POST-MARKET REPORT

Bulls further tightened their holding on Dalal Steet as the benchmarks extended the gains on the third consecutive session on December 3 with Nifty above 24,450, amid buying across sectors, barring FMCG.

Amid positive global markets, the Indian indices opened higher, and extended buying pushed Nifty and Sensex towards 24,500 and 81,000 respectively, led by media and PSU Banks.

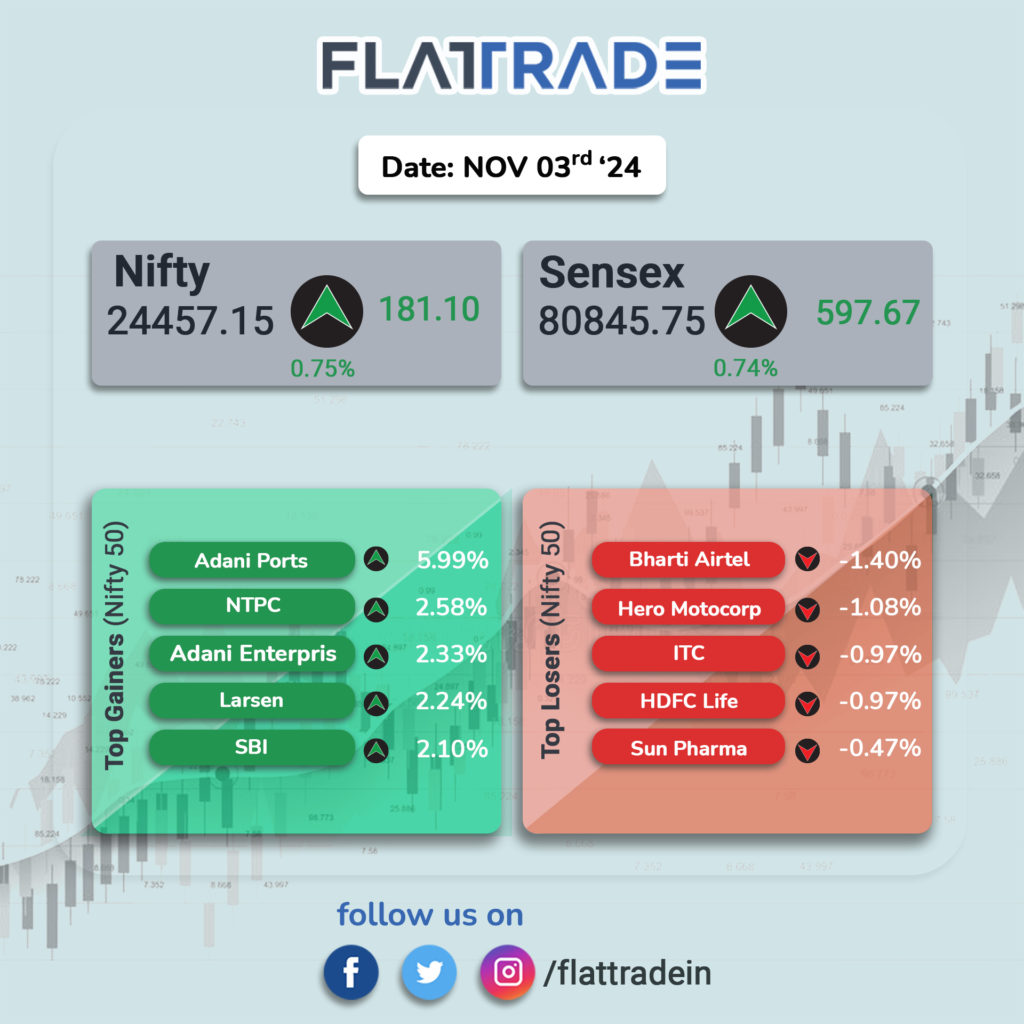

At close today, the Sensex was up 597.67 points or 0.74 percent at 80,845.75, and the Nifty was up 181.10 points or 0.75 percent at 24,457.15.

In today’s gain, investors’ wealth rose by Rs 3.69 lakh crore, as the market capitalization of BSE-listed companies rose to Rs 453.41 lakh crore, from Rs 449.72 lakh crore in the previous session.

Top Nifty gainers included Adani Ports, NTPC, Adani Enterprises, Axis Bank, and SBI, while losers were Bharti Airtel, ITC, Hero MotoCorp, HDFC Life, and Sun Pharma.

Among sectors, except FMCG, all other indices ended in the green with Media and PSU Bank indices up more than 2 percent each.

The BSE midcap and smallcap indices rose a percent each.

STOCKS TODAY

Adani Ports: Shares of Adani Ports and Special Economic Zone (APSEZ) surged over 7 percent to Rs 1,310 per share on December 3 after the company came out with its strong business update until November. The optimism was also built after CARE Ratings upgraded its recent acquisition – Gopalpur Ports to AA/Stable from BBB Rating Watch Positive.

NTPC Green Energy: NTPC Green Energy shares have risen 32 percent over its IPO price of Rs 108 per share on the NSE. The company’s market capitalization has touched Rs 1,19,755 crore on the NSE. The company raised Rs 10,000 crore during its three-day IPO, which was an entirely fresh issue of equity shares.

Solar Industries: share price rose 4 percent in the opening trade on December 3 after the company received export orders worth Rs 2,039 crore. The order included a supply of defence products for four years. Also on November 5, the company received an order worth Rs 887 crore from Singareni Collieries Company for the supply of SME explosives, LDC explosives, and initiating systems for blasting of Overburden, to be delivered for two years.

Swiggy: Food tech and grocery delivery company Swiggy posted a revenue of Rs 3,601.5 crore during the July-September period, an increase of 30 percent from Rs 2,763.3 crore recorded during the same period last year, as the number of transacting users increased on the platform, regulatory filings showed. The company also saw its consolidated losses narrow 5 percent from Rs 657 crore to Rs 626 crore during the period.

Granules India: Granules India shares slipped sharply in trade, down nearly 10% after the company informed that US FDA has classified the inspection at the Gagillapur facility in Hyderabad, Telangana as an ‘Official Action Indicated’ (OAI). The USFDA had conducted an inspection at the Gagillapur finished dosage facility from August 26-September 6, 2024. Granules India had earlier said that the impact on the facility will have a ‘small spillover’ into Q3FY25 as well but the impact on lost sales will be less than what was seen in Q2FY25.