POST-MARKET REPORT

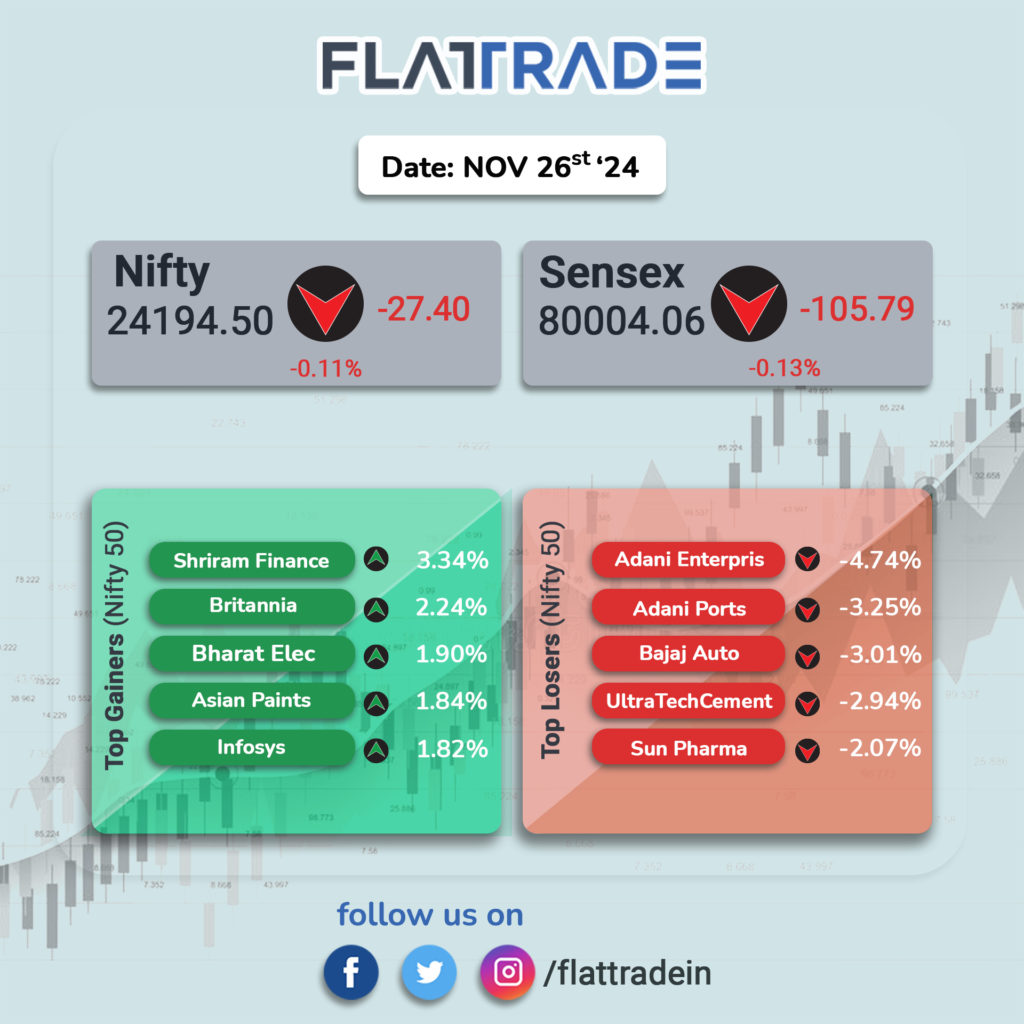

The Indian benchmark indices broke a two-day rally to end marginally lower in a volatile session on November 26 with Nifty closing slightly below 24,200.

At close, the Sensex was down 105.79 points or 0.13 percent at 80,004.06, and the Nifty was down 27.40 points or 0.11 percent at 24,194.50.

A mixed trend was seen on the sectoral front, with auto, power, pharma, oil & gas sectors closing 1-1.5 percent lower, while FMCG, IT, and metal sectors closed 0.5-1 percent higher.

Britannia Industries, Asian Paints, Shriram Finance, Bharat Electronics, and Infosys are among the top gainers on the Nifty, while losers are Adani Enterprises, Adani Ports, UltraTech Cement, Sun Pharma, and Bajaj Auto.

BSE Midcap index ended flat, while Smallcap index added 0.6 percent.

STOCKS TODAY

Triveni Turbine: Shares surged 8 percent on November 26. The strong buying action in the stock was triggered by a steep spike in trading volumes on the back of the company’s robust growth prospects. As much as three crore shares of the company have changed hands on the exchanges so far, a meteoric rise from the one-month daily traded average of 25 lakh shares. Volumes were also strong in the previous session when 56 lakh shares changed hands.

Sagility India: Shares surged around 10 percent as investors cheered for the company’s strong performance in the July-September quarter, marked by growth across all key parameters. The company reported a 30.5 percent on-year growth in its net profit to Rs 163.60 crore while revenue grew around 21 percent to Rs 1,325 crore. Meanwhile, operational performance also improved as the company’s EBITDA rose 22 percent on year to Rs 337.80 crore, making up 25.5 percent of total revenue.

Vodafone Idea: Shares surged 9 percent after the Union Cabinet approved the waiver of bank guarantees for telecom operators. The wavier will be applied to spectrum acquired by telecom operators in auctions held before 2022, reports said. This move, aimed to reduce the financial burden on the telecom sector stands to benefit Vodafone Idea the most as it owns the government over Rs 24,700 crore on bank guarantees (BG), Moneycontrol had previously reported. Indian telecom operators, including Airtel and Vodafone Idea, collectively hold more than Rs 30,000 crore in bank guarantee obligations.

ACME Solar Holdings: Shares slipped a percent on the back of a sharp decline in the company’s Q2 net profit. Consolidated net profit for the July-September period dropped 60 percent on year to Rs 15.29 crore, a sharp downturn from the Rs 38.63 crore it reported in the same quarter last fiscal. The drag in net profit was mainly on account of lower revenue after the company monetized 369 MW of operational assets in the second half of the previous fiscal. These assets had contributed Rs 169 crore in revenue in the first half of FY24, leading to a high base of the previous fiscal.

Hitachi Energy India: Shares zoomed 5 percent after a consortium between the company and BHEL bagged a contract from the Power Grid Corporation of India. The consortium has been awarded the contract for the establishment of over eight hundred 6000 MW high voltage direct current (HVDC) terminal stations at Khavda Pooling Station-2 (HVDC) and Nagpur (HVDC) for the evacuation of renewable power from the Khavda region in Gujarat to Nagpur in Maharashtra.