POST-MARKET REPORT

The Indian equity markets witnessed a rangebound movement on December 9 and ended lower for the second consecutive session with Nifty closing near 24,600 amid selling seen in the FMCG, PSU Bank, auto, and pharma names. However, buying was seen in capital goods, IT, and metal stocks.

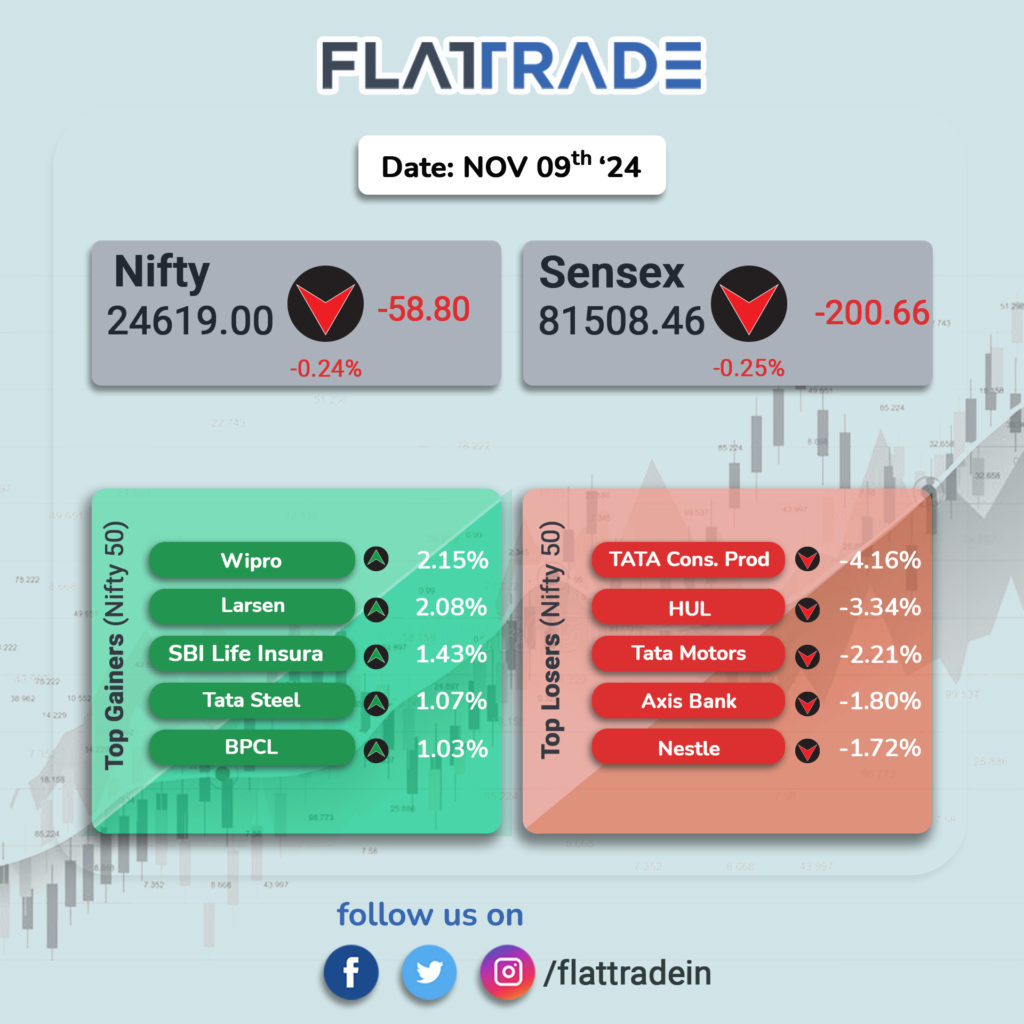

At close, the Sensex was down 200.66 points or 0.25 percent at 81,508.46, and the Nifty was down 58.80 points or 0.24 percent at 24,619.

Nifty losers included Tata Consumer, HUL, Tata Motors, Axis Bank, and Nestle India, while gainers were L&T, Wipro, SBI Life Insurance, BPCL, and Tata Steel.

Among sectors, FMCG and Media were down 2 percent each, pharma, PSU Bank, auto, and energy were down 0.5 percent each, while the metal index was up 0.6 percent and the capital goods index added 1 percent.

The BSE midcap index was up 0.3 percent and the smallcap index rose 0.5 percent.

STOCKS TODAY

ITI: Shares surged as much as 15 percent, extending gains for a second consecutive session in a row, driven by soaring volumes and fresh investor interest. Over 4 crore shares changed hands in the morning, taking the total tally to a massive 12 crore shares in two sessions, significantly higher than the one-month and one-week average of 2 crore equity shares on the bourses, Moneycontrol data showed.

Mishtann Foods: Shares were locked in a 20 percent lower circuit for a second session in a row on December 9 as investors dumped the stock after the company received a show cause notice from the market regulator, Sebi. The show cause notice was issued over the company’s Rs 100 crore fund which Sebi stated was misappropriated or diverted through group entities.

CEAT: Shares rose over 10 percent to hit a fresh record high on December 9 after the company announced it has entered into definitive agreements with Michelin to buy Camso brand’s Off-Highway construction equipment bias tire and tracks business in an all-cash deal valued at about $225 million.

SAMIL: Shares fell as much as 2.5 percent after Kotak Institutional Equities downgraded to ‘reduce’ from ‘add’ following the company’s acquisition of a 95 percent stake in Japan’s Atsumitec for $57 million. Kotak cut by 4-7 percent owing to lower margin pressure assumptions, as it believes global OEMs revising their margin guidance will weigh on the margins of Tier-1 suppliers.

RITES: Shares rose over 2 percent after the company secured an order worth $9.71 million from the Ministry of Public Works, Government of the Co-operative Republic of Guyana. The order is for the upgrade of the Palmyra to Moleson Creek Highway and will be executed over the next 60 months.

Star Health and Allied Insurance: Shares tanked over 4 percent after it received a Show Cause Notice from the Insurance Regulatory and Development Authority of India (IRDAI) for non-compliance with various IRDAI regulations and guidelines. IRDAI conducted a general inspection from January 31, 2022, to February 11, 2022.