POST-MARKET REPORT

Indian equity markets snapped a five-day losing streak and ended on a strong note on October 28, with the Nifty inching closer to 24,500, intraday, amid buying across sectors, especially banking and metal stocks.

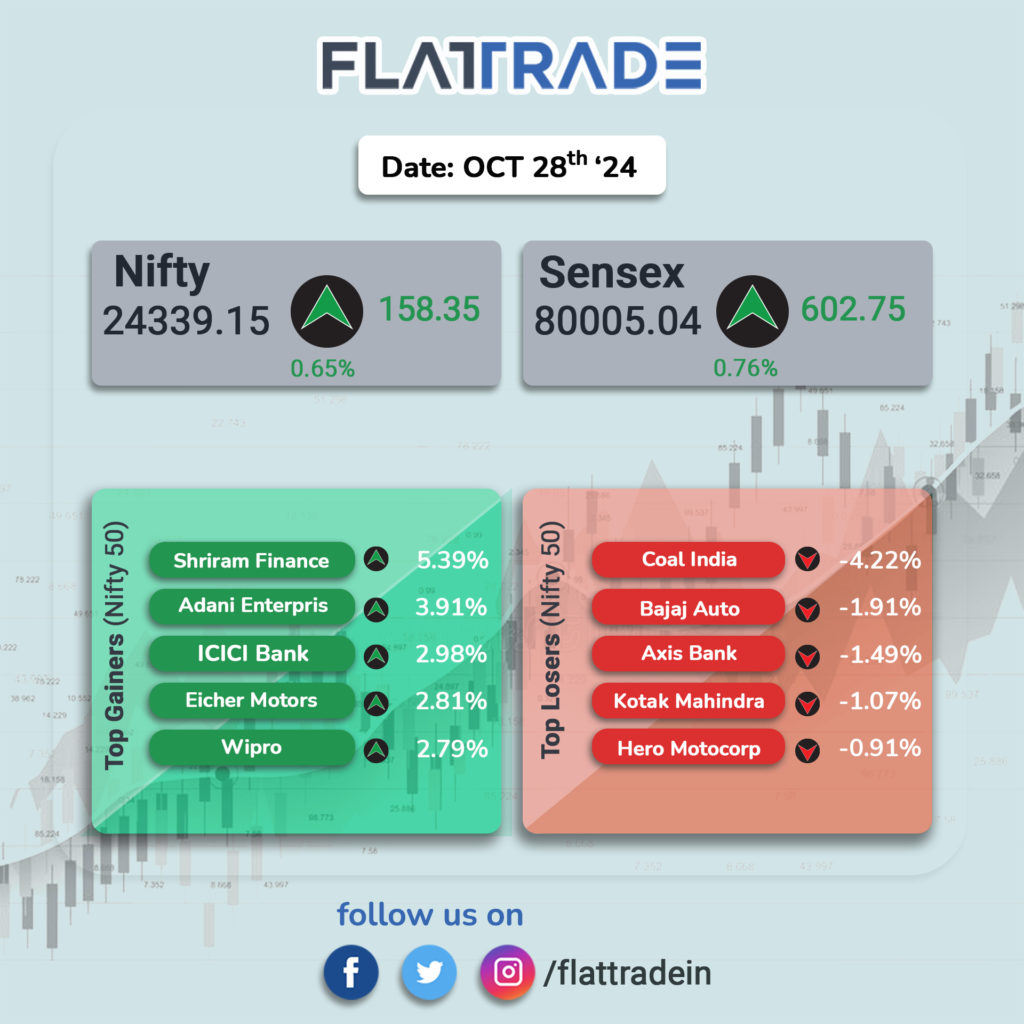

At close, the Sensex was up 602.75 points or 0.76 percent at 80,005.04, and the Nifty was up 158.35 points or 0.65 percent at 24,339.15.

The biggest Nifty gainers included Shriram Finance, Adani Enterprises, ICICI Bank, Eicher Motors, and Wipro, while losers were Coal India, Bajaj Auto, Axis Bank, Kotak Mahindra Bank, and Hero MotoCorp.

All the sectoral indices ended in the green with the PSU Bank index rising 3.8 percent, the Metal index added 2.5 percent, while pharma, media, and realty up more than 1 percent each.

The BSE midcap index was up 0.7 percent and smallcap index gained 1 percent.

STOCKS TODAY

Praj Industries: Shares dropped over a percent as investors dumped the stock after the company’s disappointing earnings performance for the September quarter. The company’s net profit slipped 14 percent on year to Rs 53.83 crore as compared to Rs 62.37 crore in the same period last fiscal. Revenue also dipped close to 7.5 percent on year to Rs 816.19 crore, down from Rs 882.33 crore in the base period.

Interglobe Aviation: Shares of IndiGo parent plunged 8 percent after the airline reported a net loss of Rs 987 crore for the quarter that ended September 30, 2024, compared to a net profit of Rs 189 crore in the year-ago period. Despite the disappointing earnings, brokerages remained bullish on stock on account of healthy demand and efforts to improve its international presence through strategic partnerships and loyalty programs.

DLF: Shares of India’s largest realty firm surged nearly 6 percent after the company reported a 121 percent YoY jump in its consolidated net profit at Rs 1,387 crore for the quarter ended September 30, 2024. The company’s consolidated revenue surged 48 percent YoY to Rs 2,181 crore during the period under review.

YES Bank: The stock soared 7 percent following the announcement of stronger-than-expected results for the July-September quarter (Q2FY25). The bank posted a remarkable two-fold year-on-year (YoY) increase in net profit, reaching Rs 553 crore in Q2FY25, compared to Rs 225 crore in the same period last year. Net interest income (NII) also registered solid growth, rising 14.3 percent YoY to Rs 2,200 crore from Rs 1,925 crore in Q2FY24.

ICICI Bank: The lender’s solid Q2 performance lifted its shares 3 percent higher. ICICI Bank’s Q2 net profit rose 14.5 percent year-on-year to Rs 11,746 crore, surpassing market expectations. Net interest income (NII) increased by 9.5 percent YoY to Rs 20,048 crore, reflecting healthy growth, although net interest margins (NIM) declined by 26 basis points to 4.27 percent.

Coal India: State-run miner’s shares fell 4 percent after the firm’s earnings show for the quarter ended September came under expectations. Coal India reported a 22 percent drop in consolidated net profit at Rs 6,274.80 crore for the quarter ended September 30, 2024, on the back of lower sales. It had posted a consolidated net profit of Rs 8,048.64 crore in the year-ago period, according to a regulatory filing.