POST-MARKET REPORT

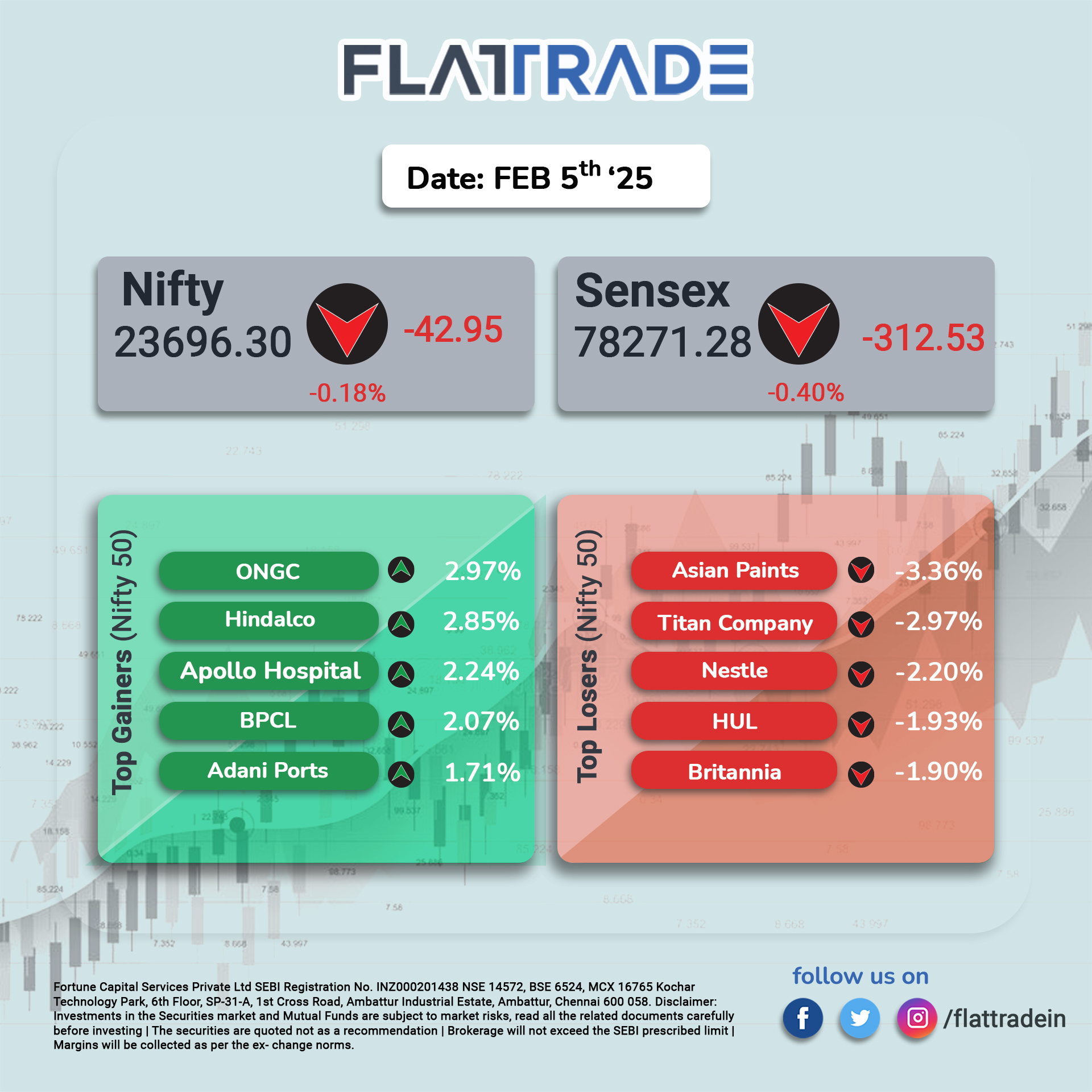

Indian markets closed lower on February 5, dragged down by losses in consumer stocks amid weak earnings. The benchmark Sensex declined 0.4 percent, shedding 312 points to close at 78,271, while the Nifty settled 0.18 percent lower, losing 43 points to end at 23,696.30.

Among consumer stocks, Asian Paints Ltd and Titan Co Ltd tumbled over 3 percent each. Nestlé India Ltd and Hindustan Unilever Ltd declined nearly 2 percent each, while ITC Ltd slipped 1.5 percent.

The broader markets remained resilient, with the BSE MidCap and SmallCap indices gaining 0.7 percent and 1.4 percent, respectively. Furthermore, the Nifty Smallcap 100 index rose by 1.85% to 17,108, while the Nifty Midcap 100 index ended the day with a gain of 0.68%, closing at 54,180.

The Indian rupee hit a fresh low of 87.5 against the dollar as expectations of a rate cut intensified ahead of the RBI’s interest rate decision later this week.

STOCKS TODAY

Asian Paints: Paint industry giant Asian Paints reported disappointing Q3FY25 results, largely falling short of market expectations, as weak demand in urban centers continued to impact the paint giant’s performance. On the bourses, Asian Paints share tanked over 3 percent. The company’s consolidated net profit declined 23.3 percent YoY to Rs 1,110.5 crore in Q3FY25, while revenue also took a hit, falling 6.1 percent YoY to Rs 8,549.4 crore.

Force Motors: Shares of Force Motors surged 6 percent following the release of its January sales data, signaling a strong performance in the commercial and utility vehicle segments. In January, domestic sales of small commercial vehicles (SCVs), light commercial vehicles (LCVs), utility vehicles (UVs), and sports utility vehicles (SUVs) grew 39.27 percent year-on-year to 3,493 units, up from 2,508 units a year ago. Overall sales, including exports, rose 20.3 percent to 3,597 units.

MTNL: Shares of Mahanagar Telephone Nigam jumped nearly 18 percent as optimism around its asset monetization plans for FY26 fueled a sharp rally. This surge followed a 7 percent gain in the previous session, breaking a two-day losing streak. The rally was driven by comments from Arunish Chawla, Secretary of the Department of Disinvestment and Public Asset Management (DIPAM), during CNBC-TV18’s Budget 2025 Verdict discussion. Chawla reaffirmed the government’s commitment to helping MTNL and BSNL monetize their assets to unlock value, clear liabilities, and revitalize the sector.

Symphony: Shares of the consumer durables manufacturer slumped 9 percent after the company reported its December quarter results. Symphony reported a net loss of Rs 10 crore during the quarter, compared to a net profit of Rs 41 crore during the same quarter last year. The net loss was due to a one-time loss of Rs 46 crore that dragged the company into the red. There was no exceptional item in the base quarter.

CAMS: Stock soared 7 percent after brokerage firm Kotak Institutional Equities noted that Computer Age Management Services shares have fallen by ~35 percent from the peak, likely due to higher starting valuations. The brokerage upgraded CAMS to ‘add’ from ‘reduce’, giving more reasonable valuations.