POST MARKET

The benchmark equity indices gave up early gains and ended lower on Thursday as foreign fund outflows, weakness in the rupee and uncertainty over the India-US trade deal weighed on investor sentiment.

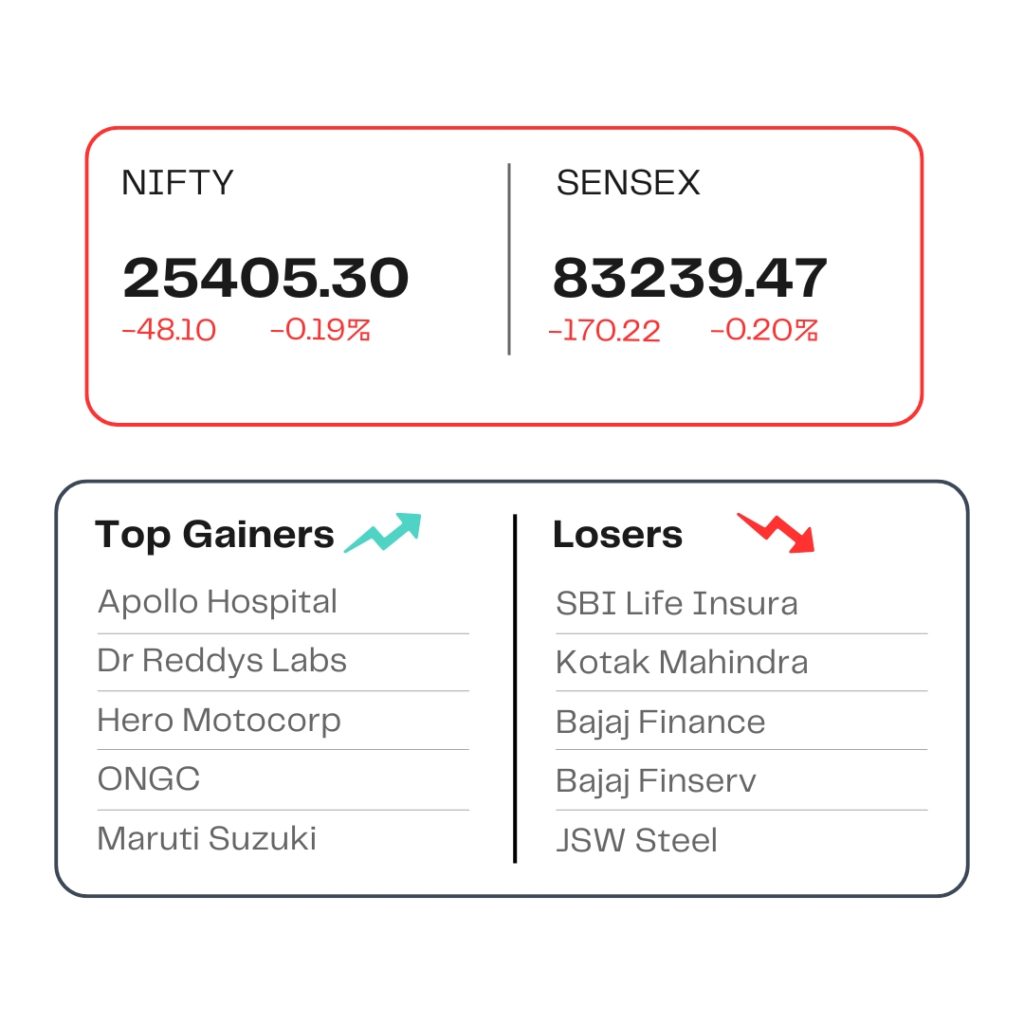

At close, the Sensex was down 170.22 points or 0.20 percent at 83,239.47, and the Nifty was down 48.10 points or 0.19 percent at 25,405.30. About 1878 shares advanced, 1885 shares declined, and 135 shares unchanged.

Apollo Hospitals, Hero MotoCorp, Dr Reddy’s Labs, ONGC, Maruti Suzuki were among major gainers on the Nifty, while losers were SBI Life Insurance, Kotak Mahindra Bank, Bajaj Finance, JSW Steel, Bajaj Finserv.

On the sectoral front, metal, realty, PSU Bank, telecom indices down 0.5 percent each, while pharma, media, oil & gas, auto, consumer durable added 0.3-1 percent.

The broader markets were mixed. The midcap gauge was trading at the flatline, but the smallcap index was higher by around 0.2 percent.

STOCKS TODAY

Spice Jet

The shares of SpiceJet jumped nearly 3 percent intraday on July 3 after the Indian airline announced that it has received the first two of its overhauled engines from international MRO provider StandardAero. The firm also said that it has successfully ungrounded another Boeing 737 NG. The shares later pared some gains to close at Rs 39.97 apiece.

Bosch

The shares of export-oriented auto stocks recorded significant gains on July 3 as markets remained optimistic around the possibility of India-US trade deal being announced soon. India and US are on the verge of a breakthrough in their negotiations for a mini-trade deal, and an announcement could come as early as this weekend.

Bosch shares were the top gainer among the auto stocks, jumping over 6 percent.

Natco Pharma

Pharma stocks also accompanied auto stocks, bucking the downturn in the overall market to close in the green amid buzz around US-India trade deal. Natco Pharma shares were the top gainer on the pharma index, rallying over 5 percent to trade at Rs 970 apiece.

Nykaa

Shares of FSN E-Commerce Ventures, also known as the Nykaa parent, fell 4 percent after a large deal took place on the bourses. Around 6 crore shares or 2.3 percent equity in the firm was exchanged.

According to sources, the Banga family, which includes shipping tycoon Harindarpal Banga, known as Harry Banga, and others, launched block deals to sell nearly 2 percent of its stake, or half of what it owns, in FSN E-Commerce.

Punjab National Bank

Shares of Punjab National Bank (PNB) declined by more than 3 percent after the state-owned lender’s April–June quarter (Q1FY26) business update fell short of brokerage expectations. Citi assigned a “sell” rating on the bank, while Morgan Stanley maintained its “underweight” stance.

Source – Money Control