POST-MARKET REPORT

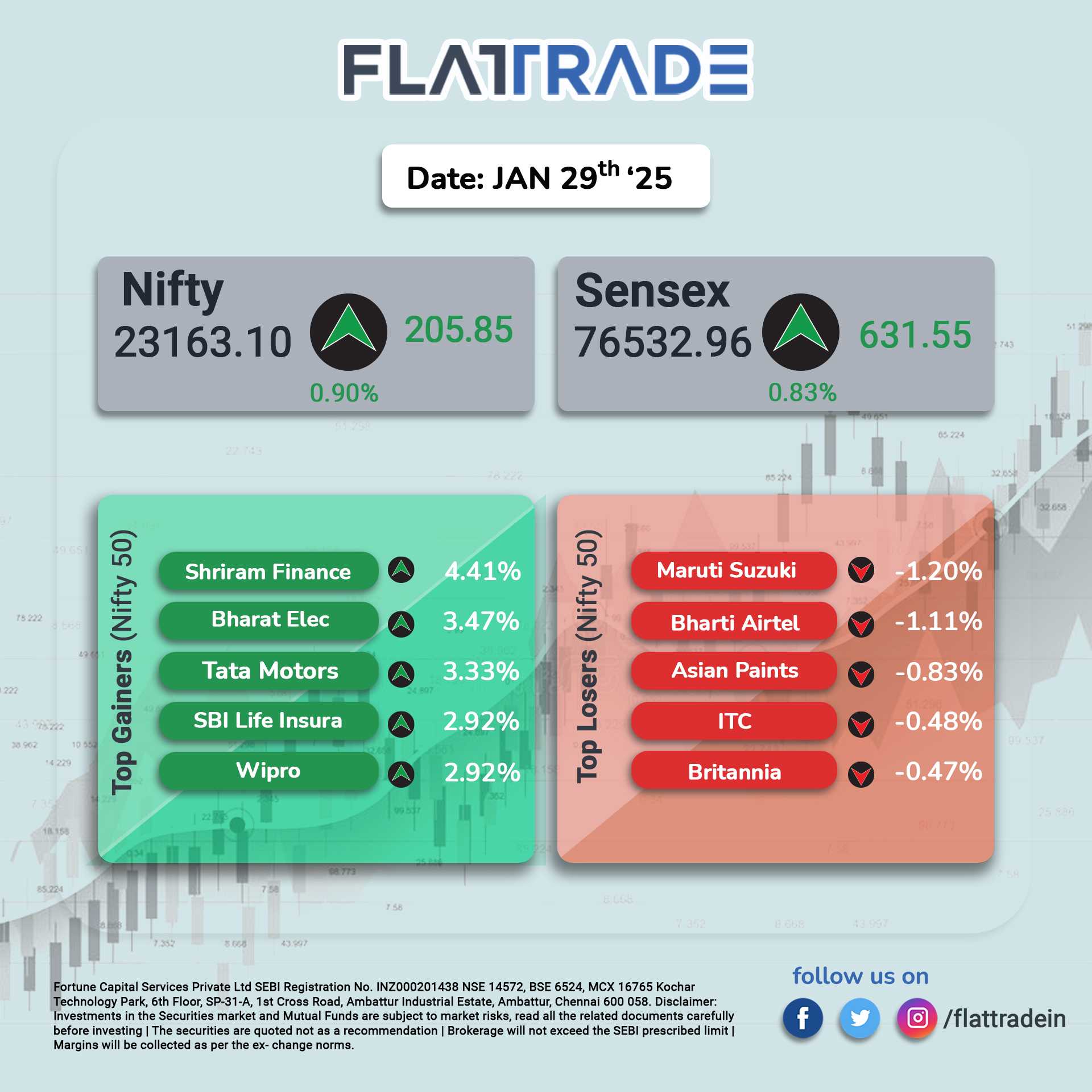

The Indian benchmark indices continued the gaining momentum on the second consecutive session on January 29 with Nifty rising above 23,150 amid buying seen in the broader indices and across the sectors, barring FMCG.

At close, the Sensex was up 631.55 points or 0.83 percent at 76,532.96, and the Nifty was up 205.85 points or 0.90 percent at 23,163.10.

The biggest gainers on the Nifty included Shriram Finance, Bharat Electronics, Wipro, Tata Motors, and SBI Life, while losers were Asian Paints, Maruti Suzuki, BPCL, Britannia Industries, ITC.

On the sectoral front, media, capital goods, IT, metal, and realty rose 2-3 percent, while auto, bank, pharma, oil & gas gained between 0.5-1.5 percent. The FMCG index was down 0.5 percent.

BSE Midcap index added 2.5 percent and Smallcap indices rose 3.2 percent.

STOCKS TODAY

Triveni Turbines: In the exchange filing issued on January 29, the company said the order from National Thermal Power Corporation (NTPC) was worth Rs 290 crore. The order entails the installation of a Co2-based standalone Energy Storage System (ESS) with a capacity of 160 MWh, at NTPC Kudgi STPP (Super Thermal Power Plant) in Karnataka. This will be executed on a turn-key basis and will involve technology partner, Energy Dome with Triveni Turbine. The period for the completion is given as 18 months.

RailTel: shares rebounded by over 4 percent on January 29, recovering from the decline following a weak Q3FY25 performance. This uptick follows the company securing a significant order from M/s Navodaya Vidyalaya Samiti for the procurement and maintenance of IT infrastructure projects. The order is valued at over Rs 17 crore, inclusive of taxes, with an expected completion timeline set for July 27, 2025.

Ixigo: LE Travenues Technology (Ixigo) shares surged over 12 percent on January 29, despite the company reporting a decline in profits for Q3FY25. The company’s consolidated net profit for the quarter ending December 2024 fell 49 percent year-on-year to Rs 15.5 crore from Rs 30.6 crore in the same period last year. However, revenue rose significantly to Rs 241.7 crore, compared to Rs 170.5 crore in Q3FY24.

KPIT Tech: KPIT Technologies has recorded a 20 percent rise in consolidated net profit to Rs 187 crore in the December quarter. It reported a net profit of Rs 155 crore in the year-ago period, according to a regulatory filing on January 29, 2025. Revenue for the quarter under review stood at Rs 1,478 crore, up 17.6 percent from Rs 1,257 crore in October -December of FY24. The company has also raised its EBIT margin guidance for the financial year 2025.

TVS Motor: shares gained over 6 percent on January 29 post-December quarter results. The company’s net profit rose by 4.2 percent on a year-on-year (y-o-y) basis, to Rs 618 crore during the third quarter of this fiscal year. It was attributed to higher sales volumes and higher operational efficiency. Revenue from operations reached Rs 9,097 crore, marking a 10 percent rise year-on-year, from Rs 8,245 crore reported in the same quarter of the previous year.