POST-MARKET REPORT

Indian benchmark indices, Sensex and Nifty, extended gains from the previous session and ended higher on January 23, albeit off their day’s highs.

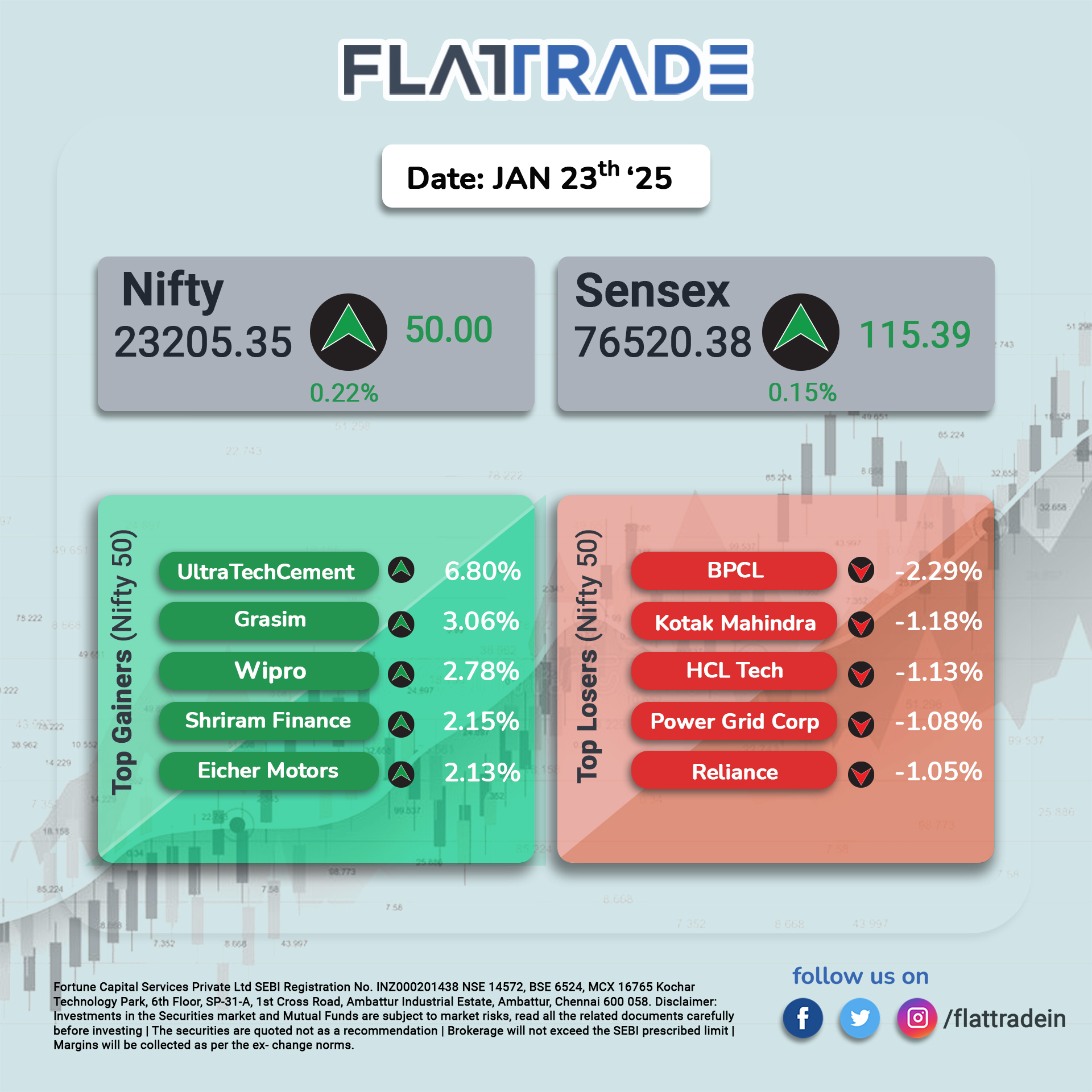

At close, the Sensex was up 115.39 points or 0.15 percent at 76,520.38, and the Nifty was up 50.00 points or 0.22 percent at 23,205.35. Market breadth remained strong, with gainers outnumbering laggards.

Most sectors, barring banks–private and PSBs and energy, ended in the green territory, with the Nifty IT index leading with its near 2 percent upmove. Other sectors, consumer durables, automobiles, pharma, and media also closed 1-2 percent higher. On the flipside, the Nifty Bank and PSU Bank indices edged lower, while oil and gas slipped by 0.5 percent.

Among individual stocks, Ultratech Cement emerged as the top Nifty gainer with its over 6 percent surge, buoyed by the company’s positive Q3 earnings. Grasim Industries, Wipro, Shriram Finance, Eicher Motors, and M&M were the other top Nifty gainers, up 2-4 percent.

Among laggards, BPCL was the worst hit, down over 2 percent on the back of its Q3 numbers. Other losers included Kotak Mahindra Bank, HCL Tech, and index heavyweight Reliance Industries which ended 1-2 percent lower.

In the broader market, the Nifty Midcap 100 surged nearly 2 percent while the Nifty Smallcap 100 ended with 1.1 percent gains.

STOCKS TODAY

Dr Reddy’s Laboratories: shares tumbled in trade today, after Hong Kong-based brokerage CLSA downgraded its rating on the stock to ‘underperform’, from ‘hold’ earlier, slashing its price target to Rs 1,090, which indicates a 16 percent downside. The brokerage said it anticipated competition going ahead for Dr Reddy’s key drug offerings.

IndiaMART Intermesh: shares extended their decline for the second session as the management’s guidance of sub-10 percent growth in collections for upcoming quarters and the absence of meaningful improvement in subscriber retention are expected to keep medium-term growth under pressure, despite lower sales and marketing costs temporarily boosting profitability.

Hindustan Unilever Ltd (HUL): saw a decline after reporting underwhelming earnings show for the October-December quarter (Q3) of the current financial year (FY25). Brokerages have already slashed their target price on HUL shares, as volume growth lagged expectations amid a weak product mix.

Bharat Petroleum Corporation Ltd: shares sank 2 percent in trade after its earnings show for the October-December quarter disappointed the Street, coming underestimates. While the oil marketing major’s profit jumped almost 20 percent on-year, it fell sharply under the estimates polled by most brokerages that expected a 50 percent jump in net profit.

PB Fintech: surged over 5 percent after brokerage firm Citi Research placed the stock under a 90-day positive catalyst watch. Citi remains optimistic about PB Fintech’s prospects, generating its confidence from expectations of sustained growth in its retail protection, retail health, and savings businesses