POST-MARKET REPORT

Indian benchmark indices were dragged down by extended selling in the broader markets, poor global cues, and weak sectoral performance.

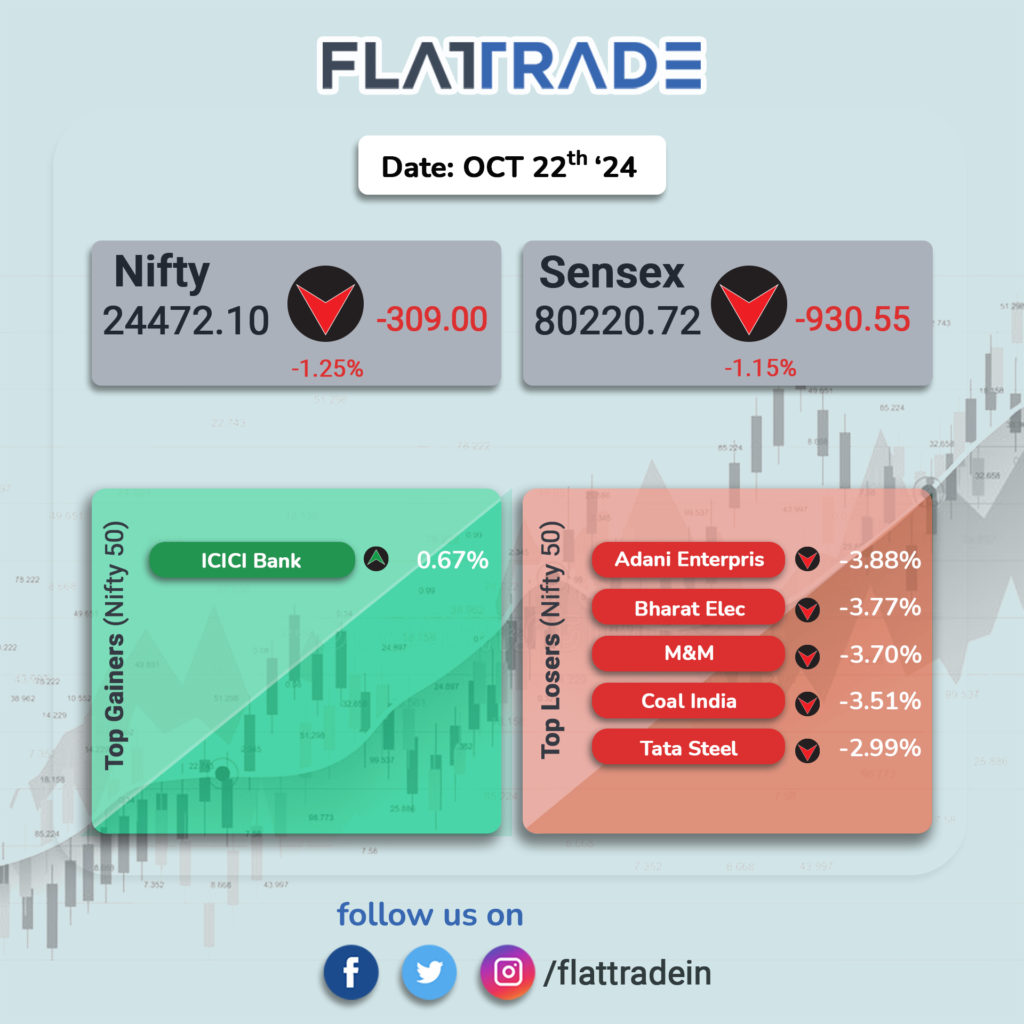

At close, the Sensex was down 930.55 points or 1.15 percent at 80,220.72, and the Nifty was down 309.00 points or 1.25 percent at 24,472.10.

Adani Enterprises, M&M, Bharat Electronics, Coal India, and Tata Steel were among the top losers on the Nifty, while gainers included ICICI Bank, Nestle India, and Infosys.

All the sectoral indices ended in the red with auto, capital goods, metal, power, realty, telecom, media, and PSU bank down 2-3 percent.

BSE Midcap index shed 2.5 percent and Smallcap index declined 3.8 percent.

STOCKS TODAY

Hyundai Motor India: Shares of the newly-listed company fell as much as 7 percent on its stock market debut on October 22. The company’s IPO, the largest in India’s history, also experienced significant volatility in its grey market premium (GMP).

Varun Beverages: Shares jumped 3 percent from the red after the PepsiCo bottler reported a 22 percent rise in its consolidated net profit at Rs 630 crore in the September 2024 quarter. This is the third quarter result of the PepsiCo for the 2024 calendar year. The management credited the company’s growth to the contributions from BevCo, supported by a wider distribution network, greater product reach, and strong demand in key markets.

PNC Infratech: Shares slipped as much as 7 percent and extended losses after the Ministry of Road Transport and Highways (MoRTH) disqualified it from participating in tenders for one year, starting October 18. The CBI had initiated an investigation against the company in June and apprehended four of its employees for bribing NHAI officials with Rs 10,000 lakh in exchange for final approval, a no objection certificate (NOC), and the processing of the final bill for NHAI’s Jhansi-Khajuraho project.

City Union Bank: Shares surged 12 percent as the private sector lender’s earnings for the quarter were above expectations on October 22. International brokerage Investec maintained its buy call, with a price target of Rs 200 per share, indicating a 33 percent upside. The Q2 results were better across all metrics: growth, profitability, and asset quality.

Nitco: Shares fell 5 percent after it announced a sale of real estate assets, expansion of share capital, along with a preferential allotment to Authum Investment and a clutch of investors. The shareholder capital has been increased from Rs 230 crore to Rs 500 crore, with the tile maker converting its debt into equity shares as part of the business restructuring.

Mazagon Dock: Once a darling of the market, defense stocks came under selling pressure yet again amid a broader sell-off in the small and mid-cap space. Stocks like Mazagon Dock Shipbuilders, one of the top leaders of the defence rally over the past two years—were among the hardest hit, declining by 10 percent.