Smartworks Coworking IPO is a bookbuilt issue of ₹582.56 crore. It combines a fresh issue of 1.09 crore shares aggregating to ₹445.00 crores and an offer for sale of 0.34 crore shares aggregating to ₹137.56 crores.

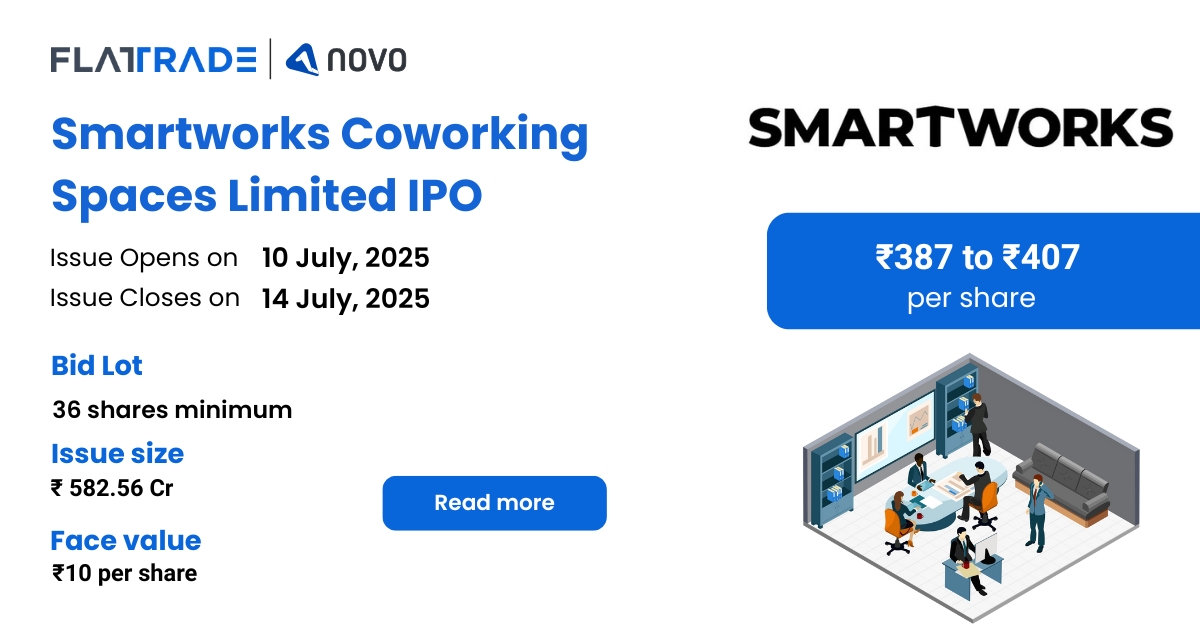

The IPO opens for subscription on July 10, 2025, and closes on July 14, 2025. The allotment is expected to be finalized on Tuesday, July 15, 2025. The price band for the IPO is set at ₹387 to ₹407 per share, and the minimum lot size for an application is 36 shares.

Company Summary

Incorporated in 2015, Smartworks Coworking Spaces Limited is engaged in the business of customized managed workspace solutions, offering fully serviced, tech-enabled office environments with aesthetic designs and essential amenities to meet the specific needs of enterprises and their employees.

The company serves mid-to-large enterprises, including Indian corporates, MNCs, and startups, offering modern campuses with design, technology, and amenities like cafeterias, gyms, crèches, and medical centers for employee well-being.

As of March 31, 2025, the company served 738 clients with 152,619 seats. Currently, it has 728 clients and 169,541 seats, with 12,044 seats yet to be occupied.

As of March 31, 2024, the company holds four of India’s five largest leased centers, including the 0.7 million square feet Vaishnavi Tech Park in Bengaluru, surpassing other campuses in size.

As of March 31, 2025, the company had 794 permanent employees.

Business Model

The company’s managed campus platform creates an ecosystem of key stakeholders: clients, landlords, employees, and service partners.

Clients: The company specializes in serving large and emerging enterprises with customizable, tech-enabled workspaces across key Indian cities, offering modern, cost-efficient solutions and amenities to enhance employee well-being and productivity.

Landlords: The company partners with non-institutional landlords to transform properties into fully serviced Smartworks campuses, offering rental assurance, efficient management, and long-term leases, benefiting both landlords and tenants.

Clients’ Employees: The company offers fully serviced, tech-enabled centers with amenities like cafeterias, gyms, crèches, and medical centers, promoting collaboration, team building, and employee well-being in a vibrant work environment.

Service partners: The company collaborates with service partners like Chaipoint and ClearTax to provide amenities such as cafeterias, gyms, and medical centers, offering employees value-added services and partners access to a large customer base.

Company Strengths

- Their market leadership backed by scale and steady growth

- Their ability to lease and transform entire/ large properties across India’s key clusters into amenities-rich ‘Smartworks’ branded Campuses.

- Their focus is on acquiring Enterprise Clients with higher Seat requirements as well as emerging mid-to-large Enterprises and growing with them.

- Their execution capabilities are backed by cost efficiencies, effective processes, and technology infrastructure.

- Their financial acumen and strategic execution abilities make us capital efficient, resulting in saving our equity on capital expenditure and working capital.

- Their risk-mitigating strategy allows us to build a financially stable business model.

Company Financials

Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

Assets | 4,650.85 | 4,147.08 | 4,473.50 |

Revenue | 1,409.67 | 1,113.11 | 744.07 |

Profit After Tax | -63.18 | -49.96 | -101.05 |

EBITDA | 857.26 | 659.67 | 424.00 |

Net Worth | 107.51 | 50.01 | 31.47 |

Reserves and Surplus | 4.69 | 29.01 | -46.23 |

Total Borrowing | 397.77 | 427.35 | 515.39 |

Amount in ₹ Crore | |||

Objectives of IPO

- Repayment/ prepayment/ redemption, in full or in part, of certain borrowings availed by the Company

- Capital expenditure for fit-outs in the New Centres and for security deposits of the New Centres

- General corporate purposes

Promoters of the company

Neetish Sarda, Harsh Binani, Saumya Binani, NS Niketan LLP, SNS Infrareality LLP, and Aryadeep Realstates Private Limited are the promoters of the company.

IPO Details

IPO Date | July 10, 2025 to July 14, 2025 |

Listing Date | July 14, 2025 |

Face Value | ₹10 per share |

Price Band | ₹387 to ₹407 per share |

Lot size | 36 shares |

Total Issue Size | 1,43,13,400 shares (aggregating up to ₹582.56 Cr) |

Fresh Issue | 1,09,33,660 shares (aggregating up to ₹445.00 Cr) |

Offer for sale | 33,79,740 shares of ₹10 (aggregating up to ₹137.56 Cr) |

Issue type | Bookbuilding IPO |

Listing at | NSE, BSE |

Share Holding Pre Issue | 10,31,89,592 shares |

Share Holding Post Issue | 11,41,23,252 shares |

Category Reservation Table

Application Category | Maximum Bidding Limits | Bidding at Cut-off Price Allowed |

Only RII | Upto Rs 2 Lakhs | Yes |

Only sNII | Rs 2 Lakhs to Rs 10 Lakhs | No |

Only bNII | Rs 10 Lakhs to NII Reservation Portion | No |

Only employee | Upto Rs 5 lakhs | Yes |

Employee + RII/NII | 1. Employee limit: Upto Rs 5 lakhs (In certain cases, employees are given discount if bidding amount is upto Rs 2 Lakhs) 2. If applying as RII: Upto Rs 2 Lakhs 3. If applying as NII: sNII > Rs 2 Lakhs and upto Rs 10 Lakhs and bNII > Rs 10 lakhs | Yes for Employee and RII/NII |

Lot Allocation Details

Application | Lots | Shares | Amount |

Retail (Min) | 1 | 36 | ₹14,652 |

Retail (Max) | 13 | 468 | ₹1,90,476 |

S-HNI (Min) | 14 | 504 | ₹2,05,128 |

S-HNI (Max) | 68 | 2448 | ₹9,96,336 |

B-HNI (Min) | 69 | 2484 | ₹10,10,988 |

Allotment Schedule

Basis of Allotment | Tue, Jul 15, 2025 |

Initiation of Refunds | Wed, Jul 16, 2025 |

Credit of Shares to Demat | Wed, Jul 16, 2025 |

Tentative Listing Date | Thu, Jul 17, 2025 |

Cut-off time for UPI mandate confirmation | 5 PM on July 14, 2025 |

IPO Reservation

Investor Category | Investor Category | Maximum Allottees |

QIB Shares Offered | 71,10,632 | NA |

NII (HNI) Shares Offered | 21,33,189 (14.89%) | NA |

bNII > ₹10L | 14,22,126 (9.93%) | 2,821 |

sNII < ₹10L | 7,11,063 (4.96%) | 1,410 |

Retail Shares Offered | 49,77,442 (34.75%) | 1,38,262 |

Employee Shares Offered | 1,01,351 (0.71%) | NA |

Total Shares Offered | 1,43,22,614 (100.00%) | – |

To check allotment, click here