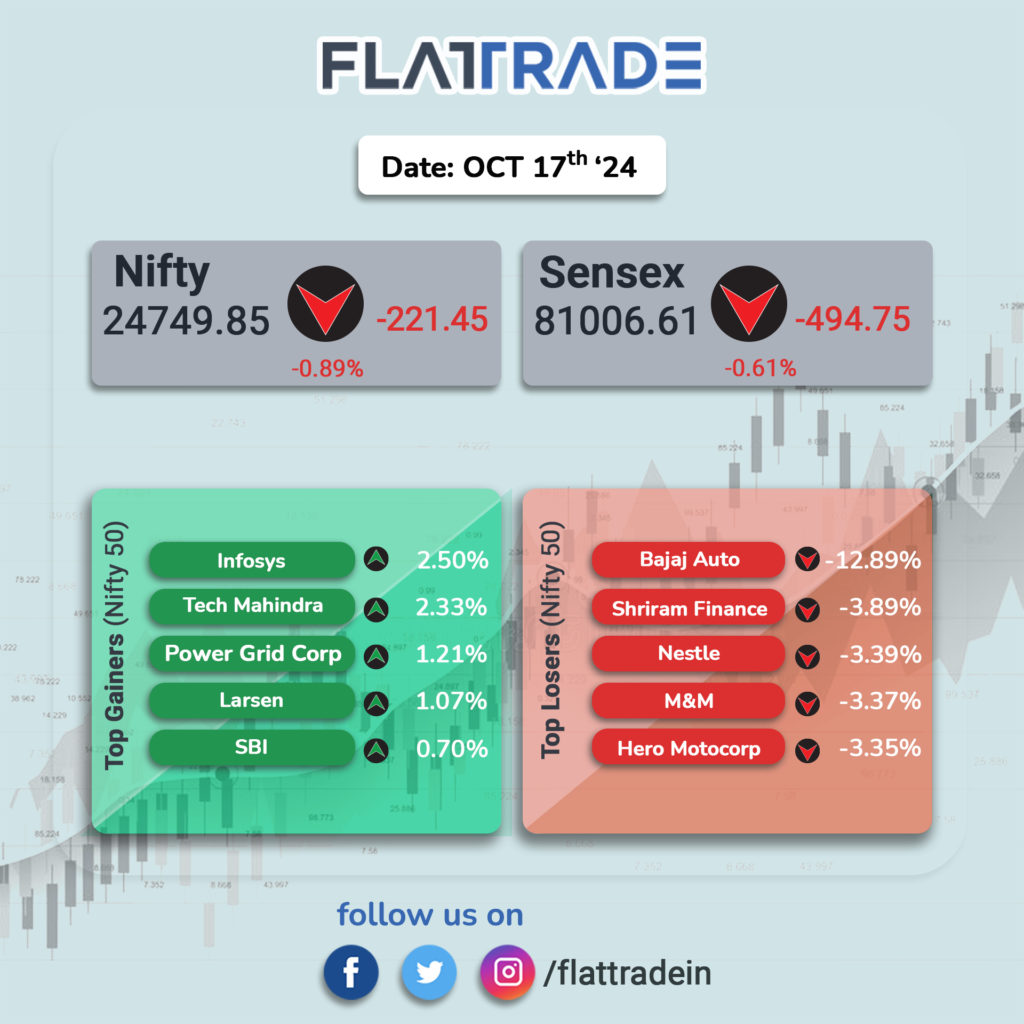

At close, the Sensex was down 494.75 points or 0.61 percent at 81,006.61, and the Nifty was down 221.50 points or 0.89 percent at 24,749.80.

The biggest Nifty losers were Bajaj Auto, Shriram Finance, Hero MotoCorp, Nestle, and M&M, while gainers were Tech Mahindra, Infosys, L&T, Power Grid Corp and SBI.

Among sectors, except the Information Technology index (up 1 percent), all other sectoral indices ended in the red with auto, media, and realty down 2-3 percent.

The BSE midcap and smallcap indices shed more than 1 percent each.

STOCKS TODAY

Nestle India: Nestle India’s share price dropped almost 4 percent after the FMCG major reported a marginal fall in the September quarter profit. The company reported a decline of 0.94 percent in its net profit at Rs 899.49 crore for the quarter that ended September 2024, in which it faced high commodity prices and some of its key brands faced softer consumer demand.

Bajaj Auto: Shares of the two-wheeler and three-wheeler major tanked over 13 percent after the company posted lower-than-expected net profit in the second quarter. This comes after it revised its growth outlook for two-wheeler sales in India to a modest 5 percent, at the lower end of its earlier estimate of 5-8 percent.

CRISIL: Shares slipped 1 percent despite the rating firm reporting a 12.9 percent on-year (YoY) increase in net profit at Rs 171.6 crore for the quarter ended September 30, 2024. The company’s revenue from operations rose 10.3 percent YoY to Rs 811.8 crore.

Nalco: Shares of domestic aluminum makers surged over 3 percent helped by global major Alcoa Corporation’s robust quarterly profit, as well as strong alumina prices. Lower raw material cost was also one of the factors helping Alcoa’s quarterly results. Futures prices of alumina – a key ingredient in making aluminum – have risen over 45% this year, as supply remains tight.

Mphasis: Shares advanced over 6 percent after the company reported an 8 percent jump in net profit at Rs 423.3 crore in the second quarter of FY25. Mphasis said its revenue recorded a 7.92 percent drop at Rs 3,536.14 crore in the reported quarter over Rs 3,276.5 crore in the same period last fiscal.

Hero MotoCorp: Shares slipped 3.5 percent, registering its biggest single-day drop in two years after Bajaj Auto reported weaker-than-expected second-quarter earnings. Investors turned bearish on call two-wheeler stocks after Bajaj cut its guidance stating weak demand.