POST-MARKET REPORT

In the highly volatile session on January 21, the Nifty50 index lost more than a percent, dragging the index below 23,000, intraday as investors remained cautious after US President Donald Trump announced tariffs plans on neighboring countries.

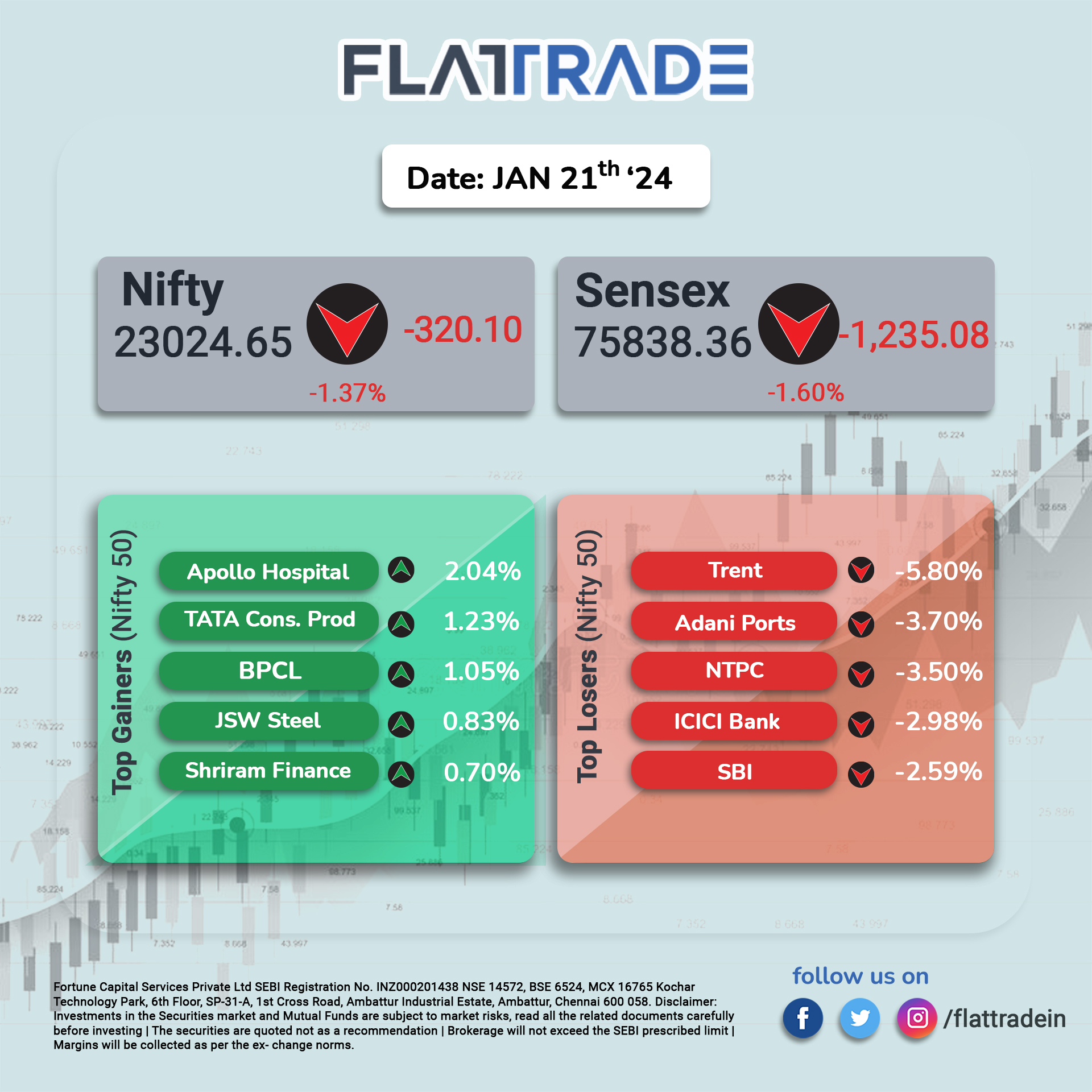

At the close, the Sensex fell by 1.60 percent, losing 1235 points to settle at 75838.36, a level last seen on 6 June 2024, while the Nifty declined by 1.37 percent, or 320.1 points, ending at 23024.65.

The Bank Nifty index also failed to build on the opening gains and lost nearly 1,000 points from its day’s high of 49,543.15, to close 1.58 percent down at 48,570.90.

Trent, Adani Ports, NTPC, ICICI Bank, and SBI were among the biggest losers on the Nifty, while gainers included Apollo Hospitals, BPCL, Tata Consumer, JSW Steel, and Shriram Finance.

All the sectoral indices ended in the red with consumer durables and realty indices declining 4 percent each, while auto, bank, energy, media, and PSU Bank were down 0.5 percent each.

Nifty mid-cap and small-cap indices shed 2 percent each.

STOCKS TODAY

JSW Steel: JSW Steel is expected to report a 74 percent year-on-year (YoY) decline in net profit to Rs 638.79 crore for Q3, reflecting an 18 percent sequential drop. Revenue is forecast to rise modestly by 4 percent YoY but is likely to decline slightly quarter-on-quarter (QoQ) to Rs 4.12 lakh crore.

Dixon Technologies: Shares of Dixon Technologies (India) fell over 13 percent after the company reported a sequential decline in its consolidated net profit and revenue from operations for the quarter ending December. In Q3FY25, Dixon’s net profit dropped 47.5 percent year-on-year to Rs 216 crore from Rs 411.7 crore in Q3FY24. Revenue for the quarter declined by over 9 percent to Rs 10,453.7 crore.

Newgen Software: In Q3FY25, Newgen Software’s consolidated net profit rose 27 percent sequentially and over 30 percent year-on-year to Rs 89 crore. Revenue from operations grew 5 percent sequentially and 18 percent year-on-year to Rs 381 crore. The Brokerage firm Jefferies downgraded the stock to ‘Underperform’ from its earlier rating of ‘Buy’ following the company’s December quarter results.

Vodafone Idea: Shares of Vodafone Idea (Vi) dropped around 5 percent on January 21 after the telecom giant issued a clarification over a news report that stated that the government is mulling a waiver of Rs 1 lakh crore worth of AGR dues of telecom companies.

Apollo Hospitals: Shares of Apollo Hospitals Enterprise jumped 3.5 percent on January 21 after Kotak Institutional Equities upgraded its rating from ‘add’ to ‘buy.’ The brokerage also emphasized Apollo’s stronger competitive position, supported by its diversified presence and limited exposure to the three potentially hypercompetitive micro-markets of Delhi NCR