POST-MARKET REPORT

The Indian equity market snapped a two-day losing streak and gained 0.5 percent on January 28 supported by auto, realty, and financials post RBI announced liquidity-boosting measures.

Despite mixed global cues, the Indian indices opened higher with Nifty around 22,950 and traded in a range in the first half, while extended buying in the second half helped Nifty to cross 23,100, intraday, but last hour profit booking erased some of the day’s gain.

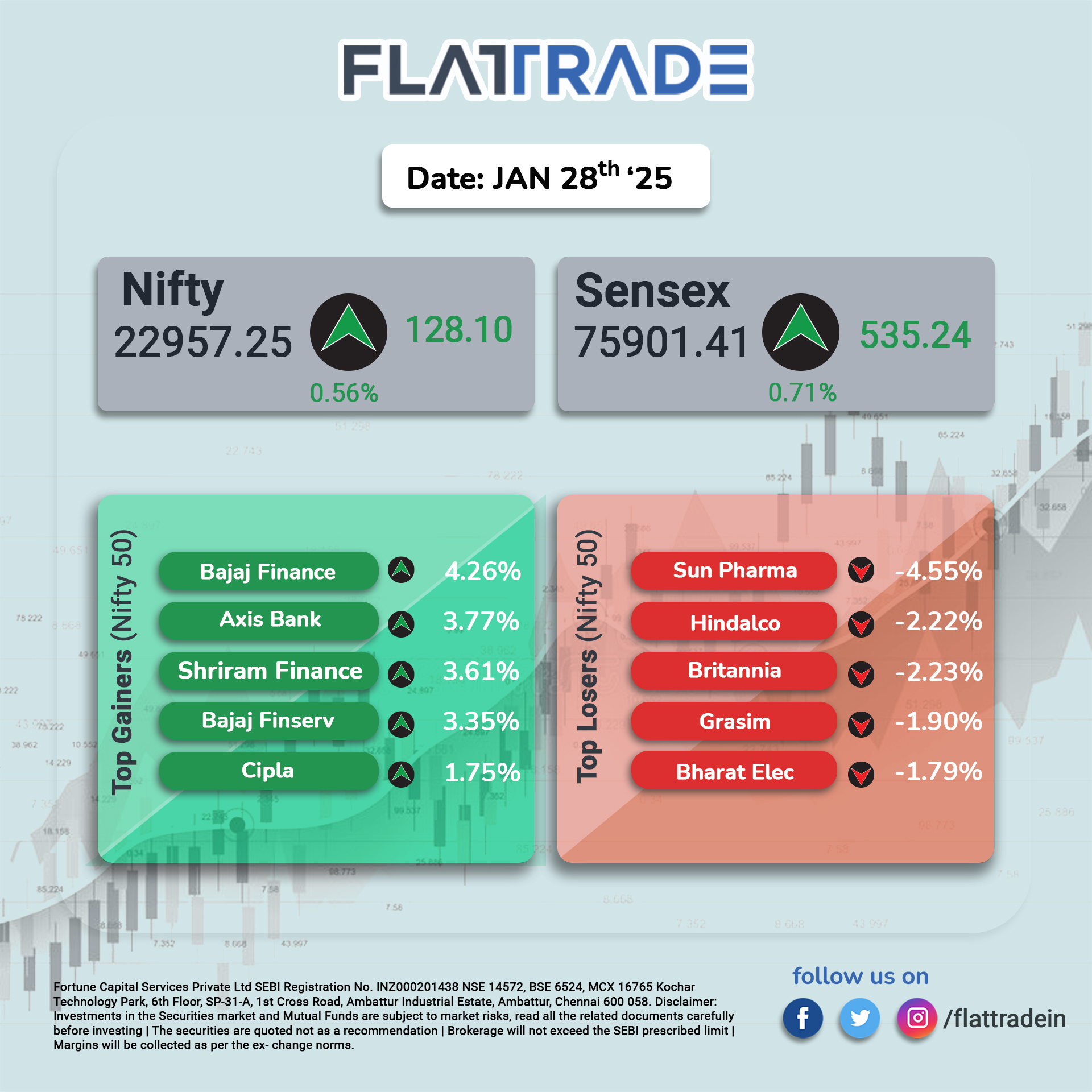

At close, the Sensex was up 535.24 points or 0.71 percent at 75,901.41, and the Nifty was up 128.1 points or 0.56 percent at 22,957.25.

Axis Bank, HDFC Bank, Bajaj Finserv, Shriram Finance, and Bajaj Finance were among the major gainers on the Nifty, while losers included Sun Pharma, Britannia Industries, Eicher Motors, Grasim Industries, and L&T.

Among sectors, auto, bank, and realty indices rose 1-2 percent, while capital goods, power, metal, oil & gas, FMCG, healthcare, and IT were down 0.5-1 percent.

BSE Midcap index shed 0.6 percent, while smallcap index fell 1.7 percent.

STOCKS TODAY

Apar Industries: The company announced its Q3 results for FY2025 on Tuesday, January 28, with the majority of the key metrics posing for a degrowth. It reported a 17.7 percent increase in revenue, reaching Rs 4,716 crore for the quarter. However, the company’s net profit fell nearly 20 percent compared to the previous year, settling at Rs 175 crore. The shares fell as much as 20 percent on Tuesday, January 28.

Hyundai Motor: Hyundai Motor India Ltd on Tuesday reported a 19 percent decline in its consolidated net profit to Rs 1,161 crore for the third quarter ended on December 31, 2024, amid lower domestic car sales and exports. The company had earned a net profit of Rs 1,425 crore in the October-December quarter of the previous year. The total income of the company decreased to Rs 16,892 crore in the third quarter of the current fiscal from Rs 17,244 crore in the year-ago period, Hyundai Motor India Ltd said in a regulatory filing.

Balkrishna Industries: The company in Q3FY25 revealed an increase of 47 percent year-on-year (YoY), in its third-quarter net profit, to Rs 449.5 crore. The previous fiscal year saw a net profit of Rs 305.4 in the same quarter. Its revenue was at Rs 2,560.3 crore, higher by 12.6 percent YoY, as against Rs 2,274.4 crore in Q3 FY23. Balkrishna shares settled at Rs 2,727.1, higher by 6.3 percent in trade on January 28.

SpiceJet: SpiceJet shares gained about 3 percent after the airline announced the re-induction of its grounded 737 Max aircraft into service. The company revealed that the first grounded Boeing 737 MAX aircraft had been restored as part of a significant fleet restoration effort, aided by an agreement with Standard Aero and CFM International.

Cipla: Pharmaceutical giant Cipla saw its stock price rise over 5 percent after reporting a 49 percent YoY increase in consolidated net profit, reaching Rs 1,571 crore for Q3 FY25. Shares jumped from an intraday low of Rs 1,367 to Rs 1,470 following the strong results.